Рынок Forex – происхождение

CFD – Contract for Difference

Description

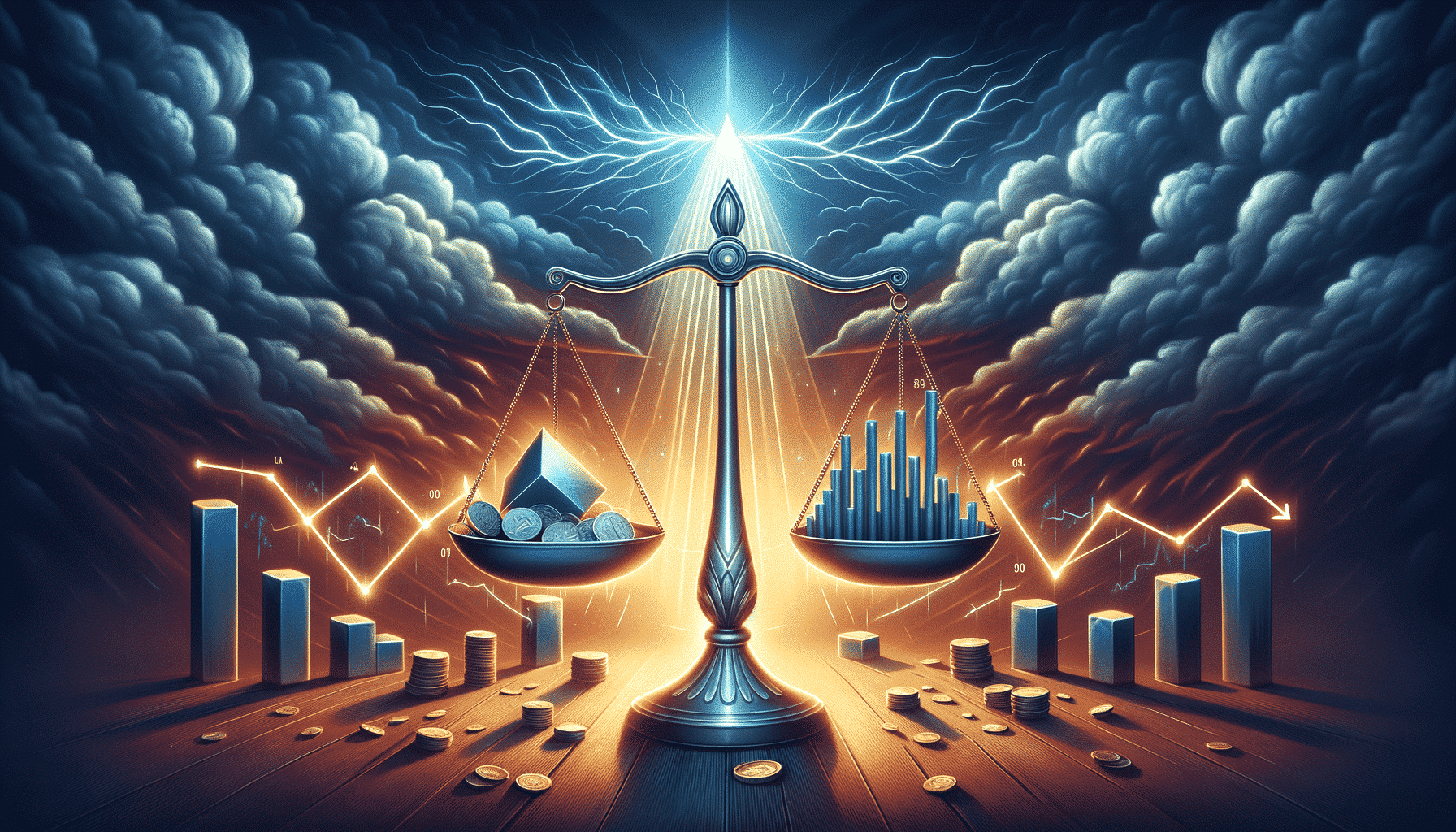

What is hedging

Definition and examples.

Hedging is the use of one instrument to reduce the risk associated with the adverse effect of market factors on the price of another associated with the first instrument or on the cash flows generated by it.

The hedged asset may be a commodity or financial asset that is on hand or planned to be purchased or produced. The hedging instrument is chosen so that adverse changes in the price of the hedged asset or associated cash flows are offset by changes in the relevant parameters of the hedging asset.

Here are some examples:

Hedging Against Price Decline: A gasoline producer buys oil and plans to sell the gasoline produced from it in 3 months. He fears that during this period, oil prices (and gasoline prices) might fall, leading to reduced profits or potential losses. To mitigate this risk, he enters into a forward contract for the supply of gasoline with a maturity date of 3 months. This locks in a price and provides financial stability.

Using Options for Flexible Hedging: Instead of a forward contract, the gasoline producer could buy a put option on a gasoline futures contract with a maturity of 3 months (or slightly more). This option allows the producer to sell gasoline at a predetermined price or opt-out if prices are higher. By spending a small premium today, the producer secures a minimum sale price while retaining the potential to benefit from favorable market conditions.

Interest Rate Risk Management: A European firm plans to take a dollar loan from a bank for 3 months at a rate of LIBOR + 3% in 6 months. To hedge against rising interest rates, the firm sells a futures contract for a three-month Eurodollar deposit with a maturity in 6 months on the CME exchange. Here, the futures price is 100% minus the deposit rate, meaning a rise in interest rates makes a “short” position in the futures market profitable.

Inflation Protection for Bonds: A US investor holds 30-year fixed-coupon US Treasury bonds in the conservative portion of his portfolio. To protect real returns from inflation, he includes bonds with fixed interest coupons and par values indexed to the current inflation rate (CPI-U). This strategy ensures that the bond’s value adjusts with inflation, safeguarding purchasing power.

Currency Risk Hedging: A Japanese firm sells products to the US and receives payments in dollars, which are then converted to yen. To hedge against a rise in the yen against the dollar, the firm buys JPY/USD futures. This locks in a favorable exchange rate, protecting against potential losses due to currency fluctuations.

Stabilizing Tax Revenues: In Texas, 25% of local taxes come from oil-producing and refining companies. Falling world oil prices reduce tax revenues. To stabilize future cash flows, the state administration develops a hedging program to secure future oil sale prices. This real-life example shows how hedging can protect public finances from volatile commodity prices.

Sources of price risk.

Assessing Exposure to Price Risk Before Hedging

Before deciding whether to hedge, a company must evaluate its exposure to price risk. This exposure occurs under the following conditions:

- Variable Input or Output Prices:

- Prices for inputs (services) or outputs are not constant.

- Limited Control Over Raw Material Prices:

- The company cannot set prices for raw materials (services) at its discretion.

- Limited Control Over Output Prices:

- The company cannot freely set prices for output products while maintaining sales volume (in physical terms).

Main Sources of Risk from Price Changes

To understand the need for hedging, it is essential to identify the primary sources of risk associated with possible price changes:

- Unsold Stocks of Finished Products:

- Holding unsold inventory exposes the company to the risk of price declines, which can lead to losses if the inventory’s market value decreases.

- Non-Produced Products or Future Harvest:

- Future production or harvests are subject to market price fluctuations. Uncertainty in future prices can affect profitability and financial planning.

- Concluded Forward Contracts:

- Engaging in forward contracts can lock in prices, but they also expose the company to the risk of price movements that can make the contract less favorable than the current market price at the time of execution.

Basic hedging instruments.

Understanding Hedging Instruments

When discussing hedging, it is crucial to emphasize the purpose of the transaction rather than the means used. Both hedgers and speculators use the same instruments; the difference lies in their objectives. Hedgers aim to reduce the risk associated with price movements, while speculators deliberately take on this risk, hoping for a favorable outcome.

Types of Hedging Instruments

Depending on the form of trade organization, hedging instruments can be classified into two categories: exchange and over-the-counter (OTC).

OTC Hedging Instruments

OTC instruments include forward contracts and commodity swaps. These transactions are conducted directly between counterparties or through a dealer, such as a swap dealer.

Advantages of OTC Instruments:

- Highly customizable to meet specific client requirements regarding the type of goods, lot size, and delivery conditions.

Disadvantages of OTC Instruments:

- Low Liquidity: Terminating a previously concluded transaction typically involves significant material costs.

- High Overhead Costs: These transactions often have relatively high associated costs.

- Minimum Lot Size Restrictions: There are substantial limitations on the minimum lot size.

- Difficulty in Finding Counterparties: It can be challenging to find a counterparty for the transaction.

- Risk of Non-fulfillment: In direct transactions between the seller and the buyer, there is a risk that one party may not fulfill their obligations.

Exchange Hedging Instruments

Exchange instruments include commodity futures and options on those futures. These instruments are traded on specialized trading platforms (exchanges). A key aspect of exchange trading is that a clearing house acts as a counterparty to every transaction, guaranteeing the fulfillment of both the seller’s and the buyer’s obligations. Standardization is essential for commodities traded on exchanges, which typically include oil, oil products, gas, non-ferrous and precious metals, and food products (such as cereals, meat, sugar, and cocoa).

Advantages of Exchange Instruments:

- High Liquidity: Exchange-traded instruments typically have high liquidity, making it easier to enter and exit positions.

- Reduced Counterparty Risk: The clearing house guarantees the obligations of both parties, reducing the risk of default.

- Standardization: The standardization of contracts simplifies the trading process and ensures uniformity.

Disadvantages of Exchange Instruments:

- Lack of Customization: Standardization limits the ability to tailor contracts to specific needs regarding lot size, delivery conditions, and other specifications.

- Market Costs: There may be costs associated with trading on exchanges, such as fees and margin requirements.

Conclusion

Choosing between OTC and exchange hedging instruments depends on the hedger’s specific needs and circumstances. OTC instruments offer greater customization but come with higher costs and risks. Exchange instruments provide liquidity and reduced counterparty risk but lack flexibility. Understanding these trade-offs is crucial for making informed hedging decisions.

Exchange instruments:

Advantages

- High Liquidity:

- The futures market is highly liquid, allowing positions to be opened and closed at any time. This flexibility ensures that traders can quickly respond to market changes.

- High Reliability:

- The clearing house of the exchange acts as a counterparty to every transaction. This guarantees the fulfillment of contractual obligations, significantly reducing counterparty risk.

- Relatively Low Overhead Costs:

- Transaction costs in the futures market are relatively low compared to other hedging instruments, making it a cost-effective option for hedging.

- Global Accessibility:

- Thanks to telecommunications, trading on most exchanges can be conducted from anywhere in the world. This global accessibility allows for seamless participation in the market.

Disadvantages

- Strict Restrictions:

- There are very strict restrictions on the type of goods that can be traded, as well as on lot sizes, conditions, and delivery times. This lack of flexibility can be a limitation for hedging specific needs.

Futures price.

The use of futures exchange instruments for hedging real goods transactions is based on the parallel movement of futures prices and spot market prices. If this correlation did not exist, it would create arbitrage opportunities between the cash and futures markets.

Arbitrage Example

Let’s consider an arbitrage scenario where the futures price significantly exceeds the spot price:

- Take a Loan:

- Secure a loan to finance the purchase.

- Buy Goods on the Spot Market:

- Purchase a consignment of goods at the current spot price.

- Sell Futures Contract:

- Sell a futures contract for the same goods on the futures market at the higher futures price.

- Deliver Goods:

- Upon the futures contract’s maturity, deliver the purchased goods to fulfill the futures contract.

- Repay the Loan:

- Use the proceeds from the futures sale to pay off the loan.

Understanding the Basis

The difference between the futures price and the spot price is known as the basis. This basis reflects factors such as the cost of debt capital (current interest rates) and the cost of holding the commodity. The basis can be either positive or negative:

- Positive Basis:

- Common for commodities that are expensive to store, like oil and non-ferrous metals.

- Negative Basis:

- Common for commodities that gain value when held before delivery, such as precious metals.

Basis Dynamics

The basis is not constant; it is subject to systematic and random changes. A general trend is that the absolute value of the basis decreases as the delivery time for a futures contract approaches. However, in situations of urgent demand for a cash commodity, the market can become “inverted,” where cash prices exceed futures prices, often significantly.

Hedging strategies.

A hedging strategy involves using specific financial instruments to mitigate price risks. These strategies rely on the parallel movement of spot prices and futures prices, allowing losses in the real commodity market to be offset by gains in the derivatives market. However, basis volatility introduces residual risk that cannot be completely eliminated through hedging.

Types of Hedging

There are two main types of hedging: the buyer’s hedge and the seller’s hedge.

Buyer’s Hedge

A buyer’s hedge is used when an entrepreneur plans to purchase goods in the future and wants to mitigate the risk of price increases. The primary methods for hedging the future purchase price of a commodity include:

- Buying a Futures Contract:

- By purchasing a futures contract, the buyer locks in a price for the future purchase of the commodity. If the spot price increases, the gain in the futures position offsets the higher cost in the spot market.

- Buying a Call Option:

- A call option gives the buyer the right, but not the obligation, to purchase the commodity at a predetermined price. This protects against price increases while allowing the buyer to benefit if prices fall.

- Selling a Put Option:

- The buyer earns a premium by selling a put option. If the commodity price stays above the option’s strike price, the option expires worthless. However, if the price drops, the premium earned can offset some of the losses.

Seller’s Hedge

A seller’s hedge is used to limit the risks associated with a potential decrease in the price of goods. The main methods for hedging the future sale price of a commodity include:

- Selling a Futures Contract:

- By selling a futures contract, the seller locks in a price for the future sale of the commodity. If the spot price decreases, the gain in the futures position offsets the lower revenue in the spot market.

- Buying a Put Option:

- A put option gives the seller the right, but not the obligation, to sell the commodity at a predetermined price. This protects against price decreases while allowing the seller to benefit if prices rise.

- Selling a Call Option:

- By selling a call option, the seller earns a premium. If the commodity price stays below the option’s strike price, the option expires worthless. However, if the price rises, the premium earned can offset some of the reduced revenue.

Let’s consider the main methods of hedging using the seller’s hedge as an example.

1. Hedging by selling futures contracts.

This strategy consists of selling futures contracts in the futures market in an amount corresponding to the volume of the hedged batch of real goods (full hedge) or less (partial hedge).

A deal on the derivatives market is usually concluded at a point in time when

1. the seller can predict with a high degree of certainty the cost of the sold consignment of goods

2. the prices on the derivatives market have formed, providing an acceptable profit.

For example, suppose a gasoline manufacturer wants to hedge its future selling price, and the cost of refining oil can be estimated at the time of its purchase. In that case, the hedge is entered at the same moment, i.e., open positions in the futures market.

Hedging with futures contracts fixes the price of future delivery of a commodity; at the same time, in the event of a drop in prices on the spot market, the lost profit will be compensated by the income from the sold futures contracts (if the futures price drops, the traded futures makes a profit). However, the other side of the coin is the impossibility of taking advantage of rising prices in the real market – additional profit in the “spot” market, in this case, will be “eaten” by losses on sold futures.

Another disadvantage of this hedging method is the need to constantly maintain a certain amount of collateral for open futures positions. When the spot price for a real product falls, maintaining the minimum margin is not a critical condition because, in this case, the seller’s exchange account is replenished with a variation margin on the sold futures contracts; however, as the spot price rises (and the futures price rises with it), the variation margin on open futures positions is removed from the exchange account, and additional funds may be required.

2. Hedging by buying a put option.

The holder of an American put option has the right (but not the obligation) to sell the futures contract at a fixed price (the strike price of the option) at any time. Having bought an option of this type, the seller of the goods sets the minimum selling price while retaining the opportunity to take advantage of the price increase that is favorable for him. When the futures price drops below the strike price of the option, the owner executes it (or sells it), compensating for losses in the real commodity market; when the price rises, he waives his right to exercise the option and sells the commodity at the highest possible price. However, unlike a futures contract, when buying an option, a premium is paid, which disappears when the option is canceled.

The purchased option does not require a guarantee.

Thus, hedging by buying a put option is similar to traditional insurance: the insured receives compensation in the event of an unfavorable development of events for him (in the event of an insured event). It loses the insurance premium in the normal development of the situation.

3. Hedging by selling a call option.

The holder of an American call option has the right (but not the obligation) to buy the futures contract at a fixed price (strike price) at any time. Thus, the owner of an option can exercise it if the current futures price is greater than the strike price. For the option seller, the situation is reversed – for the premium received when selling the option, he assumes the obligation to sell, at the request of the option buyer, a futures contract at the strike price.

The margin for a sold call option is calculated similarly to the margin for a traded futures contract. Thus, the two strategies are largely similar; their difference lies in the fact that the premium received by the seller of the option limits his income on the urgent position; as a result, the written option compensates for the decrease in the price of the commodity by an amount no greater than the premium received by it.

4. Other hedging instruments.

A significant number of other options-based hedging methods have been developed (for example, selling a call option and using the resulting premium to buy a put option with a lower strike price and a call option with a higher strike price).

The choice of specific hedging instruments should be made only after a detailed analysis of the hedger’s business needs, the industry’s economic situation and prospects, and the economy as a whole.

The simplest in terms of implementation is the full short-term hedging of a single batch of goods. In this case, the hedger opens a position on the futures market, the volume of which corresponds as closely as possible to the volume of a lot of real goods sold, and the term of the futures contract is chosen close to the term of the real transaction. Positions on the futures market are closed at the moment of execution of the transaction on the spot market.

While hedging is an effective tool for managing price risks, several complexities can arise, particularly in long-term transactions, continuous production cycles, and when dealing with non-standard commodities. Here are some advanced considerations and strategies to address these challenges:

1. Rolling Over Contracts for Long-Term Hedging

For long-term hedging (more than one year), it is often difficult to find a futures contract with suitable maturity and sufficient liquidity. In such cases, the “roll” or “roll-over” practice is used:

- Initial Position: Open a position in a nearer-term contract (e.g., a 6-month maturity).

- Rolling Over: As liquidity for longer-term contracts improves, close the near-term position and open a new position in a more distant contract.

This approach allows continuous hedging over extended periods despite the lack of long-term futures contracts.

2. Hedging in Continuous Production Cycles

Hedging becomes more complex with continuous or near-continuous production cycles. This scenario involves maintaining open positions in the derivatives market with varying delivery times:

- Managing Open Positions: Continuously manage the “cash-term” position, which involves monitoring and adjusting the hedges across different maturities.

- Coordination: This requires sophisticated tracking and coordination to ensure that the hedging strategy aligns with the production cycle and market conditions.

3. Selecting the Right Exchange Commodity

Finding an exact match for the commodity in a real transaction is not always possible. This necessitates additional analysis:

- Commodity Correlation: Determine which exchange-traded commodity or group of commodities closely correlates with the real market position.

- Cross-Hedging: Use a related commodity to hedge the position, understanding that this introduces basis risk due to the imperfect correlation.

4. Dynamic Hedging for Variable Sales Volumes

When changes in prices affect potential sales volumes, traditional hedging schemes may become ineffective, leading to “under-hedging” or “over-hedging.” Dynamic hedging can address this:

- Constant Analysis: Regularly analyze and adjust the hedge volume to match the actual market position.

- Adjustment: Modify the size of the futures or options positions to reflect changes in the real market, ensuring better alignment and risk management.

Hedging cost.

The primary objective of hedging is to reduce the risk of potential losses, not to generate additional profit. However, risk reduction often comes with additional costs, which can manifest in various forms. Here are some of the key sources of these costs:

- Risk Transfer Costs:

- When entering a hedge, the hedger transfers some risk to a counterparty. This counterparty can be another hedger or a speculator. Speculators take on additional risk in anticipation of profiting from future price movements. They are compensated either through real money (such as when selling an option) or potential future gains (as in futures contracts).

- Transaction Costs:

- Every trade involves costs, such as commission payments and the bid-ask spread (the difference between purchase and sale prices). These costs are inherent in executing any transaction in the market.

- Security Deposit:

- For exchange-traded instruments, the exchange requires a security deposit to ensure transaction obligations are met. This deposit usually ranges from 2% to 20% of the hedged position’s value, depending on the price volatility of the underlying commodity. Collateral is required for instruments where the owner has obligations, such as futures and sold options.

- Variation Margin:

- Variation margin is another significant cost in hedging with futures and some options. It is calculated daily based on the movement of futures prices relative to the hedger’s position. If the futures price moves against the hedger’s position, funds are withdrawn from their exchange account, and vice versa if the price moves favorably. This margin compensates for potential real market losses but can also increase costs due to the timing of fund movements.

Example of Hedging Costs

Consider a hedger using futures contracts:

- Favorable Scenario: If the hedger incurs losses in the real market but profits in the derivatives market, the variation margin is credited to their account before the real market losses are realized. This timing can be beneficial as it provides liquidity to cover the impending real market losses.

- Unfavorable Scenario: Conversely, if the hedger makes a profit in the real market but incurs losses in the derivatives market, they must pay the variation margin before realizing the profit from the actual sale of goods. This can increase the overall cost of hedging due to the upfront margin payments.

The risk associated with a hedged position.

The primary goal of hedging is to reduce price risk, but it is typically impossible to entirely eliminate exposure to unfavorable price movements in the real asset market. Furthermore, a poorly developed hedging strategy can actually increase a company’s exposure to price risk. Here are the main types of risks inherent in hedging:

Basis Risk

The main risk associated with hedging is basis risk, which arises from the non-parallel movement of the price of a real asset and the corresponding forward instrument. This risk exists due to differences in the operation of supply and demand laws in the cash and futures markets. While the prices in these markets cannot diverge significantly due to arbitrage opportunities, some basis risk always remains. Basis risk can be caused by:

- Different Supply and Demand Dynamics: The cash and futures markets operate under slightly different supply and demand conditions, leading to potential discrepancies in price movements.

- Administrative Restrictions: Some exchanges impose limits on daily price fluctuations for futures contracts. These restrictions can cause significant differences between futures and spot prices, especially during periods of strong price movements in the real asset market.

Systemic Risk

Hedging cannot address systemic risks, which are associated with unpredictable changes in legislation, the introduction of duties and excises, and other regulatory actions. In fact, hedging can sometimes exacerbate these risks because open-term positions might prevent a company from adjusting delivery volumes to mitigate the impact of adverse regulatory changes.

Basic principles of hedging.

- Purpose of Hedging:

- An effective hedging program is designed to transform risk from unacceptable to acceptable forms, achieving an optimal risk structure. The goal is to balance the benefits of hedging against its costs.

- Assessing Potential Losses:

- Before deciding to hedge, it’s crucial to assess the potential losses the company may incur if it does not hedge. If the potential losses are insignificant and have little impact on the firm’s income, the costs of hedging might outweigh the benefits. In such cases, refraining from hedging may be the better option.

- Developing a Hedging Framework:

- Like any financial activity, a hedging program requires an internal system of rules and procedures. This framework ensures consistency, accountability, and effectiveness in implementing the hedging strategy.

- Contextual Evaluation of Hedge Effectiveness:

- The effectiveness of a hedge should be evaluated in the context of the main spot market activities. Isolated assessments of hedging operations’ profitability or losses are meaningless without considering the broader business context.

Benefits of Hedging

Despite the associated costs and challenges, hedging plays a vital role in sustainable business development by:

- Reducing Price Risk:

- Hedging significantly reduces the price risk associated with purchasing raw materials and selling finished products. It also mitigates uncertainties in future cash flows related to interest rates and exchange rates, leading to more efficient financial management and improved profit stability.

- Optimizing Risk and Cost:

- A well-designed hedging program not only reduces risk but also minimizes costs. It frees up company resources, allowing management to focus on core business activities where the company has a competitive advantage, while minimizing non-central risks. This approach increases capital efficiency, lowers funding costs, and stabilizes returns.

- Facilitating Normal Business Operations:

- Hedging allows for continuous price protection without disrupting normal business transactions. It eliminates the need to change inventory policies or enter into long-term forward contracts.

- Enhancing Creditworthiness:

- A hedged position often makes it easier to raise credit. Banks and financial institutions tend to value hedged collateral higher and apply the same principle to contracts for the supply of finished products.

Practical steps.

To effectively hedge price risk using futures instruments, a company must follow these steps:

- Select a Trading Platform and Futures Contract:

- Identify a trading platform and a futures contract that best suits the company’s hedging needs. This requires additional analysis because a futures contract may not always exactly match the commodity transaction. Choose a futures contract whose price dynamics closely align with the real product’s price movements.

- Choose a Clearing Company and Exchange Broker:

- Select a clearing company accredited on the relevant exchange to control the movement of funds and guarantee the fulfillment of transaction obligations. Also, choose an exchange broker who will execute trading orders on behalf of the company.

- Complete Required Documentation:

- Fill out the necessary standard forms and sign service contracts with the clearing company and the broker.

- Open and Fund a Trading Account:

- Open an account with the selected clearing company and transfer funds to it. These funds serve as a security deposit for open positions, typically around 10% of the planned transaction amount. Many exchanges and clearing companies require a minimum initial deposit, usually around $10,000.

- Develop a Hedging Strategy:

- Create a comprehensive hedging strategy tailored to the company’s specific risk management needs. This strategy should outline the goals, instruments, and methods for effectively hedging against price risk.

Hedging of basic commodities.

Oil and oil products.

Hedging price risk in the oil and oil products market involves using futures and options on futures contracts. The bulk of this trading is concentrated on two major exchanges: the New York Mercantile Exchange (NYMEX) and the International Petroleum Exchange (IPE) in London.

New York Mercantile Exchange (NYMEX)

NYMEX offers futures and options on futures for several petroleum products, including light crude oil, fuel oil, and unleaded gasoline. Below are the details for each:

1. Light Crude Oil (Light Sweet)

- Futures and Options Volume (1997-1998):

- Futures: 28,964,383 contracts

- Options: 7,476,904 contracts

- Volume: 4,900 million tons

- Contract Specifications:

- Delivery Object: Light Sweet Crude Oil (other grades like Brent can be supplied with specified discounts or surcharges)

- Contract Size: 1,000 barrels

- Trading Hours: 9:45 AM – 3:10 PM (main session), 4:00 PM – 8:00 AM (e-trading)

- Delivery Months: 36 monthly futures contracts (for the next 3 years) and long-term futures (3, 4, 5, 6, and 7 years)

- Price Change Step: 1 cent/barrel ($10/contract)

- Maximum Price Movement: $15/barrel ($15,000/contract) for the nearest two futures contracts; no limits for options

- Security Deposit: $1,620/contract

2. Unleaded Gasoline

- Futures and Options Volume (1997-1998):

- Futures: 7,880,645 contracts

- Options: 754,812 contracts

- Volume: 1,000 million tons

- Contract Specifications:

- Delivery Object: Unleaded gasoline

- Contract Size: 42,000 gallons (1,000 barrels)

- Trading Hours: 9:45 AM – 3:10 PM (main session), 4:00 PM – 8:00 AM (e-trading)

- Delivery Months: 18 monthly futures contracts

- Price Change Step: 0.01 cents/gallon ($4.2/contract)

- Maximum Price Movement: 40 cents/gallon ($16,000/contract) for the nearest two futures contracts; no limits for options

- Security Deposit: $1,620/contract

3. Fuel Oil (Heating Oil N2)

- Futures and Options Volume (1997-1998):

- Futures: 8,619,979 contracts

- Options: 828,494 contracts

- Volume: 1,350 million tons

- Contract Specifications:

- Delivery Object: Fuel oil (heating oil N2)

- Contract Size: 42,000 gallons (1,000 barrels)

- Trading Hours: 9:45 AM – 3:10 PM (main session), 4:00 PM – 8:00 AM (e-trading)

- Delivery Months: 18 monthly futures contracts

- Price Change Step: 0.01 cents/gallon ($4.2/contract)

- Maximum Price Movement: 40 cents/gallon ($16,000/contract) for the nearest two futures contracts; no limits for options

- Security Deposit: $1,620/contract

International Petroleum Exchange (IPE)

IPE trades futures and options for North Sea Brent oil and diesel fuel. Below are the details:

1. North Sea Brent Oil

- Futures and Options Volume (April 1, 1998 – March 31, 1999):

- Futures: 13,988,556 contracts

- Options: 365,930 contracts

- Volume: 1,958 million tons

2. Diesel Fuel

- Futures and Options Volume (April 1, 1998 – March 31, 1999):

- Futures: 5,276,713 contracts

- Options: 93,436 contracts

- Volume: 716 million tons

Trading Specifications

- Trading Hours: 10:00 AM – 8:15 PM GMT (7:00 AM – 5:15 PM MSK)

- Price Movement Limits: No restrictions on daily price fluctuations, making it easier to enter and exit hedges during strong price movements

- Settlement: If positions are not closed at the close of trading, they can be settled in cash (no need for physical delivery)

- Option Margining: Options on futures are margined similarly to futures, with the fundamental rule that the maximum margin for a purchased option cannot exceed the premium paid

- Security Deposit: $1,600 for both futures and options contracts

Case Study: Texas Hedging Program

In 1986, oil prices plummeted from $35 per barrel to $11, creating a financial crisis for Texas. The state treasury, heavily reliant on oil duties for revenue (about 25% of its income), faced a severe shortfall. The decline in oil prices resulted in a loss of $3.5 billion in expected revenue. To prevent such a situation from recurring, Texas developed a hedging program to stabilize tax revenues using options on the NYMEX.

Implementation of the Hedging Program

- Initiation and Strategy:

- The program began in September 1991.

- A price of $21.5 per barrel was chosen as the hedging benchmark.

- Hedging Mechanics:

- The state used options to hedge its tax revenues from oil.

- The goal was to lock in a minimum price of $21.5 per barrel, ensuring stable revenue regardless of market fluctuations.

- Price Movements:

- During the hedging period, oil prices fluctuated between $22.6 and $13.91 per barrel.

- Benefits and Outcomes:

- The hedging strategy ensured that the minimum price of oil was fixed at $21.5 per barrel.

- When oil prices rose above $21.5 per barrel, the state received additional profits.

- This approach provided stable income for two years despite significant price volatility in the oil market.

Key Takeaways

- Risk Mitigation:

- By using options, Texas was able to mitigate the risk of revenue shortfalls due to falling oil prices.

- Stabilized Revenues:

- The program provided the state with predictable and stable income, which was crucial for budgeting and financial planning.

- Flexibility and Profitability:

- The hedging strategy not only protected against downside risk but also allowed the state to benefit from rising oil prices.

- Effective Use of Financial Instruments:

- This case highlights the effective use of financial instruments like options to manage and stabilize state revenues in the face of volatile commodity prices.

Conclusion

The Texas hedging program is a prime example of how governments can use financial derivatives to manage revenue risks associated with volatile commodity markets. By locking in a minimum price and retaining the potential for additional profits, Texas was able to navigate a period of significant price fluctuations while ensuring stable and predictable tax revenues. This strategic approach can serve as a model for other states or entities facing similar risks.

Interesting posts

- “30 Rules of a Successful Forex Trader”

- Forex Glossary – Basic Concepts and Definitions

- Forex trading for beginners Part 1: Financial Markets

- Forex trading for beginners Part 2: Currency, Hedge

- Forex trading for beginners Part 3: Activities, Quotes

- Forex trading for beginners Part 4: Fundamental analysis, Rates

- Forex trading for beginners Part 5: Exchange rate, Manufacturing indicators

- Forex trading for beginners Part 6: Consumer demand indicators

- Forex trading for beginners Part 7: Market psychology, Types of charts, Trend Analysis

- Forex trading for beginners Part 8: Trendlines

- Forex trading for beginners Part 9: GRAPHIC PRICE MODELS

- Forex trading for beginners Part 10: MATHEMATICAL ANALYSIS, Indicators

- Forex trading for beginners Part 11: Trade Patterns

- Links to banks, stocks, exchanges…

- We are searched for by such words

- Market History

- Support and Resistance Levels

- Auto Trading and Trading robots

- CFD – Contract for Difference

- What is hedging

- Forex Market – Origins

- Futures Market

This post is also available in: English Українська Portuguese Español Deutsch Chinese Русский Français Italiano Türkçe 日本語 한국어