Trading Forex pour débutants Partie 8 : Lignes de tendance

Trading Forex pour débutants Partie 6 : Indicateurs de demande des consommateurs

Données Fondamentales, Psychologie du Marché et Prise de Décision

Nous comprenons l’analyse fondamentale comme l’étude des événements qui se produisent en dehors des graphiques de cotations des taux de change mais qui affectent ces taux de change.

De manière générale, tout dans le monde, même la météo, peut influencer les taux de change.

Autrefois, pour les traders négociant la lire italienne, les prévisions météorologiques étaient utiles : s’il faisait beau, le flux de touristes augmentait et, par conséquent, le taux de change de la lire se renforçait !

Pourquoi ne pas le considérer comme un facteur fondamental du marché des changes ? De nos jours, les traders peuvent généralement ignorer les régimes climatiques européens, ce qui facilite quelque peu leur travail.

Pour éviter une surcharge d’informations, il est courant de classer les facteurs fondamentaux en quatre catégories : facteurs économiques, politique financière, événements politiques et crises.

Dans ce document, nous nous concentrons sur les facteurs économiques et certains aspects de la politique financière.

Ce sont les principaux sujets d’étude de l’analyse fondamentale car il existe une relation de cause à effet directe entre l’économie et les marchés financiers.

Un trader de devises doit comprendre ce lien et la signification des principaux indicateurs financiers et économiques. Le reste est une question de technique, plus précisément, d’analyse technique. Pour obtenir des conseils sur l’installation et l’utilisation de solutions automatisées pour fusionner ces analyses, consultez Comment installer un Expert Advisor et des indicateurs sur les terminaux MetaTrader.

Les graphiques des indicateurs économiques, comme tous les graphiques, ont des tendances, des niveaux de support et de résistance, et des corrélations mutuelles.

Cela signifie qu’ils peuvent être analysés de la même manière que les graphiques de taux de change à l’aide des outils d’analyse technique.

Du côté positif, les données économiques et les indicateurs financiers clés des principales économies de marché sont largement publiés à des moments prédéterminés.

Sur la base de l’historique précédent et des prévisions, le marché se forge une opinion sur les valeurs attendues des indicateurs. De là, le sentiment du marché (market sentiment) pour chaque devise émerge – s’il faut la faire monter ou descendre.

Cette opinion peut provenir de la propre analyse par un trader des graphiques de données économiques ou de la comparaison et de la pondération intuitive des opinions de divers experts. Pour les traders intéressés à tirer parti de l’analyse automatisée et des stratégies personnalisées, considérez l’EA The xCustomEA : Conseiller de Trading Universel pour les indicateurs iCustom.

Il est préférable que le trader ait sa propre évaluation, en la vérifiant par rapport à d’autres opinions. Cependant, le facteur principal lors de la prise de décisions basées sur les données fondamentales est de comprendre l’opinion générale du marché.

Aucune prévision économique n’est exacte. Si les données publiées diffèrent considérablement de ce que le marché attendait, le marché réagira en conséquence. Dans de tels scénarios, des mouvements de prix soudains et vigoureux commencent souvent.

Chaque indicateur économique est naturellement lié au comportement du taux de change en raison de son contenu économique.

On pourrait imaginer un simple tableau de recommandations : si un indicateur particulier augmente, le taux de change devrait augmenter. Mais que le marché réagisse “normalement” ou ne réagisse pas – ou même aille dans la direction opposée – dépend de l’humeur dominante du marché, des perceptions actuelles et des attentes futures.

Il existe un schéma général de cause à effet, mais des humeurs et des sentiments spécifiques peuvent soit s’inscrire dans ce schéma (conduisant à une réaction “normale” du marché), soit le contredire (provoquant une réaction vive et non standard).

Nous devons souligner la nature psychologique de la façon dont le marché perçoit les données économiques. Au moment de la publication, le facteur crucial n’est pas seulement la valeur numérique de l’indicateur, mais à quel point elle diffère des attentes du marché.

Si l’indicateur publié correspond aux attentes du marché, il est généralement déjà “intégré dans le prix” (priced in). Dans de tels cas, il peut n’y avoir aucune réaction spéciale, même si l’indicateur est significatif (comme le PIB ou l’inflation).

Mais si le marché s’attendait à une chose et que des chiffres complètement différents sont publiés, alors la réaction du marché aux indicateurs économiques significatifs sera notable.

Notez que l’opinion du marché peut ne pas coïncider avec les prévisions officielles. Un trader professionnel doit distinguer l’un de l’autre et comprendre quels facteurs comptent actuellement le plus pour le marché FOREX.

L’importance d’un indicateur n’est pas constante. En fonction des conditions actuelles du marché économique et financier, certains indicateurs passent au premier plan, et pendant un certain temps, tous les regards restent fixés sur eux.

Les attentes entourant ces indicateurs peuvent influencer les prix des devises bien avant la publication des données.

Après la publication, le taux de change peut s’inverser brusquement, se déplaçant parfois de pourcentages entiers si la valeur publiée diffère de la prévision de fractions de pourcentage.

Plus tard, l’attention du marché peut se déplacer vers d’autres indicateurs ou d’autres devises. À ce moment-là, l’indicateur autrefois influent pourrait ne plus déclencher de réponse significative du marché, même s’il montre de grands écarts par rapport aux prévisions.

Il existe de nombreux exemples de paramètres économiques qui étaient autrefois au centre de l’attention du marché mais qui ont finalement perdu leur influence à mesure que de nouvelles préoccupations émergeaient.

C’est naturel et inévitable – les marchés sont des organismes vivants et, avec le temps, leurs priorités et leurs réactions changent.

L’objectif principal de ce livre est d’aider le trader à comprendre la nature des principaux indicateurs économiques et à appliquer ces connaissances au trading. Pour réussir, il faut surveiller en permanence la vie du marché, ses problèmes, l’évolution des sentiments et les changements de réactions. Souvenez-vous de cela !

Un indicateur économique sorti de son contexte peut induire en erreur plutôt qu’informer.

Par exemple, un manuel peut indiquer que si un indicateur particulier augmente, le taux de change baisse.

Un trader voyant cela à l’écran pourrait se dépêcher de vendre la devise, pour ensuite subir des pertes car le taux de change augmente en fait.

Pourquoi cela arrive-t-il ? Peut-être parce que, avant la publication de l’indicateur, le marché était saturé de commentaires et de sondages suggérant que tout le monde s’attendait à ce que l’indicateur augmente, et le prix s’était déjà ajusté à la baisse en prévision.

Lorsque les données confirment les attentes, de nombreux traders qui ont vendu la devise auparavant commencent maintenant à prendre des bénéfices en achetant à bas prix ce qu’ils ont vendu à un prix plus élevé.

Les achats massifs font monter le prix, causant des pertes à quiconque a ignoré le comportement antérieur du marché. L’utilisation d’outils qui aident à analyser et à automatiser les réactions peut être utile. Par exemple, l’Expert Advisor Automatique TickSniper peut aider à réagir rapidement aux fluctuations à court terme du marché.

De même, copier les stratégies de traders ou de terminaux performants peut rationaliser la prise de décision. Considérez Copylot – Copieur Forex pour les transactions entre terminaux MetaTrader.

L’analyse technique étudie la dynamique du marché pour identifier les principales tendances de prix, prédire le comportement futur et déterminer les points d’entrée et de sortie optimaux.

“La dynamique du marché” comprend trois sources principales d’information pour l’analyste technique : le prix, le volume et le temps.

Formulons trois principes fondamentaux de l’analyse technique :

- Le prix prend tout en compte. Tout facteur (économique, politique ou psychologique) est pris en compte par le marché et reflété dans le prix. Le graphique des prix “annonce” les intentions du marché, et la tâche de l’analyste est d’interpréter correctement ces signaux. Il n’est pas nécessaire de connaître la motivation de chaque participant au marché ; l’étude du graphique des prix est suffisante.

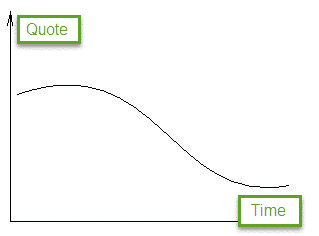

- Le mouvement des prix suit des tendances. L’objectif principal de l’analyse graphique est de détecter ces tendances tôt et de trader dans leur direction. Une tendance est un mouvement de prix directionnel.

- L’histoire se répète. Les principes valables dans le passé restent valables aujourd’hui et persisteront à l’avenir. C’est ce qui sous-tend toutes les méthodes d’interpolation pour prédire les mouvements de prix futurs, considérant essentiellement l’avenir comme une répétition du passé.

Trois types de tendances par direction du mouvement des prix :

- Montante (haussière, uptrend) – les prix montent

- Descendante (baissière, downtrend) – les prix baissent

- Latérale (plate, sans tendance) – pas de direction définie

Trois types de tendances par durée :

- Long terme (principale) – plus de 6 mois à plusieurs années

- Moyen terme (intermédiaire) – de 2 semaines à 6 mois

- Court terme (mineure) – jusqu’à 2 semaines

Lois fondamentales du mouvement des prix :

- Une tendance en cours est plus susceptible de continuer que de s’inverser.

- La tendance persiste jusqu’à ce qu’elle montre des signes d’affaiblissement.

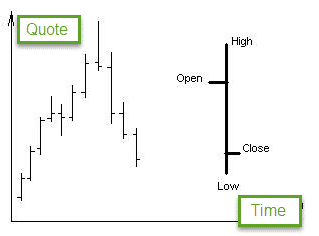

L’outil principal de l’analyse technique classique est un graphique des variations de prix sur une période sélectionnée. Les graphiques de prix et de volume dépendent des données tracées.

Avant d’examiner les types de graphiques utilisés sur le marché FOREX, notez que les données de prix sur de petits intervalles peuvent créer beaucoup de “bruit”, rendant l’évaluation à long terme difficile.

Pour filtrer les fluctuations à court terme et le bruit du marché, seuls les événements principaux de la période choisie sont utilisés.

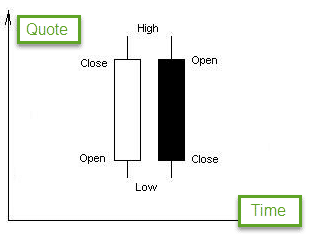

À la fin d’un intervalle de temps donné, nous traçons :

- Ouverture (Open) – prix au début de l’intervalle

- Plus Haut (High) – prix le plus élevé de l’intervalle

- Plus Bas (Low) – prix le plus bas de l’intervalle

- Clôture (Close) – prix à la fin de l’intervalle

Ainsi, l’information continue est transformée en points de données discrets.

En fonction de l’intervalle de temps sélectionné, les graphiques peuvent être :

- Mensuels (M)

- Hebdomadaires (W)

- Journaliers (D)

- Horaires (H)

- 30 minutes

- 15 minutes

- 5 minutes

Principaux types de graphiques

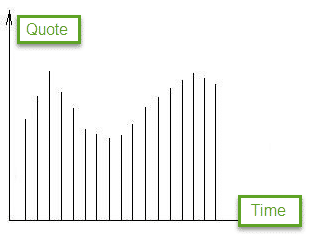

Les types de graphiques diffèrent par la manière dont les données de prix sont représentées :

- Linéaire – Une ligne reliant les prix de clôture. Les prix de clôture sont considérés comme le facteur le plus significatif. L’inconvénient : il ignore les fluctuations de prix intrapériodiques.

- Graphique en barres – Utilise quatre prix : Plus Haut, Clôture, Ouverture, Plus Bas. Le haut et le bas de la barre représentent respectivement le Plus Haut et le Plus Bas. Les tirets gauche et droit représentent l’Ouverture et la Clôture.

- Chandeliers japonais – Développés au 17ème siècle au Japon, les graphiques en chandeliers sont très avancés et peuvent servir de méthode d’analyse technique indépendante.

Les chandeliers japonais reflètent les informations du marché et peuvent être analysés comme une méthode autonome d’analyse technique.

- Graphiques de volume – Généralement placés sous le graphique des prix. Les graphiques de volume de ticks (Tick volume charts) montrent le volume par le nombre de contrats négociés dans l’intervalle sélectionné, et non par la masse monétaire. Pour analyser les performances de trading, considérez ExtraReportPad – Journal du Trader, qui fournit une analyse professionnelle du compte.

ANALYSE DES TENDANCES

Une tendance est un certain mouvement de prix directionnel. Les marchés réels ne se déplacent pas en lignes droites ; ils zigzaguent. Identifier les tendances tôt et trader dans leur direction est crucial, s’alignant sur le principe “La tendance est votre amie”. Pour les stratégies de tendance automatisées, considérez des EA avancés comme l’Expert Advisor Intelligent Automatique AI Sniper.

Le concept de tendance est essentiel sur le marché FOREX. Identifier correctement une tendance à un stade précoce aide à préserver et à faire fructifier votre capital. L’ignorer peut entraîner des pertes.

Suivre la tendance réduit les risques de trading. Inversement, aller à contre-tendance augmente les chances de pertes.

La tâche principale de l’analyse des tendances est d’identifier une tendance tôt et de déterminer la fourchette de prix à court terme la plus probable, ainsi que les conditions d’une cassure de prix (price breakout).

Les tendances sur le marché FOREX sont classées par durée (long terme, moyen terme, court terme) et par direction (ascendante tendance haussière, descendante tendance baissière, ou latérale). Pour une exécution facile des ordres en ligne avec les tendances, considérez le Panneau de Trading VirtualTradePad (VTP).

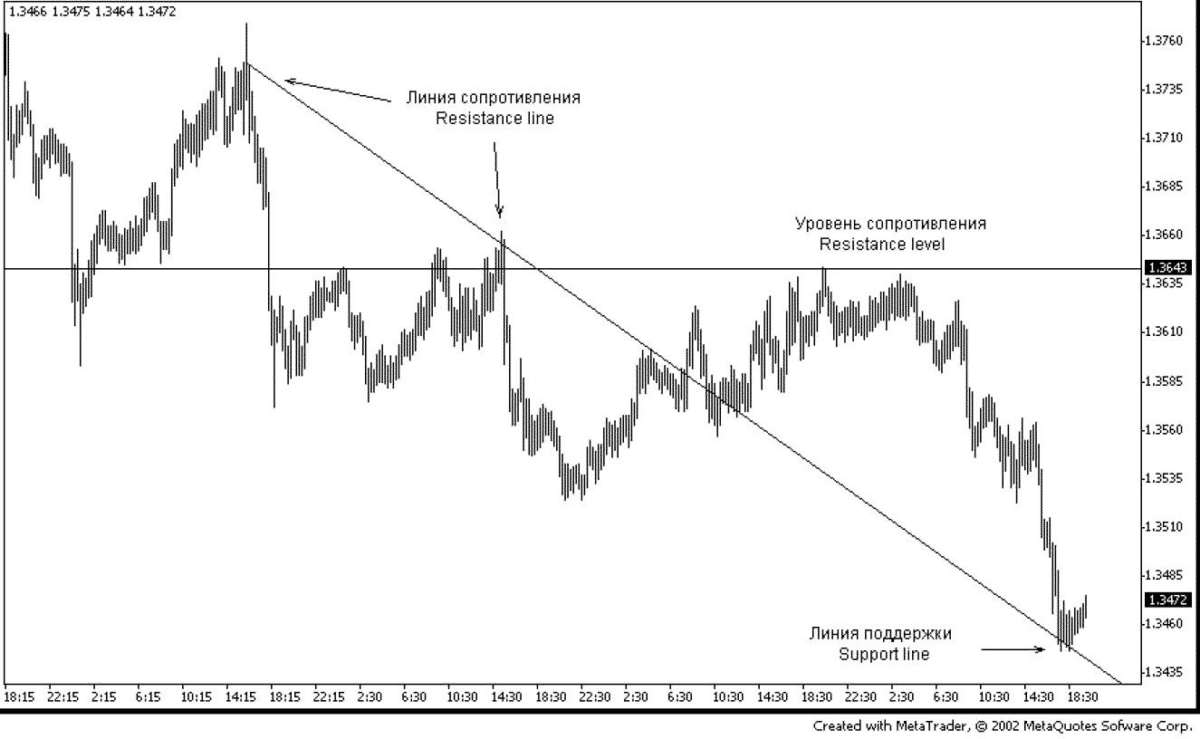

Lignes de Résistance :

- Relient les sommets (tops) importants du marché.

- Lorsque les vendeurs ne peuvent pas pousser les prix plus haut, leur pression dépasse celle des acheteurs, provoquant l’arrêt de la croissance et le début d’une baisse.

- Un type clé de ligne de résistance est le niveau de résistance, généralement une ligne horizontale qui agit comme une “barrière” pour le mouvement des prix.

- Les prix rebondissent souvent sur ces niveaux plutôt que de les franchir. Si un niveau de résistance est cassé (généralement de 20-30 points), il peut devenir un niveau de support.

Lignes de Support :

- Relient les creux (bottoms) importants du marché.

- Lorsque les acheteurs soutiennent le niveau de prix, cela empêche de nouvelles baisses et peut entraîner une hausse.

- Un niveau de support est un autre type de “barrière” horizontale. Les prix ont tendance à rebondir sur les niveaux de support plutôt qu’à les franchir. La cassure d’un niveau de support le transforme souvent en niveau de résistance.

Le graphique ci-dessus montre des cas où une ligne de résistance est cassée et devient une ligne de support, et vice-versa.

L’identification et la construction des niveaux de support/résistance sont un élément clé de l’analyse technique. Ces niveaux représentent des valeurs psychologiques de prix significatives où de nombreux traders changent ou ferment leurs positions.

Connaître les points de rebond potentiels permet aux traders de planifier efficacement leurs transactions. La construction de niveaux fait également partie intégrante de certaines tactiques de trading. Pour les sorties partielles et la gestion avancée des positions, des fonctionnalités comme Fermeture Partielle et Trailing peuvent être utiles.

Force des Niveaux et Lignes de Support et de Résistance

Plus les prix rebondissent sur un niveau ou une ligne, plus celui-ci devient significatif. Plus ces niveaux persistent dans le temps, plus les traders les reconnaissent, augmentant leur importance.

Par exemple, un niveau de support qui dure trois semaines est plus significatif qu’un niveau qui dure trois jours, car plus de traders ont interagi avec lui au fil du temps.

Une autre mesure de l’importance est le volume. Si un volume de transactions important a accompagné la formation d’un niveau de support, ce niveau est très significatif, et vice-versa.

Vous pouvez lire d’autres chapitres

Trading Forex pour débutants Partie 6 : Indicateurs de la demande des consommateurs

Les indicateurs de la demande des consommateurs reflètent la volonté des consommateurs à dépenser. Une forte demande des consommateurs peut stimuler la production et influencer le marché FOREX. Ces indicateurs sont essentiels pour comprendre les conditions économiques. Pour les stratégies intégrant ces fondamentaux avec des EA, voir aussi Travailler avec Telegram dans MetaTrader pour recevoir des alertes de marché en temps opportun.

Trading Forex pour débutants Partie 8 : Lignes de tendance

Apprenez à construire des lignes de tendance, à sélectionner des points TD, à projeter les prix et à comprendre les longueurs de correction. La maîtrise des lignes de tendance vous aide à visualiser plus clairement la direction du marché. Pour des informations complètes sur les fonctionnalités de divers experts, voir Fonctionnalités des experts de expforex.com.

Cet article est également disponible en : English Portuguese Español Deutsch Français Русский Українська Indonesian Italiano العربية Chinese 日本語 한국어 Türkçe ไทย Tiếng Việt