One-click trading on the Strategy Tester chart. The utility allows you to manually test your strategies in the strategy tester….

Extra Report Pad – Trader’s Diary. Professionally analyzes your trading account. MyFxBook in live chart. ExtraReportPad

Assistant – the best free trading panel to support positions and deals with real/virtual StopLoss / TakeProfit / Trailing Stop

Main

Documentation

Settings

FAQ

Changelog

Reviews

Comments

Extra

About Exp Averager

The Expert Advisor Averager is a tool for averaging positions. It allows you to open additional positions in the direction of the trend and against it and includes a smart average trailing stop for a series of positions. With this tool, traders can increase or decrease the lot (volume) size for each position.

This tool is popularly used for averaging unprofitable positions to the average price. It is a strategy that involves opening new positions in the same direction as the original position but at different price levels. By doing so, the trader can bring the average price of the position closer to the current market price, which can help minimize losses.

The Expert Advisor Averager also includes a general trailing stop for profits, which can help traders lock in gains as the market moves in their favor. This feature is especially useful for traders who like to ride trends and capture as much profit as possible before exiting the market.

Overall, the Expert Advisor Averager is a powerful tool that can help traders manage their positions more effectively and optimize their trading strategies.

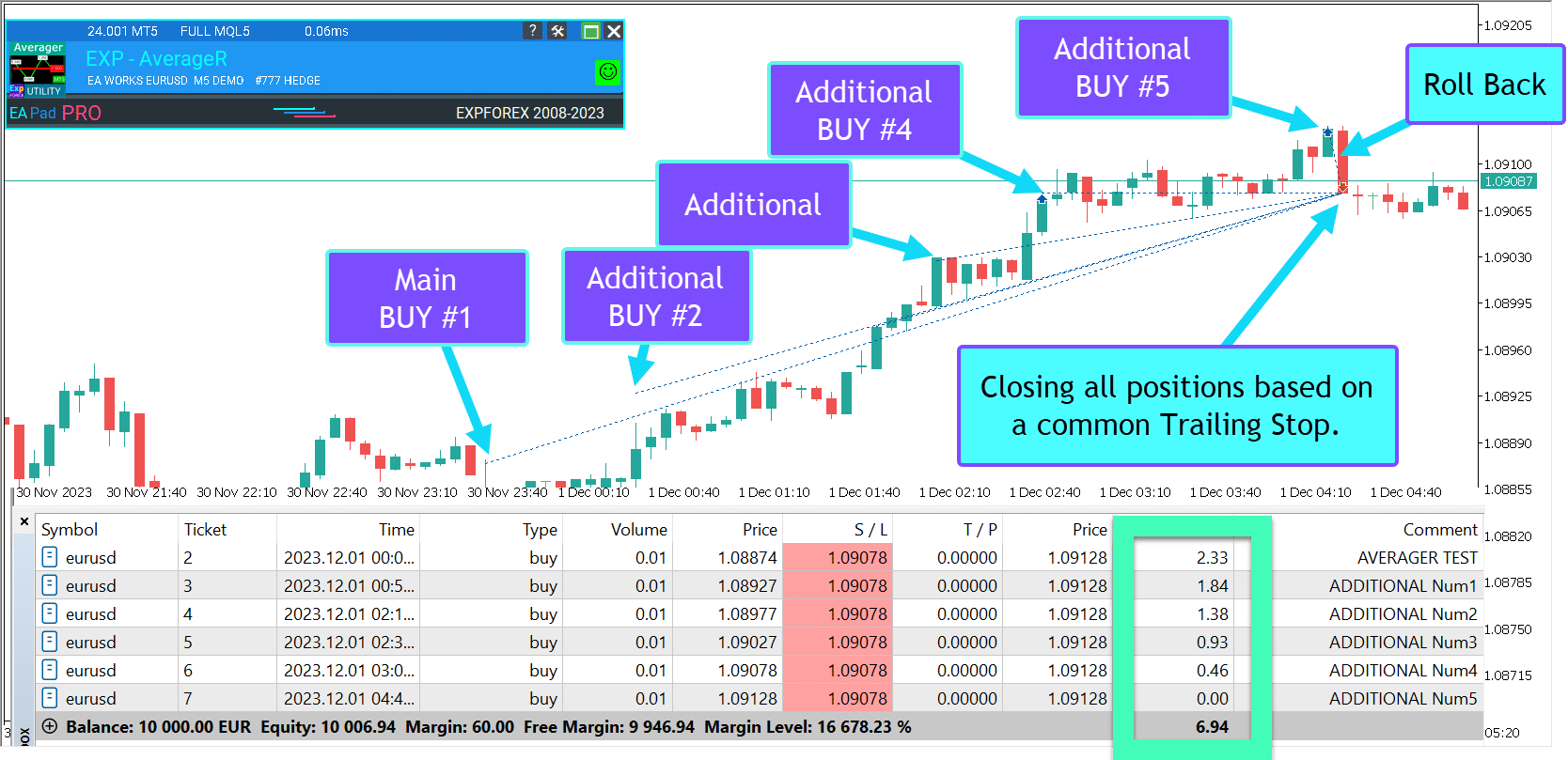

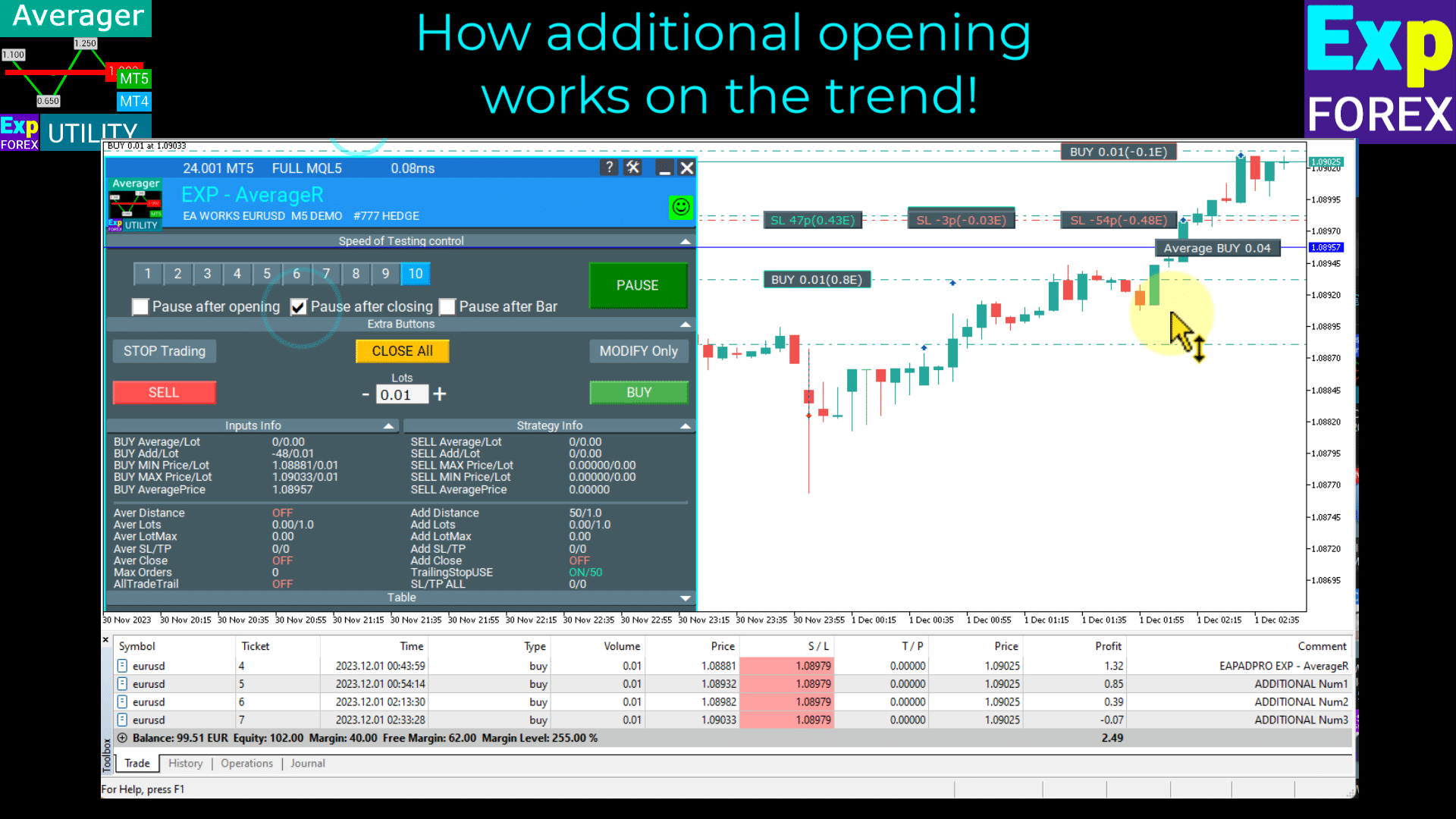

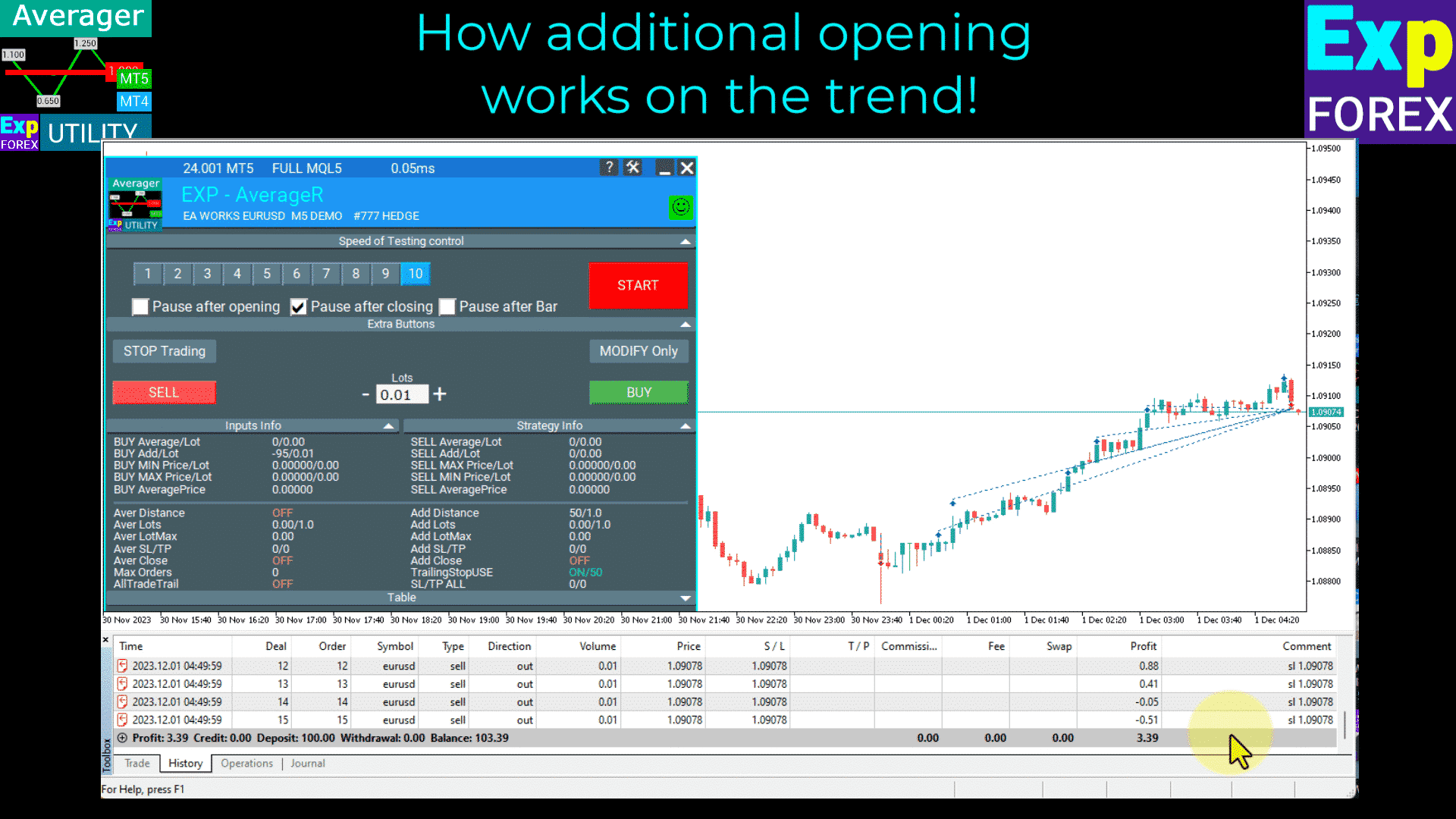

How Additional Opening Works In the Trend!

Suppose

- You open a BUY position at a price of 1.600;

- The price goes up to 1.700, and the current profit is +100 points;

- Breakeven point (Average Price) = 1.600;

- If you open a BUY position at a price of 1.700, then your position is averaged, and the breakeven can be set to 1.650;

- The Expert Advisor opens 3 additional positions (deals).

- Price rollback.

- The Expert Advisor (EA) activates the trailing stop, and 5 positions gain profit to increase it.

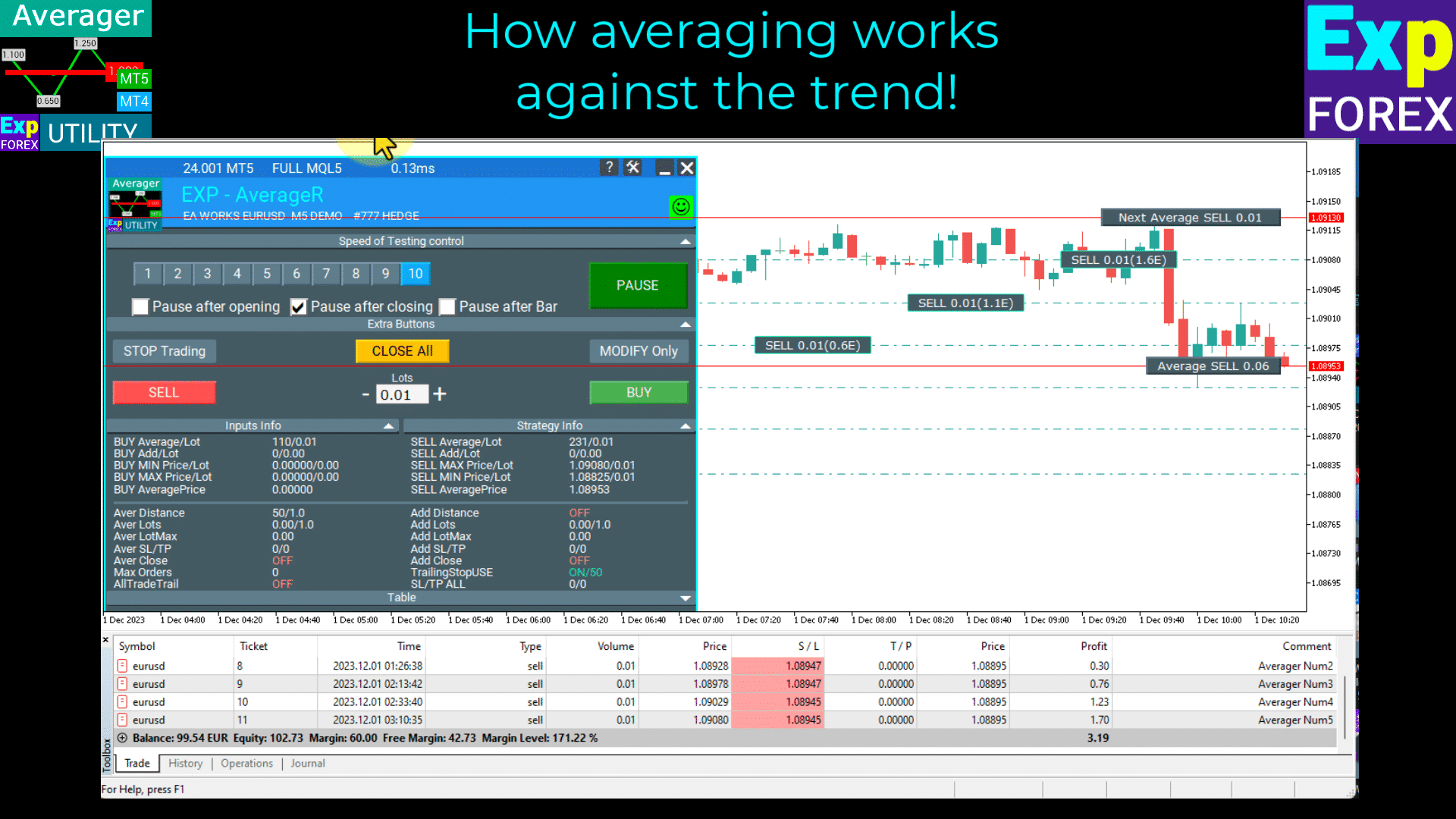

How Averaging Works Against the Trend!

Suppose

- You open a BUY position at a price of 1.600;

- The price goes down to 1.500, and the current loss is -100 points;

- Breakeven point (Average Price) = 1.600;

- To modify Stop Loss to the breakeven level, the trend needs to rise by 100 points;

- If you open a BUY position at a price of 1.500, then your position is averaged, and the breakeven can be set to 1.550;

- To close two deals, the price must move up by 50 points, not 100 points;

- The Expert Advisor (EA) activates the trailing stop, and two positions gain profit to increase it.

How does Exp Averager work?

What do people write about Exp Averager?

You can Download free Exp Averager

Get started for FREE!

You can download and install our program for free!

And you can test it on your DEMO account without time limits!

You can also test our program for free on a REAL account using the USDJPY symbol!

You can Buy full version of Exp Averager

Trade Accounts

Computers / Activations

FULL MT4 version

For MetaTrader 4

50 $

FULL MT5 version

For MetaTrader 5

50 $

RENT for 3 months

For MetaTrader 4

30 $

RENT for 3 months

For MetaTrader 5

30 $

Before making a purchase, we highly recommend reviewing our instructions and FAQ section to ensure a smooth experience.

Links

Table of Contents (click to show)

List

- Description

- How Does Additional Opening Work with the Trend?

- How Does Averaging Work Against the Trend?

- How to Install Exp-Averager

- The Information Displayed in the EAPADPRO Panel

- Recommendations for Calculating the Averaging Distance (Distance) and StopLoss

- Recommendations for Testing and Optimizing Averager Options

Description

At that point, you have several options:

- Wait for the price to return to the break-even point.

- Close the position with minimal losses.

- Apply the averaging strategy.

The strategy of averaging positions involves opening an additional position against your main position.

Thus, we average the break-even point (Average Price) of two positions (Deals).

How Does Additional Opening Work with the Trend?

Suppose

- You open a BUY position at a price of 1.600;

- The price goes up to 1.700, and the current profit is +100 points;

- Break-even point (Average Price) = 1.600;

- If we open another BUY position at the price of 1.700, then our position is averaged, and the break-even can be set to 1.650;

- The Expert Advisor (EA) opens 3 additional positions (deals).

- Price reverses.

- The Expert Advisor (EA) activates the Trailing Stop, and 5 positions gain profit to increase it.

How Does Averaging Work Against the Trend?

Suppose

- You open a BUY position at a price of 1.600;

- The price goes down to 1.500, and the current loss is -100 points;

- Break-even point (Average Price) = 1.600;

- To modify Stop Loss to the break-even level, we need to rise 100 points up trend;

- If we open another BUY position at the price of 1.500, then our position is averaged, and the break-even can be set to 1.550;

- To close two trades, the price must move up 50 points, not 100 points.

- The Expert Advisor (EA) activates the Trailing Stop, and two positions gain profit to increase it.

The disadvantage of this method, of course, is that you open an additional lot, which puts a load on the deposit.

The advantages of this method are unquestionable: you get the opportunity to close before the level you set, but with a profit and not with a loss.

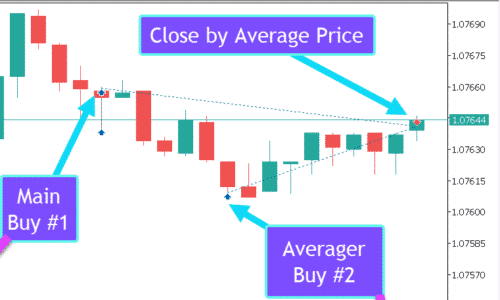

Averager: Example in GIF

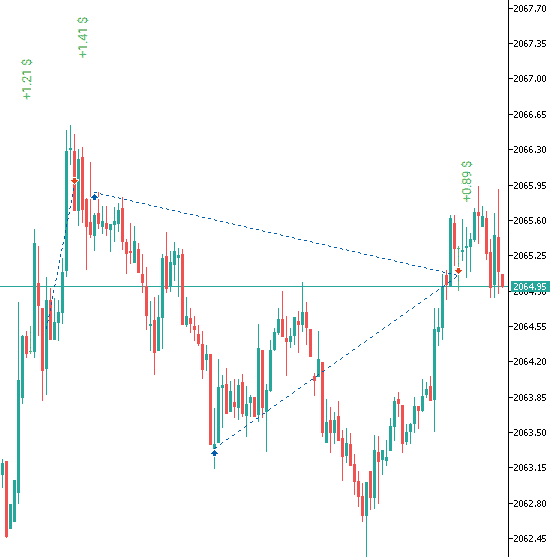

Averager: Example in Picture

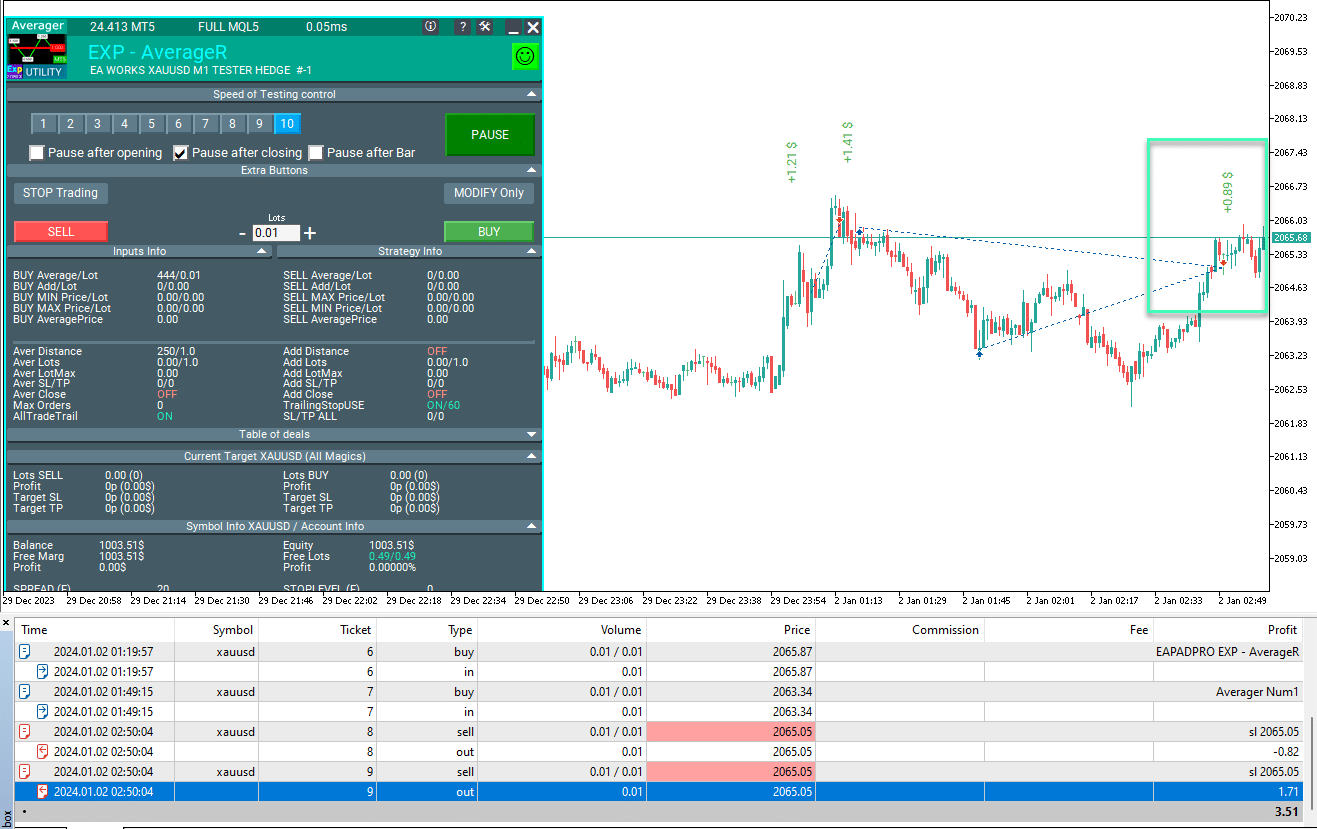

We open a BUY deal, and our EA Averager opens the next BUY position:

The Expert Advisor (EA) then activates the average trailing stop function and sets the total stop-loss of deals at an average price.

As a result, all positions in the BUY direction are closed at one price with a total profit.

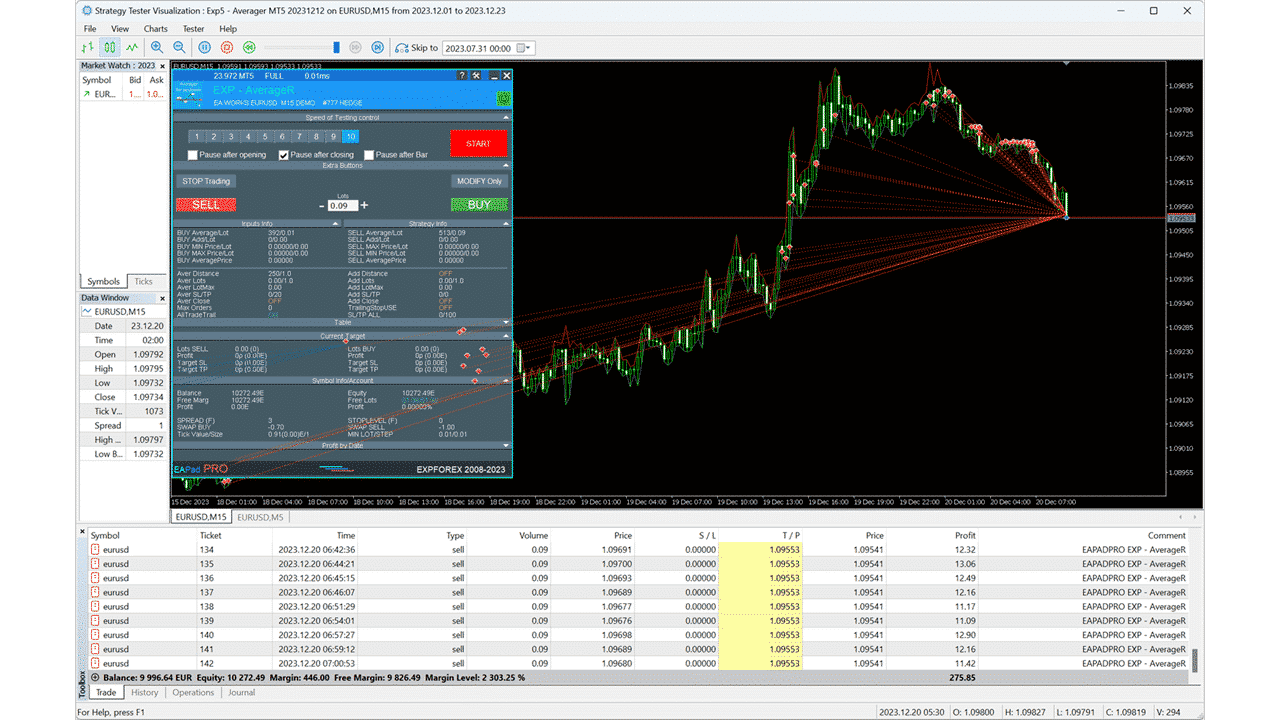

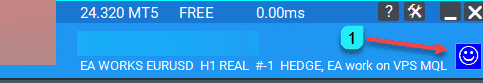

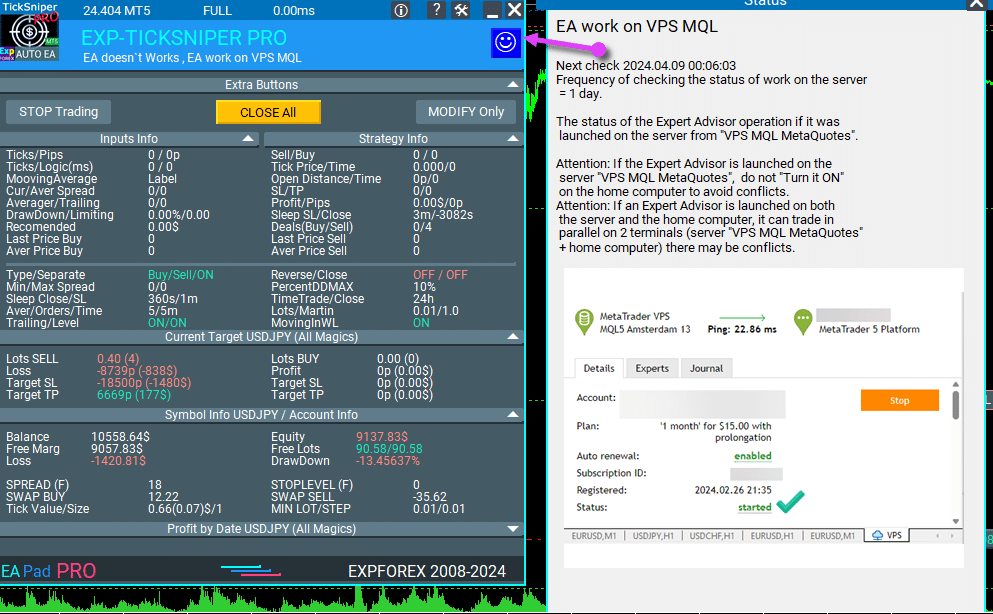

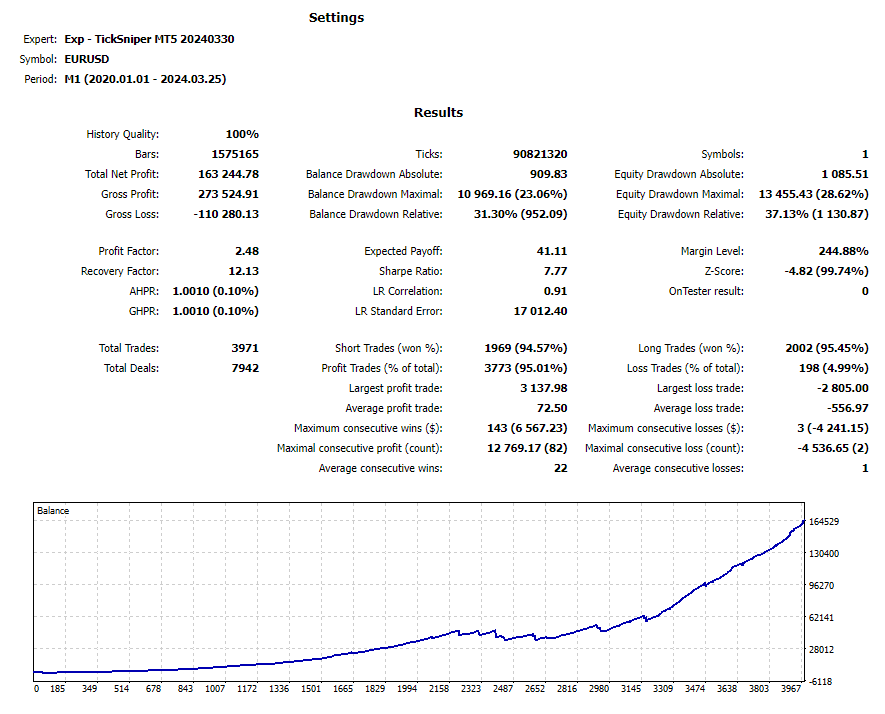

An example of how a TickSniper advisor works with the averaging strategy:

Example of Work Using TakeProfit

Distance = 100 points, TakeProfit = 250 points, LotsMartin = 2

1 2013.01.02 09:00 BUY 1 0.10 1.32732 0.00000 0.00000 0.00 10000.00 2 2013.01.02 09:00 MODIFY 1 0.10 1.32732 0.00000 1.32982 0.00 10000.00 3 2013.01.02 11:27 BUY 2 0.20 1.32632 0.00000 0.00000 0.00 10000.00 4 2013.01.02 11:27 MODIFY 1 0.10 1.32732 0.00000 1.32915 0.00 10000.00 5 2013.01.02 11:27 MODIFY 2 0.20 1.32632 0.00000 1.32915 0.00 10000.00 6 2013.01.02 12:20 BUY 3 0.40 1.32532 0.00000 0.00000 0.00 10000.00 7 2013.01.02 12:20 MODIFY 1 0.10 1.32732 0.00000 1.32839 0.00 10000.00 8 2013.01.02 12:20 MODIFY 2 0.20 1.32632 0.00000 1.32839 0.00 10000.00 9 2013.01.02 12:20 MODIFY 3 0.40 1.32532 0.00000 1.32839 0.00 10000.00 10 2013.01.02 12:27 BUY 4 0.80 1.32429 0.00000 0.00000 0.00 10000.00 11 2013.01.02 12:27 MODIFY 1 0.10 1.32732 0.00000 1.32754 0.00 10000.00 12 2013.01.02 12:27 MODIFY 2 0.20 1.32632 0.00000 1.32754 0.00 10000.00 13 2013.01.02 12:27 MODIFY 3 0.40 1.32532 0.00000 1.32754 0.00 10000.00 14 2013.01.02 12:27 MODIFY 4 0.80 1.32429 0.00000 1.32754 0.00 10000.00 15 2013.01.02 14:28 T/P 1 0.10 1.32754 0.00000 1.32754 2.20 10002.20 16 2013.01.02 14:28 T/P 2 0.20 1.32754 0.00000 1.32754 24.40 10026.60 17 2013.01.02 14:28 T/P 3 0.40 1.32754 0.00000 1.32754 88.80 10115.40 18 2013.01.02 14:28 T/P 4 0.80 1.32754 0.00000 1.32754 260.00 10375.40

This example shows the opening of the first main position.

As the price moves into a loss, our advisor opens additional BUY positions.

After that, the price returns to the BUY trend, and all positions are closed by the common (Average) Take Profit.

Brief Description of the Principle of Operation and Parameters

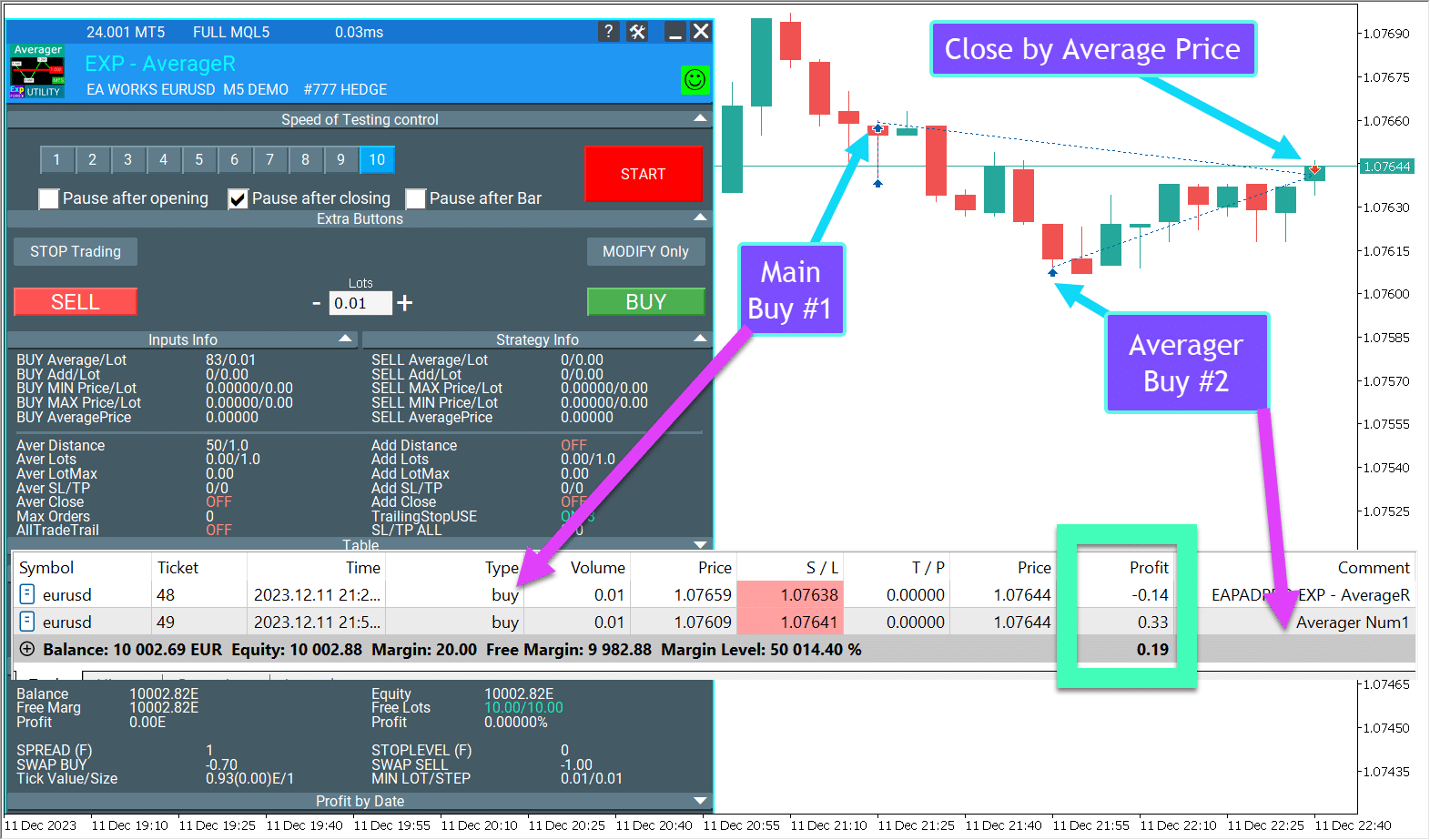

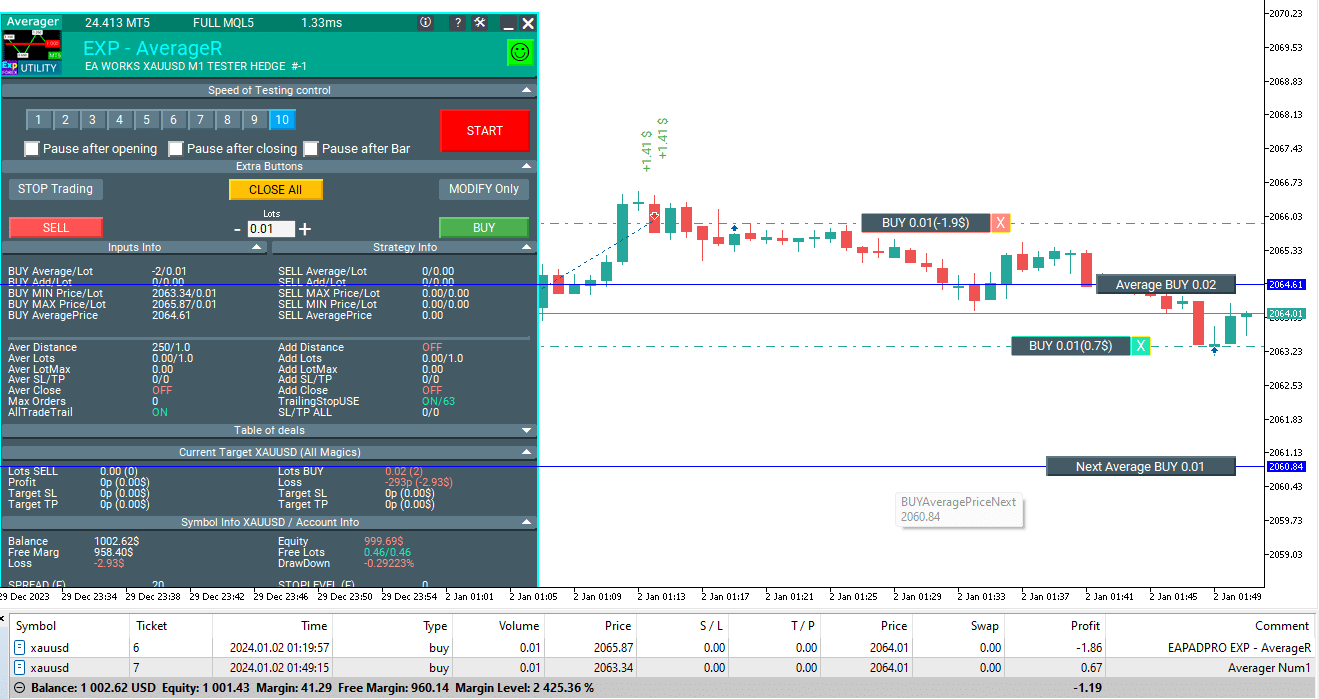

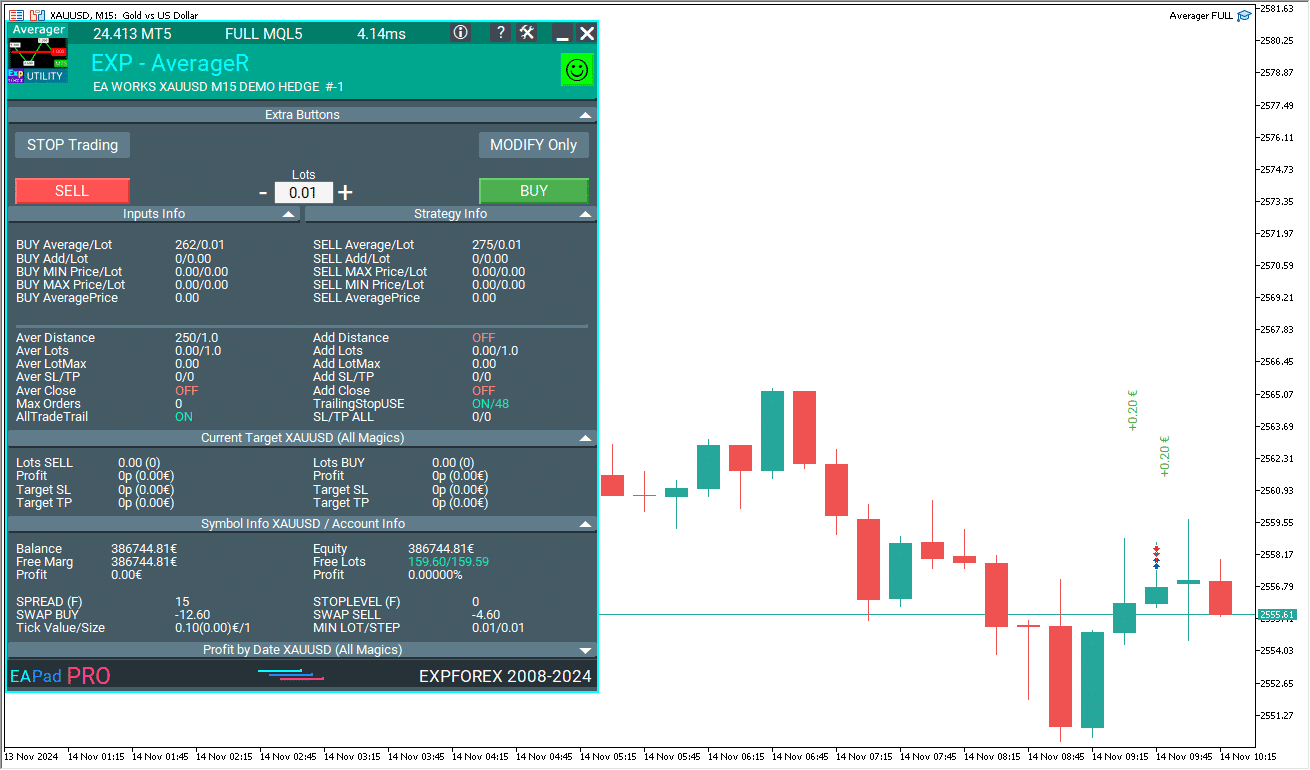

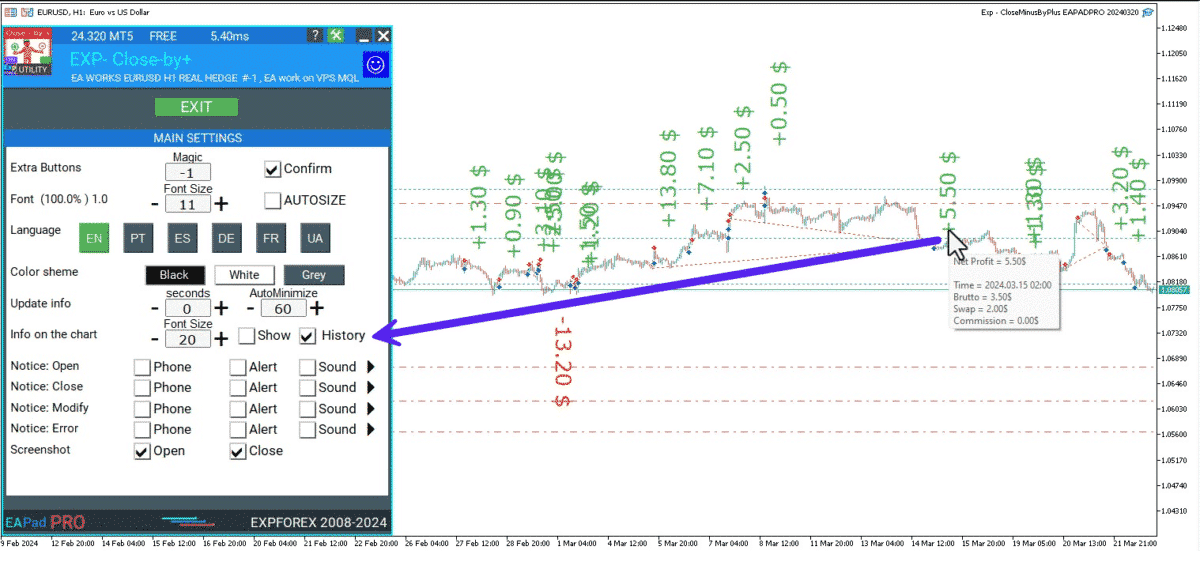

Our Exp-Averager appears like this on the graph:

Exp-Averager is designed for averaging deals that have experienced a certain drawdown and did not follow the trend.

Our advisor, based on a predetermined number of points Distance, opens a position in the same direction with Lot = Previous Deal Lot * LotsMartin and modifies the overall Take Profit (TP) on all deals to the price of the “zero point line for all positions in one direction” + TakeProfit points.

It is also possible to modify (Trailing Stop TrailingStopUSE = true) the Stop Loss of all positions in the direction when the price breaks through the “zero point of all positions in the same direction” at a distance of TrailingStop points.

In the Expert Advisor settings, there is also an option for the maximum number of open positions for averaging: MaxOrdersOpen.

The advisor will operate on the currency pair chart where it is installed.

To enable averaging mode on the EURUSD currency pair, you need to open the EURUSD chart and install the expert.

You can also limit averaging by the Expert Advisor using the OrderToAverage parameter and the MagicToAverage option for Position Magic.

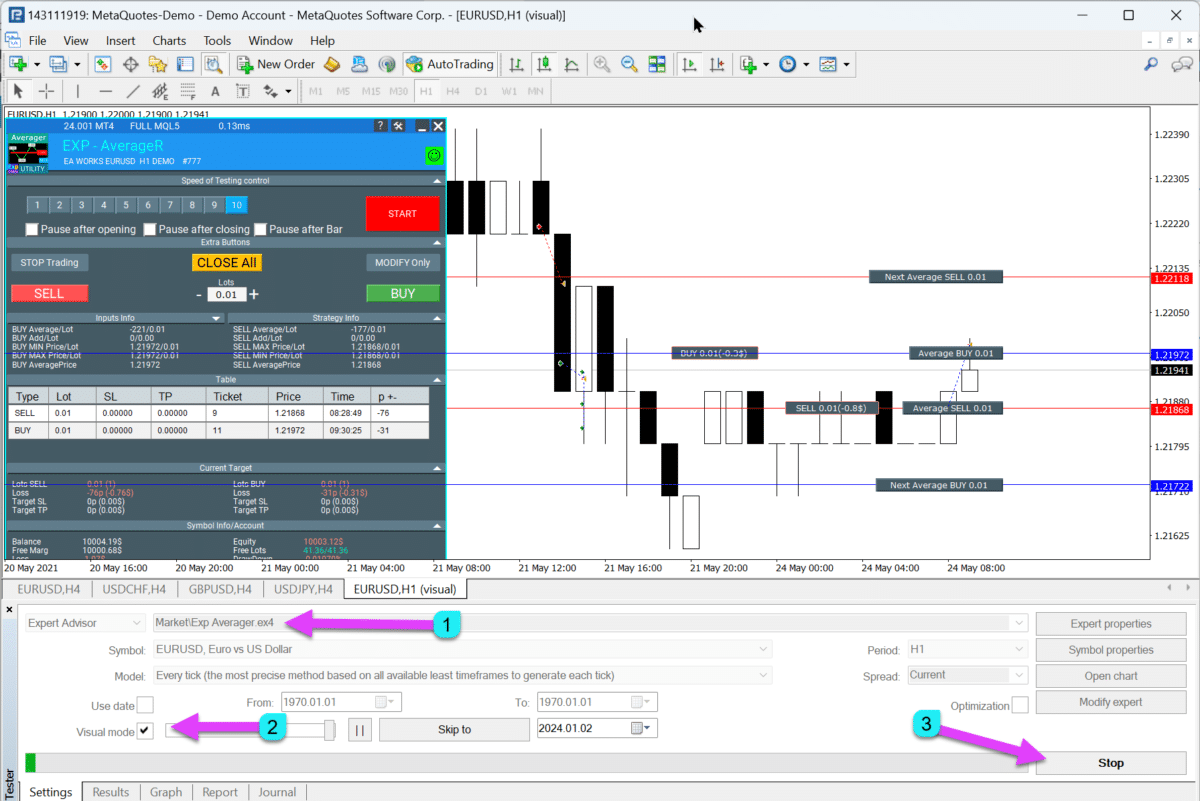

This Expert Advisor can be tested using the strategy tester in the terminal.

To do this, at startup, one BUY position will be opened with a lot size of 0.1 for verification.

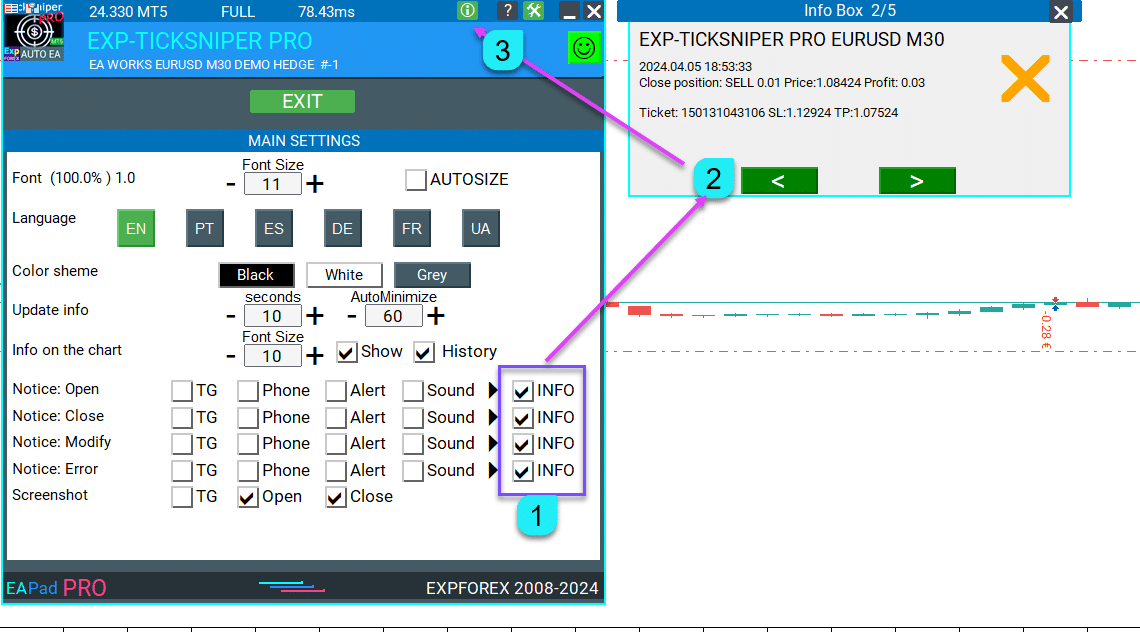

You can use our EAPADPRO to work with Exp-Averager in the Strategy Tester!

How to Install Exp-Averager

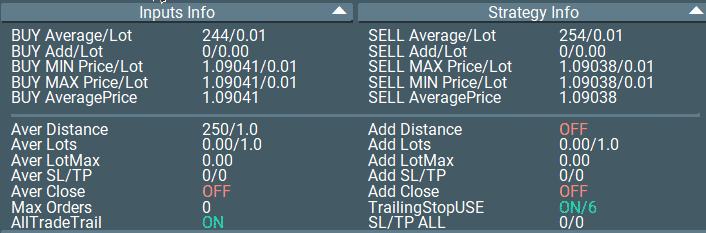

The Information Displayed in the EAPADPRO Panel

“BUY Average / Lot” – The number of points (pips) before averaging for BUY positions. It is shown with a minus! + Last deal Lot (volume);

“SELL Average / Lot” – The number of points before averaging for SELL deals. It is shown with a minus! + Last deal Lot (volume);

“BUY Add / Lot” – The number of points before averaging for BUY positions. It is displayed with a plus! + Last deal Lot (volume);

“SELL Add / Lot” – The number of points before averaging for SELL positions. It is displayed with a plus! + Last deal Lot (volume);

“Min Price Buy” – Minimum price for BUY deals;

“Max Price Sell” – Maximum price for SELL deals;

“Min Lot Buy” – Lot size of the minimum BUY position;

“Max Lot Sell” – Lot size of the maximum SELL position;

“Max Price Buy” – Maximum price of BUY deals;

“Min Price Sell” – Minimum price of SELL deals;

“Max Lot Buy” – Lot size of the maximum BUY position;

“Min Lot Sell” – Lot size of the minimum SELL position;

“Average Price Buy” – Average price, the break-even point for all BUY positions;

“Average Price Sell” – Average price, the break-even point for all SELL positions.

When ShowInfoAverager = true is activated, you will see the following information:

- Average – Displays the average (zero) line from positions in the same direction. Hovering over the label will show additional information about the calculation of the average line!

- Next Average – Displays the next averaging position that will be opened in this direction. Hovering over the label will show additional information about the distance!

- Next Additional – Displays the next position for additional opening that will be opened in this direction.

Recommendations for Calculating the Averaging Distance (Distance) and StopLoss

All parameters depend on the currency pair and your deposit.

Calculate the averaging distance (Distance) so that when you open the next averaging position (deal), your account contains sufficient funds.

For example:

- I use an averaging distance equal to 75 SPREAD of a currency pair.

- If your SPREAD for the currency pair is 10 points, then averaging distance (Distance) = 750 points.

- If your position gains a distance of 750 points, then my advisor will open an additional position, and the break-even point will shift to 750 / 2 = 375 points from the opening price of the second position.

- This means that the two positions need to move a distance of 350 points in profit (total profit from two positions) to close at 0 points. The first position will have a loss of 350 points, and the second position will have a profit of 350 points.

- If the positions continue to incur a loss, then the next averaging position will open after 750 points.

- This means that the break-even point will shift to the level of 2250 / 3 = 750 points.

- For three positions to close at an average break-even of these 3 deals, they need to gain 750 points in profit (total profit).

Why Do I Use 75 SPREAD?

This is a sufficient averaging distance (Distance) for averaging. This figure can be applied to any currency pair.

According to our tests, an averaging distance (Distance) is enough with a deposit of $1,000 that has been held for a long time.

Another way to determine the averaging distance (Distance) is to calculate the currency pair’s average movement.

For example, over 1 week.

If the currency pair moves an average distance of 1,000 points over 1 week, then the probability of the price moving 1,000 points is 100%.

Thus, you can set the averaging distance (Distance) at 1,000 points.

It’s important to choose a value at which your deposit will not go to a total loss.

For example:

When you open one position with a lot size of 0.01 on the EURUSD currency pair (leverage 1:100, EURUSD = 1.1961), you need to have a free margin of $11.961.

The cost of 1 point = $0.10.

If the Distance = 100 points and the Expert Advisor opens 5 averaging positions, then:

Current price = 1.1800

- The first BUY position (open price = 1.18500, lot = 0.01) will be at a loss of $50.

- The second BUY position (open price = 1.18400, lot = 0.01) will be at a loss of $40.

- The third BUY position (open price = 1.18300, lot = 0.01) will be at a loss of $30.

- The fourth BUY position (open price = 1.18200, lot = 0.01) will be at a loss of $20.

- The fifth BUY position (open price = 1.18100, lot = 0.01) will be at a loss of $10.

- The sixth BUY position (open price = 1.18000, lot = 0.01) will break even with a loss of $0.

Total: $150 + 11.96 * 6 = $221.76.

This means that to maintain the 6 positions (if the averaging distance is 100 points), the account should have $221.76.

Calculate the averaging distance (Distance) independently. It all depends on your deposit and your loss limits.

I also recommend setting a StopLoss of 5 averaging distances and not using more than 5 averaging positions.

For example:

If the averaging distance (Distance) = 100 points, while StopLoss (StopLoss) = 500 points, and the maximum number of averaging orders (MaxOrdersOpen) = 5.

All the settings of our utility are familiar. You must calculate the correct distance for averaging yourself, along with lot size and StopLoss.

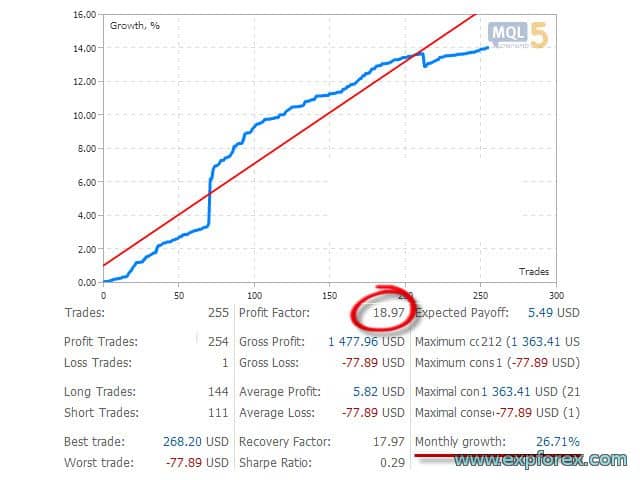

Recommendations for Testing and Optimizing Averager Options

Block of work with opening positions against the trend. Averaging positions.

input string oo2 = "========= Averager options ========="; input bool AverageUSE = true; input bool OnlyModify = false; input int TakeProfitALL = 200; input int Distance = 500; input double DistanceMartin = 1; input double LotsMartin = 1; input int MaxOrdersOpen = 5;

Parameters OnlyModify – I do not recommend changing! It makes no sense to optimize.

Parameter AverageUSE

– Enables the averaging functions. Only with AverageUSE = true can other parameters be optimized!

Optimizing values: True – FALSE

- Averaging positions can load your deposit with additional positions.

- The averaging strategy requires a balance that is at least 3 times greater than the standard deposit (without averaging).

- Averaging positions are attempts to turn a loss-making position into a profit.

- If you use the recommended deposit, you can increase the number of profitable trades to 70-90%.

- When using averaging, the advisor will try to bring a false signal into profit. Other signals will be ignored until the averaging series closes.

Parameter TakeProfitALL

– Modifies the take-profit of all positions by 1 level.

Optimization of values: 10-50-1000 (start = 10, step = 50, stop = 1000)

- It serves as additional protection for positions if you have disabled it.

- It makes sense if you do not use AdditionalOpening = false.

Parameter Distance

– Determines the distance at which additional positions are opened against the trend.

Optimization of values: It is recommended to set the parameters individually for each pair.

- For example, if this is the EURUSD currency pair and you trade on the M30 timeframe with an average price movement of 50 bars = 7500 points, then set this parameter for optimization: start 0, step 25, stop 500.

- For example, if this is the XUGUSD currency pair and you trade on the M1 timeframe with an average price movement of 50 bars = 100 points, then set this parameter for optimization as follows: start 0, step 5, stop 100.

- Another way to optimize this parameter is to use the average spread for the selected currency pair. This method is used in our TickSniper advisor.

- For example, if the average spread for a currency pair is 3 points, then the averaging distance = 50 * 3 = 150 points. In this case, the optimization can be set as follows: 100-25-250.

- The higher the distance values, the longer it takes for the advisor to turn the series of positions into total profit.

- The smaller the averaging distance, the greater the load on your balance. More positions will open. You can make a profit faster, but at the same time, there will be a significant load on your trading account!

Parameter DistanceMartin

– Increases the Distance in each additional position.

Optimization of values: Only in extreme cases, 1-0.1-2

- This parameter should be optimized only if you need to increase the distance for each new position in the series.

- If Distance is too small, then DistanceMartin allows you to increase the step of the averaging grid.

- If DistanceMartin is less than 1, then the step of the averaging grid and Distance will decrease when each additional averaging position is opened!

- If DistanceMartin is greater than 1, then the step of the averaging grid and Distance will increase when each additional averaging position is opened!

Parameter LotsMartin

– Increases the lot size for each additional position.

Optimization of values: Only in extreme cases, 1-0.1-2

- It allows you to reduce the time for a series of positions to turn into profit.

- It can put a load on your trading account and balance.

- It is recommended to use only with a sufficient balance!

- If LotsMartin is less than 1, then the next averaging lot will decrease when you open each additional averaging position!

- If LotsMartin is greater than 1, then the next averaging lot will increase when each additional averaging position is opened!

Parameter MaxOrdersOpen

– Limits the number of additional averaging positions against the trend.

Optimization of values: Only in extreme cases, 0 – 1 – 10

- Allows you to limit the load on the deposit by restricting the number of new additional positions.

- I use the value of 5. But you can optimize this value for better results.

Table of Contents (click to show)

External Variables and Settings

| Name | Description |

|---|---|

General Settings | |

| SetMinStops |

Automatically normalize all parameters of the Expert Advisor to the minimum acceptable stop levels. With virtual stops, this parameter does not apply. With AutoSetMinLevel, stop levels will be set to the lowest possible levels allowed by the server; If the Stop Loss or Take Profit level is below the server’s minimum stop level, then Stop Loss/Take Profit level = Minimum Stop Level (Spread * 2 or fixed level on the server) + Spread.When using ManualSet, the user will receive a message that the EA’s stop levels are below the minimum, and the EA will receive an error from the server. If the server’s stop level is floating, then the minimum stop level is calculated automatically as = Spread * 2. |

| Magic | The magic number of the positions opened by our Expert Advisor (EA). |

| TakeProfitALL |

Total take-profit for all positions. Take Profit will be set at a distance of TakeProfitALL points from the average opening price of positions. If you set TakeProfitALL = 5 points, this means that take profit will be set at a distance of 5 points from the middle line. |

| StopLossALL |

Total stop-loss for all positions. Stop Loss will be set at a distance of StopLossALL points from the average opening price of positions. If you set StopLossALL = 5 points, this means that Stop Loss will be set at a distance of 5 points from the middle line. |

| MaxOrdersOpen | Maximum number of positions for this currency pair in one direction (separately for BUY and SELL). |

| AllTradeTrail |

Modify the position of the original (the main position from which averaging is opened). Trailing Stop / TakeProfitALL / StopLossALL will apply to all positions (deals) and the position you want to average. If your position does not have a Trailing Stop / TakeProfitALL / StopLossALL, our advisor will also set Trailing Stop / TakeProfitALL / StopLossALL on your position. This parameter is also involved in the modification of Take Profit / Stop Loss. If this option is enabled, then all positions (deals) on the account will be recognized by our advisor as your deals. All SL and TP of all deals will be set according to our program’s settings. |

| Include_Commission_Swap |

Consider the author’s calculation of the Commission and the swap when the functions are enabled: BreakEven (stop loss at the breakeven Point (Pips)), Trailing Stop, Averaging. The author’s calculation of the Commission is based on the formula for calculating the value of 1 Point (Pips) from open positions for this symbol and the magic number; a negative swap and Commission are included in the calculation. The function returns the cost of a negative swap and Commission in Points (Pips) and takes this into account when working with the Breakeven functions (stop loss at the breakeven Point (Pips)) and Trailing Stop. Attention: If you have a floating spread with your broker, the Commission settlement is executed and set at the moment of the Breakeven functions (stop loss at the breakeven Point (Pips)) and Trailing Stop operation, but the spread may increase, resulting in additional loss Points (Pips). This is not a calculation error! Also, note that when a swap occurs, the advisor recalculates the Breakeven line (stop loss at the breakeven Point (Pips)) and sets new stops if the server allows it (restriction to the minimum stop level for your broker’s StopLevel). If the server does not allow setting a breakeven and returns a minimum stop level error, the EA will not be able to modify the position, and you may incur additional loss Points (Pips). To avoid losses when using Commission and receiving a negative swap, we recommend increasing the distance between Breakeven (stop loss at the breakeven Point (Pips)) or Trailing Stop. The Breakeven level (LevelWLoss) can be calculated independently, considering the Commission. For example, if the Commission for opening and closing a position = 2 dollars (EURUSD) per 1 lot. To cover the Commission loss, set LevelWLoss = 2 (Points (Pips)) + 1 (control point) = 3 Points (Pips). Thus, the advisor will set the Breakeven (Stop Loss at the breakeven Point (Pips)) at +3 Points (Pips), which will cover the Commission loss. |

| ShowInfoAverager |

Additional information on the chart where our advisor is installed. When ShowInfoAverager is enabled (true), you will see the following information: Average = Displays the Average (zero) line from positions in the same direction. Hovering over the label provides additional information about the average line calculation! Next Average = Displays the next averaging position that will be opened in this direction. Hovering over the label provides additional information about the distance! Next Additional = Displays the next position for additional opening that will be opened in this direction. |

Averaging Settings | |

| Distance |

The distance for opening positions in the averaging grid. After how many points against the trend to open the next averaging position (Deal) from the last open position of one type for averaging. For example, you can set 100 Points (Pips). Then, each new averaging position will be opened after 100 Points (Pips) of loss from the last open position. You can set 50 Points (Pips). Then, each new additional position (Deal) will be opened after 100 + 50 loss points from the last open position. (100,150,200,250,300) |

| DistanceMartin |

The multiplier for the distance from the average for each deal. You can set it at 1.5. Then, each new averaging position will be opened after 100 + 50 (100 * 1.5) loss Points (Pips) from the last open position (100,150,225,337,506). |

| DistanceAdditionalPoint |

Additional Points (Pips) for calculating the distance. If DistanceAdditionalPoint = 5, then 5 points (Pips) are added to each subsequent distance. If the previous number of deals = 3, then additional points (Pips) for the distance = 5 * 3 = 15 additional points (Pips). |

| DistanceMax |

The maximum number of points (Pips) for the distance. If, when calculating the distance, the obtained value exceeds DistanceMax, then the Expert Advisor will use DistanceMax in Points (Pips). |

| DistanceDifferent |

Distances for new averaging positions (against the trend), separated by commas! You can specify distance values in the format: xx, yy, zz, aa Where: xx – Distance in points for opening the first averaging position; yy – Distance in points for opening the second averaging position; zz – Distance in points for opening the third averaging position; aa – Distance in points for opening the fourth and subsequent averaging positions; The last number in the line = distance for all subsequent positions. You can set any number of distances. |

| StopLoss |

Stop Loss for the averaging position to be opened, Note: Each averaging position will initially open with its own Stop Loss. Stop Loss will be set at a distance of StopLoss points from the opening price of the averaging position. |

| TakeProfit |

Take Profit for the averaging position to be opened, Note: Each averaging position will initially open with its own Take Profit. Take Profit will be set at a distance of TakeProfit points from the opening price of the averaging position. |

| LotsMartin |

Coefficient: Increase the lot (Volume) for grid positions. The coefficient for increasing the lots of each subsequent averaging position. For example: Starting Lot (Volume) of the main position = 0.1 LotsMartin = 2, then The next lot (Volume) of the opened averaging position will be 0.2, 0.4, 0.8, and so on. If Martin = 1, then martingale does not activate (Fixed lots (Volumes)). If Martin = 0, then the Expert Advisor cannot open the next position. If Martin = 2, then the first lot = 0.1, the second lot = 0.2, and so on: 0.4 – 0.8 – 1.6 – 3.2 – 6.4… If Martin = 0.5, then the first lot = 1, the second lot = 0.5, and so on: 0.25 – 0.125. Attention: The middle line will be calculated using the formula based on the lots. This allows you to bring the breakeven level (middle line) closer to the current price. However, martingale can be dangerous for your account. Please calculate this parameter so that your deposit can withstand such a load. |

| LotAdditional |

Additional lot (Volume) for the next averaging position. For example: Starting lot (Volume) of the main position = 0.1; LotAdditional = 0.05, then The next lot of the opened averaging position will be 0.15, 0.2, 0.25, and so on. |

| LotDifferent |

Lots, separated by commas for averaging deals; You can specify the desired lot values in the format: xx.xx, yy.yy, zz.zz, aa.aa where: xx.xx – Lot to open the first averaging position; yy.yy – Lot to open the second averaging position; zz.zz – Lot to open the third averaging position; aa.aa – Lot to open the fourth and subsequent averaging positions; The last number in the line = Lot (Volume) of all subsequent positions. You can specify any number of lots. |

| LotMax |

The maximum lot (Volume) that will be set when an averaging position is opened. 0 – disabled |

| CloseAveragingAfterCloseMainDeals |

The EA can close averaging positions (opened against the trend) when the main positions are closed. The function will close averaging positions only when all the main positions (for the current symbol and magic number) are closed! Attention: The new function works separately for the BUY and SELL directions! |

Additional Settings | |

| ADDITIONALDistance |

The distance for opening positions in the additional grid. After how many points in the trend to open the next additional position (Deal). You can set 50 points (Pips). Then, each new additional position (Deal) will be opened after 100 + 50 loss points from the last open position. (100,150,200,250,300) |

| ADDITIONALDistanceMartin |

The multiplier for the distance from the additional positions for each deal. You can set 50 points (Pips). Then, each new additional position (Deal) will be opened after 100 + 50 loss points from the last open position. (100,150,200,250,300) |

| ADDITIONALDistanceAdditionalPoint |

Additional Points (Pips) for calculating the distance. If ADDITIONALDistanceAdditionalPoint = 5, then 5 points (Pips) are added to each subsequent distance. If the previous number of deals = 3, then additional points (Pips) for the distance = 5 * 3 = 15 additional points (Pips). |

| ADDITIONALDistanceMax |

The maximum number of points (Pips) for the distance. If, when calculating the distance, the obtained value exceeds ADDITIONALDistanceMax, then the Expert Advisor will use ADDITIONALDistanceMax in Points (Pips). |

| ADDITIONALDistanceDifferent |

Distances for new additional positions (in the trend), separated by commas! You can specify distance values in the format: xx, yy, zz, aa Where: xx – Distance in points for opening the first additional position; yy – Distance in points for opening the second additional position; zz – Distance in points for opening the third additional position; aa – Distance in points for opening the fourth and subsequent additional positions; The last number in the line = distance for all subsequent positions. You can set any number of distances. |

| ADDITIONALStopLoss |

Stop Loss for the additional position to be opened, Note: Each additional position will initially open with its own Stop Loss. Stop Loss will be set at a distance of ADDITIONALStopLoss points from the opening price of the averaging position. |

| ADDITIONALTakeProfit |

Take Profit for the additional position to be opened, Note: Each additional position will initially open with its own Take Profit. Take Profit will be set at a distance of ADDITIONALTakeProfit points from the opening price of the averaging position. |

| ADDITIONALLotsMartin |

Coefficient: Increase the lot (Volume) for grid positions. The coefficient for increasing the lots of each subsequent additional position. For example: Starting Lot (Volume) of the main position = 0.1 LotsMartin = 2, then The next lot (Volume) of the opened additional position will be 0.2, 0.4, 0.8, and so on. Attention: The middle line will be calculated using the formula based on the lots. This allows you to bring the breakeven level (middle line) closer to the current price. However, martingale can be dangerous for your account. Please calculate this parameter so that your deposit can withstand such a load. |

| ADDITIONALLotAdditional |

Additional lot (Volume) for the next additional position. For example: Starting lot (Volume) of the main position = 0.1; LotAdditional = 0.05, then The next lot of the opened additional position will be 0.15, 0.2, 0.25, and so on. |

| ADDITIONALLotDifferent |

Lots, separated by commas for additional deals; You can specify the desired lot values in the format: xx.xx, yy.yy, zz.zz, aa.aa where: xx.xx – Lot to open the first additional position; yy.yy – Lot to open the second additional position; zz.zz – Lot to open the third additional position; aa.aa – Lot to open the fourth and subsequent additional positions; The last number in the line = Lot (Volume) of all subsequent positions. You can specify any number of lots. |

| ADDITIONALLotMax |

The maximum lot (Volume) that will be set when an additional position is opened. 0 – disabled |

| CloseAdditionalAfterCloseMainDeals |

Close additional open positions (opened with the trend) when the main positions are closed. The function will close additional opening positions only when all main positions (for the current symbol and magic number) are closed! Attention: The new function works separately for the BUY and SELL directions! |

Filter Settings | |

| OrderToAverage |

The type of positions that our Expert Advisor (EA) monitors. The order type for the Expert Advisor, All = -1, = All Positions; BUY = 0, = Only BUY; SELL = 1, = Only SELL. |

| MagikToAverage |

The magic number of the positions that our Expert Advisor (EA) monitors. Supports multiple magic numbers! MagicNumber: Magic number of positions (deals) for tracking. MagicNumber: Magic numbers can be specified and separated by commas: 0 – orders opened manually; 123,345,147 – all positions with MagicNumber numbers 123,345,147; -1 – all MagicNumbers, without exception. |

| MarketWatch |

For opened positions with Stop Loss / Take Profit on an account with MARKET execution. First, the EA can open a position (Deal), and after successful opening, it modifies the levels of Stop Loss and Take Profit for this position (deal). |

| SleepForOpenbetweenLastClose | The number of seconds of the averaging delay after the last closed position. |

| OpenOnly1ofBar | Open only one averaging position per current bar (Depends on TF). |

Trailing Stop Settings | |

| TrailingStopUSE |

Standard trailing stop function. Note: If averaging or additional positions are enabled (true): If you open 2 or more positions, the Expert Advisor activates the trailing stop function from the average line, not from the opening position price. The average price is displayed on the chart.  Functional features of experts from www.expforex.com |

| TrailingStop |

Distance in points from the current price to the Stop Loss. If the current profit is 200 Points (Pips), and TrailingStop = 100, then the Stop Loss will be set at +100 points. Thus, the price has the possibility of a rollback of a maximum of 100 Points (Pips). Otherwise, Stop Loss will work, and the position will be closed at +100 Points (Pips). |

| TrailingStep | Step of Stop Loss when the trailing stop function is enabled. |

| MovingInWLUSE |

Enable the break-even function. The function modifies the Stop Loss by LevelWLoss points when the position reaches LevelProfit profit points. Functional features of experts from www.expforex.com Example: LevelWLoss = 50, LevelProfit = 200 As soon as the position accumulates 200 points of profit, the Stop Loss of the position will be modified to the opening price of the position (+ spread) + 50 points. Example: LevelWLoss = 0, LevelProfit = 100 As soon as the position accumulates 100 points of profit, the Stop Loss of the position will be modified to the opening price of the position (+ spread). Attention: If the averaging or additional function is enabled (true): When you open 2 or more positions, the advisor activates the break-even function from the average line, not from the opening price of positions. |

| LevelWLoss |

The profit level (LevelWLoss) in points at which the Stop Loss is set when this function is enabled. 1 = 1 point of profit; 0 = Automatic minimum profit mode. If it is 0, then the number of profit points for the break-even (Stop Loss at the breakeven Point) = Spread of the current currency pair. |

| LevelProfit |

The number of profit points (LevelProfit) gained by the position to set a Stop Loss at the LevelWLoss profit points (Pips). LevelProfit must be greater than LevelWLoss. |

FAQ about Exp Averager

Our General FAQ

FAQ Answers to the most popular questions

What are the values in the parameters in points or pips?

In points! The value is taken from the Point() variable.

- If you have a 5 or 3-digit broker, then 1 point = 0.00001 or 0.001

- If you have a 4 or 2-digit broker, then 1 point = 0.0001 or 0.01

You enter the required value (in the field) according to your particular broker.

There is much debate about what a point is and what a pip is.

I use universal values (Point = Pips).

These values are equal to your broker’s values.

When I set TakeProfitAll = 100, I see the TP lines are instantly modified. Could you please explain why? While they must be static from the middle line.

You have specified a Take Profit / Stop Loss / Trailing Stop level that is below what is allowed on your broker’s server!

Therefore, the Averager advisor calculates the minimum stop order level (StopLevel) and modifies the Take Profit / Stop Loss / Trailing Stop according to your broker’s rules (Contract Specifications).

If your account has a floating spread, then the minimum Stop Loss and Take Profit levels change with each price change (Tick).

You must set a Take Profit that is greater than the minimum allowed stop order level (StopLevel) on your server.

Or disable the automatic StopLevel detection function.

Automatically normalize all parameters of the Expert Advisor to the minimum acceptable stop levels.

With virtual stops – this parameter does not apply.

With AutoSetMinLevel, stop levels will be set to the lowest possible levels allowed by the server;

If the Stop Loss or Take Profit level is below the server’s minimum stop level, then Stop Loss/Take Profit level = Minimum Stop Level (Spread * 2 or fixed level on the server) + Spread.

When using ManualSet, the user will receive a message that the EA’s stop levels are below the minimum, and the EA will receive an error from the server.

If the server’s stop level is floating, then the minimum stop level is calculated automatically as = Spread * 2.

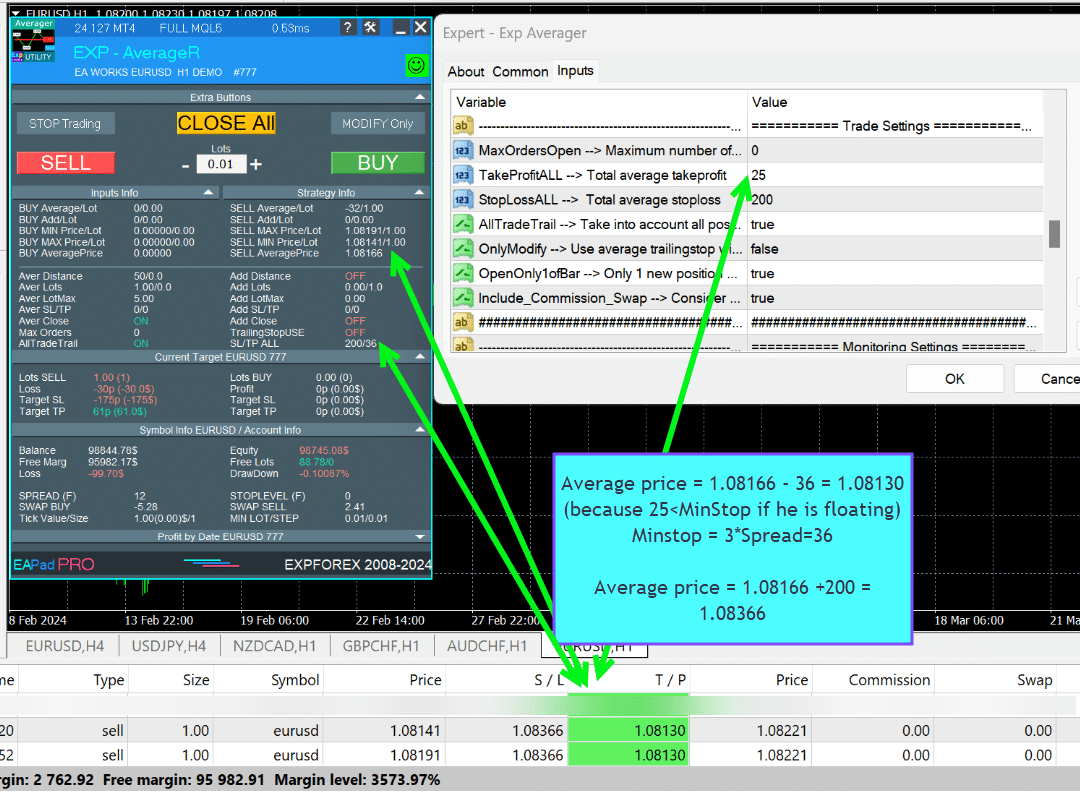

How are the average price and total Stop Loss / Take Profit calculated? Why does the EA set Take Profit at 36 pips instead of 25 pips?

Average Price = (1.08191 + 1.08141) / 2 = 1.08166

TakeProfit Average price = 1.08166 – 36 = 1.08130

(because 25 < MinStop if it is floating) MinStop = 3 * Spread = 36

StopLoss Average price = 1.08166 + 200 = 1.08366

What is the Averaging Strategy in Forex trading?

The Averaging Strategy involves opening additional positions against the trend as the price moves away from your initial position, aiming to lower the overall entry price and reach the break-even point.

How does Additional Opening work with the trend?

Additional Opening refers to opening more positions in the direction of the trend, leveraging favorable market movements to maximize potential gains. For example, opening a second BUY position at a higher price to adjust the break-even point.

What are the key differences between Averaging and Additional Opening?

Averaging involves opening positions against the trend to lower the average entry price, while Additional Opening involves adding positions in the direction of the trend to capitalize on favorable movements.

How does the Expert Advisor (EA) assist with averaging?

The Expert Advisor (EA) automates the averaging process by opening additional positions based on predefined parameters, managing Trailing Stop, and adjusting Take Profit levels to optimize trading performance.

What is the purpose of the Trailing Stop in the averaging strategy?

The Trailing Stop function moves the Stop Loss level in the direction of profit as the market moves favorably, helping to lock in profits and minimize losses.

How should I determine the Averaging Distance?

The Averaging Distance should be calculated based on the currency pair’s average movement and your account balance. It ensures that your account can sustain the additional positions without risking total loss.

What are the risks associated with the Martingale Strategy in averaging?

The Martingale Strategy increases the lot size with each additional position, which can lead to significant losses if the market continues to move against your initial position. It’s crucial to calculate parameters carefully to manage risk.

How do I install and set up the Exp-Averager?

To install the Exp-Averager, open the desired currency pair chart, install the Expert Advisor, and configure the parameters such as Distance, TakeProfit, and StopLoss according to your trading strategy.

What parameters can be optimized in the Exp-Averager?

Parameters such as TakeProfitALL, Distance, DistanceMartin, LotsMartin, and MaxOrdersOpen can be optimized to enhance the performance of the averaging strategy.

How does the Magic Number function in the EA settings?

The Magic Number uniquely identifies positions opened by the EA, allowing it to manage and track only those trades without interfering with manually opened positions.

Can I test the Exp-Averager before using it live?

Yes, you can use the Strategy Tester in your trading terminal to backtest the Exp-Averager and optimize its settings before deploying it on a live account.

What should I consider when setting the StopLoss and TakeProfit levels?

Set the StopLoss and TakeProfit levels based on the Averaging Distance and your risk management strategy to ensure that the EA can effectively manage trades and protect your account from excessive losses.

How does the EA handle Commission and Swap?

The EA considers Commission and Swap costs when calculating the BreakEven point and Trailing Stop, ensuring that these costs are accounted for to avoid unnecessary losses.

What is the role of MaxOrdersOpen in the EA settings?

MaxOrdersOpen limits the number of additional averaging positions the EA can open, helping to control the load on your deposit and manage risk effectively.

How can I customize the lot sizes for averaging positions?

You can customize lot sizes using parameters like LotsMartin, LotAdditional, and LotDifferent, allowing you to define how the lot size increases or decreases with each additional position.

What information is displayed in the EAPADPRO Panel?

The EAPADPRO Panel displays key information such as BUY Average / Lot, SELL Average / Lot, Min/Max Price for BUY and SELL deals, and the Average Price for both directions.

How does the EA manage Stop Loss when using averaging?

The EA modifies the Stop Loss to the break-even point once the price moves a certain distance in favor of the trade, helping to secure profits and minimize losses.

What is the OrderToAverage parameter used for?

The OrderToAverage parameter specifies the type of positions the EA monitors for averaging, such as all positions, only BUY, or only SELL orders.

Can the EA handle multiple Magic Numbers?

Yes, the EA supports multiple Magic Numbers, allowing it to manage positions across different strategies or trading systems simultaneously.

What is the recommended StopLoss setting when using averaging?

It is recommended to set a StopLoss of 5 averaging distances and limit the number of averaging positions to a maximum of 5 to balance risk and potential profit.

How does the EA ensure it doesn’t exceed the broker’s Minimum Stop Level?

The EA can automatically normalize all parameters to meet the broker’s Minimum Stop Level by using the SetMinStops or AutoSetMinLevel settings.

Changelog for Exp Averager

Reviews about Exp Averager

Thanks for feedback!

RBC1234

⭐⭐⭐⭐⭐

Although this utility was released a few years ago, I only recently became interested in it. I bought it because, unfortunately, I can't trust the results of demo versions, which are often very questionable. This isn't the case with this utility. It's running on a demo account and has very interesting results. It's an honest program, with great capabilities, and the developer is very attentive and honest with buyers. I've read all the reviews and comments carefully, and the explanations were always quick, thorough, and clear. It's well worth the price. I recommend purchasing it. Excellent!

RBC1234

⭐⭐⭐⭐⭐

Although this utility was released a few years ago, I only recently became interested in it. I bought it because, unfortunately, I can't trust the results of demo versions, which are often very questionable. This isn't the case with this utility. It's running on a demo account and has very interesting results. It's an honest program, with great capabilities, and the developer is very attentive and honest with buyers. I've read all the reviews and comments carefully, and the explanations were always quick, thorough, and clear. It's well worth the price. I recommend purchasing it. Excellent!Reply from ExpForex:

Thank you 🙂

Atila R Akdeniz

⭐⭐⭐⭐⭐

Atila R Akdeniz

As always, extremely useful Utility and excellent support from Vladislav.

Munir Sayed Yousef Ibrahim

⭐⭐⭐⭐⭐

Munir Sayed Yousef Ibrahim

Its really Nice software but if You have some heavy indicator on the same chart this Program might Lag in Speed otherwise it will work Just fine its a great tool, Thank You

Alex

⭐⭐⭐⭐⭐

Alex

Survey should be done after one month or later not two days later. Anyway I bought before Close Minus by Plus (now is free) from the same author and is an EXCELLENT piece of work so I give the author 5 stars in advance because: 1) his work has quality, 2) his ideas superb 3) This is honest work and price 4) The graphic EAPAD is nice and usefull 5) Finally I will be able to automatize the strategy of averaging against the trend that I use much more easily with pluses as trailing or break even that are not possible to do manually the same way. Very good you can choose to close the cycle or renew it. Thanks Vladislav for sharing your talent!

skyparc

⭐⭐⭐⭐⭐

skyparc

Thank you Vlad, for Update BreakEven WithoutLOSS options in meta 5 version, now is great, also I am using VirtualTradePad another briliant and perfect usefull tool

Jakote Molemi

⭐⭐⭐⭐

Jakote Molemi

Hello Vladislav, great program and very useful. There is a small hickup on the operation; please assist: Each time I update parameters (especially setting new levels for averaging), the program takes very very long time to test and update, how can I fix this trouble? I cannot attach a screenshot here you have disabled an option to reply to you and I do not know any other channel to reach you except here.2021.06.08 17:36Hello. Thank you. I didn't understand your mistake. are you talking about the eapadpro panel? it is updated every 10 seconds so as not to slow down the schedule. this does not affect the algorithm. please attach a screenshot or log files with the error to the discussion.

Vitali Lebianok

⭐⭐⭐⭐⭐

Vitali Lebianok

очень полезная и хорошая утилита позволяющая задать свою собственную стратегию и без лишних хлопот получать прибыль но внимательно отнеситесь при настройке к проведению тестов , а так же советую для каждой валютной пары вырабатывать отдельные настройки .ТАК ЖЕ хочу заметить что автор очень быстро и качественно помогает разобраться со всеми сложностями которые могут возникнуть при использовании хотелось бы поставить отдельно 5 звезд не только продукту но и разработчику )

Comments about Exp Averager

Do you have a question?

4 responses to “Averager. Averaging trading positions. Opening deals against the trend and on the trend!”

-

Español. Averager. ¡Abriendo operaciones en contra de la tendencia y a favor de la tendencia!

https://youtu.be/lmi5Bck0ProAVERAGER – Apertura de posiciones adicionales en la tendencia y contra la tendencia con la función del trailing stop general del beneficio.

???? GUÍA COMPLETA de AVERAGER: https://www.expforex.com/?p=25

???? AVERAGER MT4: https://www.mql5.com/es/market/product/1289

???? AVERAGER MT5: https://www.mql5.com/es/market/product/111200:00 Visión general

00:37 Cómo funciona Exp-Averager a favor de la tendencia

01:37 Cómo funciona Exp-Averager en contra de la tendencia

04:07 Cómo instalar Exp-Averager

04:54 Cómo probar Exp-AveragerVer en diferentes idiomas:

???? English: https://www.youtube.com/watch?v=7NwAcGmN0yE

???? Español: https://www.youtube.com/watch?v=lmi5Bck0Pro

???? Português: https://www.youtube.com/watch?v=IfgJhxA5_lk

???? Deutsch: https://www.youtube.com/watch?v=0vc19EzKc6w

???? Français: https://www.youtube.com/watch?v=5c6FGmyoN9UPromediar posiciones con Exp-Averager:

El Asesor Experto Averager es una poderosa herramienta de trading diseñada para abrir posiciones adicionales tanto a favor de la tendencia como en contra de la tendencia. Su característica clave es un trailing stop promedio inteligente para gestionar una serie de posiciones y ayudar a asegurar ganancias mientras el mercado se mueve.Características principales:

Incremento y decremento del lote (Volumen): Ajusta el tamaño del lote para cada posición, optimizando el riesgo.

Estrategia popular de promediado: Ideal para llevar posiciones no rentables al precio promedio y reducir pérdidas.

Trailing Stop General: Un trailing stop que asegura beneficios en series de posiciones a medida que el mercado se mueve a favor del trader.

Estrategia Popular:Esta herramienta es ampliamente utilizada por traders que buscan llevar posiciones no rentables al precio promedio. Al abrir nuevas posiciones en la misma dirección, pero a diferentes niveles de precio, el trader puede reducir las pérdidas al acercar el precio promedio al valor actual de mercado.

Conclusión:

El Asesor Experto Averager es una excelente solución para traders que buscan optimizar sus estrategias de gestión de posiciones y beneficiarse de movimientos en el mercado. Con características avanzadas como el trailing stop general, puede ayudar a maximizar las ganancias en series de posiciones.

Hashtags:

#mql5 #mql4 #experto #EA #Expforex #forex #tradingforex #metatrader #metaquotes #mql #scalping #scalper #promediar #trading #acciones #mt5 #stopmovil #estrategiadetrading #estrategiaforex #Vladon #Expforex #herramientasdetrading #tradingautomatico #gestiónderiesgos #rendimientotradingPalabras clave:

Exp-Averager MT4, Exp-Averager MT5, herramienta de trading forex, promediar posiciones, trading a favor de la tendencia, trading en contra de la tendencia, trailing stop, ajuste del tamaño de lote, tamaño del volumen, Asesor Experto de MetaTrader, minimizar pérdidas, gestión de beneficios, estrategias populares de trading, Vladon Expforex, automatización de trading, análisis técnico -

Português. Averager. Abrindo negócios contra a tendência e na tendência!

https://youtu.be/IfgJhxA5_lkGuia completo: https://www.expforex.com/?p=25

???? AVERAGER MT4: https://www.mql5.com/pt/market/product/1289

???? AVERAGER MT5: https://www.mql5.com/pt/market/product/111200:00 Visão geral

00:37 Como o Exp-Averager funciona na tendência!

01:37 Como o Exp-Averager funciona contra a tendência!

04:07 Como instalar o Exp-Averager

04:54 Como testar o Exp-AveragerAssista em diferentes idiomas:

???? English: https://www.youtube.com/watch?v=7NwAcGmN0yE

???? Español: https://www.youtube.youtube.com/watch?v=lmi5Bck0Pro

???? Português: https://www.youtube.com/watch?v=IfgJhxA5_lk

???? Deutsch: https://www.youtube.com/watch?v=0vc19EzKc6w

???? Français: https://www.youtube.com/watch?v=5c6FGmyoN9UFazendo a média das posições:

O Expert Advisor Averager é uma poderosa ferramenta de negociação projetada para abrir posições adicionais tanto a favor quanto contra a tendência. Ele possui um trailing stop inteligente para gerenciar uma série de posições, garantindo que o lucro seja maximizado.Características principais:

Aumento e redução do lote (volume): Permite ajustar o tamanho do lote para cada posição.

Estratégia popular de promediado: Ideal para trazer posições não lucrativas para o preço médio, minimizando as perdas.

Trailing Stop Geral do Lucro: A ferramenta ajuda a garantir ganhos à medida que o mercado se move a favor do trader.

Estratégia Popular:O Averager é amplamente utilizado por traders que buscam melhorar suas posições não lucrativas. Ao abrir novas posições na mesma direção da original, mas em níveis de preço diferentes, o trader pode aproximar o preço médio da posição ao preço de mercado atual, reduzindo as perdas potenciais.

Conclusão:

No geral, o Expert Advisor Averager é uma ferramenta poderosa e essencial para traders que desejam gerenciar suas posições de forma eficaz e otimizar suas estratégias de negociação. Com um trailing stop inteligente e a capacidade de ajustar o volume, o Averager é ideal para quem busca seguir tendências e maximizar o potencial de lucro.

Hashtags:

#mql5 #mql4 #expert #EA #Expforex #forex #negociaçãodemoedas #metatrader #metaquotes #mql #scalping #scalper #tendências #trading #ações #mt5 #stopmovel #estrategiadenegociação #estrategiaforex #Vladon #Expforex #ferramentasdenegociação #negociaçãoautomática #gerenciamentoderiscos #negociaçõesefetivas #lucremáximoPalavras-chave:

Exp-Averager MT4, Exp-Averager MT5, ferramenta de negociação forex, promediado de posições, negociação a favor da tendência, negociação contra a tendência, trailing stop inteligente, ajuste de volume, estratégia de preço médio, gestão de lucros, Vladon Expforex, automatização de negociação, análise técnica -

Deutsch. Averager. Deals eröffnen gegen den Trend und mit dem Trend!

https://youtu.be/0vc19EzKc6wVollständige Anleitung: https://www.expforex.com/?p=25

???? AVERAGER MT4: https://www.mql5.com/de/market/product/1289

???? AVERAGER MT5: https://www.mql5.com/de/market/product/111200:00 Übersicht

00:37 Wie Exp-Averager im Trend arbeitet!

01:37 Wie Exp-Averager gegen den Trend arbeitet!

04:07 Wie man den Exp-Averager installiert

04:54 Wie man den Exp-Averager testetAnleitungen in verschiedenen Sprachen:

???? English: https://www.youtube.com/watch?v=7NwAcGmN0yE

???? Español: https://www.youtube.com/watch?v=lmi5Bck0Pro

???? Português: https://www.youtube.com/watch?v=IfgJhxA5_lk

???? Deutsch: https://www.youtube.com/watch?v=0vc19EzKc6w

???? Français: https://www.youtube.com/watch?v=5c6FGmyoN9UDurchschnittsbildung von Positionen:

Der Expert Advisor Averager ist ein leistungsstarkes Werkzeug zur Eröffnung zusätzlicher Positionen sowohl im Trend als auch gegen den Trend. Er bietet einen intelligenten Durchschnitts-Trailing-Stop, um Gewinne in einer Reihe von Positionen zu sichern.Hauptmerkmale:

Erhöhung und Verringerung der Losgröße (Volumen): Ermöglicht die Anpassung der Losgröße für jede Position.

Beliebte Strategie der Durchschnittsbildung: Ideal, um verlustreiche Positionen auf den Durchschnittspreis zu bringen und Verluste zu minimieren.

Allgemeiner Trailing-Stop des Gewinns: Diese Funktion hilft Tradern, Gewinne zu sichern, wenn sich der Markt in ihre Richtung bewegt.

Strategie der Durchschnittsbildung:Das Averager-Tool wird häufig von Tradern verwendet, um verlustreiche Positionen durch das Öffnen neuer Positionen in derselben Richtung, jedoch auf unterschiedlichen Preisniveaus, auf den Durchschnittspreis zu bringen. Dies hilft, Verluste zu minimieren und Positionen effizienter zu verwalten.

Schlussfolgerung:

Der Expert Advisor Averager ist ein unverzichtbares Tool für Trader, die ihre Positionen effektiv verwalten und ihre Handelsstrategien optimieren möchten. Mit einem intelligenten Trailing-Stop und der Möglichkeit, das Volumen zu steuern, ist das Averager-Tool ideal für Trader, die Markttrends nutzen und ihre Gewinne maximieren wollen.

Hashtags:

#mql5 #mql4 #expert #EA #Expforex #forex #forextrading #metatrader #metaquotes #mql #scalping #scalper #trending #aktien #mt5 #trailingstop #handelsstrategie #handelsstrategieforex #Vladon #Expforex #handelswerkzeuge #automatischerhandel #risikomanagement #durchschnittsbildung #gewinnmaximierungSchlüsselwörter:

Exp-Averager MT4, Exp-Averager MT5, Forex-Handelswerkzeug, Trendfolge, Gegen-den-Trend-Handel, Durchschnittsbildung, intelligenter Trailing-Stop, Volumenanpassung, Verluste minimieren, Gewinn sichern, Vladon Expforex, Handelsstrategie optimieren, Markttrends -

Français. Averager. Ouvrir des deals à contre-courant et sur la tendance !

https://youtu.be/5c6FGmyoN9UGuide complet : https://www.expforex.com/?p=25

???? AVERAGER MT4 : https://www.mql5.com/fr/market/product/1289

???? AVERAGER MT5 : https://www.mql5.com/fr/market/product/111200:00 Vue d’ensemble

00:37 Comment Exp-Averager fonctionne dans le sens de la tendance !

01:37 Comment Exp-Averager fonctionne à contre-tendance !

04:07 Comment installer Exp-Averager

04:54 Comment tester Exp-AveragerVidéos explicatives :

???? https://www.youtube.com/watch?v=7NwAcGmN0yE English.

???? https://www.youtube.com/watch?v=lmi5Bck0Pro Español.

???? https://www.youtube.com/watch?v=IfgJhxA5_lk Português.

???? https://www.youtube.com/watch?v=0vc19EzKc6w Deutsch.

???? https://www.youtube.com/watch?v=5c6FGmyoN9U Français.Moyenne des positions :

L’Expert Advisor Averager est un outil puissant qui permet d’ouvrir des positions supplémentaires à la fois dans le sens de la tendance et à contre-tendance, avec la fonction de trailing stop général du profit.Caractéristiques principales :

Ajustement de la taille du lot (volume) : permet de modifier la taille du lot pour chaque position.

Stratégie populaire de moyenne des positions : idéale pour ramener les positions non rentables au prix moyen.

Trailing stop général du profit : cette fonction permet de sécuriser les gains lorsque le marché évolue en faveur du trader.

Stratégie de moyenne des positions :L’Averager est couramment utilisé pour ramener les positions non rentables au prix moyen. Cela consiste à ouvrir de nouvelles positions dans la même direction que la position initiale, mais à un niveau de prix différent. En procédant ainsi, le trader rapproche le prix moyen de la position au niveau actuel du marché, ce qui peut réduire les pertes.

Conclusion :

L’Expert Advisor Averager est un outil essentiel pour les traders souhaitant mieux gérer leurs positions et optimiser leurs stratégies de trading. Il permet non seulement d’augmenter ou de diminuer la taille des positions, mais aussi de suivre les tendances du marché pour maximiser les gains avant de quitter une position.

Hashtags :

#mql5 #mql4 #expert #EA #Expforex #forex #forextrading #metatrader #metaquotes #mql #scalping #scalper #trending #bourse #mt5 #trailingstop #strategie #tradingstrategie #forexstrategie #tradingfrancais #traderfrancais #Vladon #Expforex #automatedtrading #gestionderisque #profitmaximisationMots-clés :

Exp-Averager MT4, Exp-Averager MT5, outil de trading, stratégie de moyenne des positions, tendance, contre-tendance, trailing stop intelligent, gestion de position, Vladon Expforex, optimisation des stratégies de trading, marché Forex, profits

Extra

Navigation by tabs

Related Posts

The X – Universal Expert Advisor (EA) for Forex Using

Universal Expert Advisor (EA) for MetaTrader with Extensive Functionality The Expert Advisor The X is a versatile trading tool for MetaTrader,…

Close Minus by Plus, Closing unprofitable positions by searching and

Closing unprofitable positions by identifying and closing profitable ones. The Expert Advisor (EA) is designed to close unprofitable positions by identifying…

EAPADPRO LIBRARY – Adding our panel to your EA

EAPADPRO LIBRARY – Enhancing Your Expert Advisor (EA) with Our Information Panel EAPADPRO LIBRARY offers a robust solution for traders looking…

Trade Report of TickSniper and the best advisors from Expforex

Description We have summed the summary and detailed trading results of our experts TickSniper, Good Santa, Tick Hamster, The X, on our real trading accounts. Trade…

EA The xCustomEA: Universal Trading Advisor for iCustom Indicators. Custom

Universal trading adviser on custom indicators for MetaTrader . Exp – The xCustomEA Universal trading advisor on custom indicators. The xCustomEA works on…

Assistant – the best free trading panel to support positions

Auto Setting stop loss, take profit, trailing stop, breakeven levels, enabling virtual stops. Exp Assistant will help you organize maintenance of your…

CLP CloseIfProfitorLoss with Trailing. Control of the total profit or

The Expert Advisor (EA) offers advanced features for managing and closing positions in MetaTrader, specifically upon reaching a predetermined level…

AI Sniper. Automatic Smart Expert Advisor for Metatrader.

AI Sniper is an intelligent, self-optimizing trading robot designed for both MT4 and MT5 terminals. It leverages a smart algorithm…

VirtualTradePad (VTP) Trading Panel. Trade Pad for One Click Traiding

VirtualTradePad or VTP – control panel for trade in 1 click in MetaTrader 4 and 5. Trade in 1 click from…

Copylot – Forex copier for trade deals for MetaTrader. Copier

Trade copier for MetaTrader. It copies forex trades, positions, orders from any accounts. It is one of the best trade copiers MT4-MT4, MT5 – MT4 for…

TickSniper Automatic Expert Advisor for Metatrader. Tick scalper

Exp-TickSniper is a fast tick scalper that automatically selects parameters for each currency pair separately. The EA has been developed based on…

The X and The xCustomEA: Testing and Optimization

Description The X and The xCustomEA are two standout Expert Advisors (EAs) in the Forex trading community, gaining widespread popularity over…

Extra Report Pad – Trader’s Diary. Professionally analyzes your trading

Extra Report Pad – professional solution for analyzing your trading account Today, it is essential to trade at once for several…

Market Time Pad. Indicator for MetaTrader with trading sessions

The Time Indicator displays the current time across the major world markets and highlights the active trading session. It is easy…

この記事は次の言語でもご覧いただけます: English Portuguese Español Deutsch Français Русский Українська Indonesian Italiano العربية Chinese 日本語 한국어 Türkçe ไทย Tiếng Việt

Leave a Reply