Negociação Forex para iniciantes Parte 8: Linhas de tendência

Negociação Forex para iniciantes Parte 6: Indicadores de demanda do consumidor

Dados Fundamentais, Psicologia de Mercado, e Tomada de Decisão

Nós entendemos análise fundamental como o estudo de eventos que ocorrem fora dos gráficos de cotações de taxas de câmbio, mas que afetam essas taxas de câmbio.

De maneira geral, tudo no mundo, até mesmo o clima, pode influenciar as taxas de câmbio.

No passado, para os traders que lidavam com a lira italiana, as previsões meteorológicas eram úteis: se o clima estava bom, o fluxo de turistas aumentava e, consequentemente, a taxa de câmbio da lira se fortalecia!

Por que não considerar isso um fator fundamental do mercado de câmbio? Hoje em dia, os traders podem geralmente ignorar os padrões climáticos europeus, tornando seu trabalho um pouco mais fácil.

Para evitar uma sobrecarga de informações, é comum classificar os fatores fundamentais em quatro categorias: fatores econômicos, política financeira, eventos políticos e crises.

Neste material, focamos em fatores econômicos e em certos aspectos da política financeira.

Estes são os principais assuntos de estudo em análise fundamental porque existe uma relação causal direta entre a economia e os mercados financeiros.

Um trader de moeda (currency trader) deve entender essa conexão e o significado dos principais indicadores financeiros e econômicos. O restante é uma questão de técnica, mais precisamente, de análise técnica. Para orientações sobre como instalar e usar soluções automatizadas para combinar essas análises, veja Como instalar Expert Advisor e indicadores nos terminais MetaTrader.

Gráficos de indicadores econômicos, como qualquer gráfico, têm tendências, níveis de suporte e resistência e correlações mútuas.

Isso significa que eles podem ser analisados de forma semelhante aos gráficos de taxas de câmbio usando ferramentas de análise técnica.

Por outro lado, dados econômicos e principais indicadores financeiros para as principais economias de mercado são amplamente publicados em horários pré-determinados.

Com base na história anterior e nas previsões, o mercado forma uma opinião sobre os valores esperados dos indicadores. A partir disso, surge o sentimento de mercado (market sentiment) para cada moeda — se deve movê-la para cima ou para baixo.

Essa opinião pode derivar da própria análise do trader dos gráficos de dados econômicos ou da comparação e ponderação intuitiva das opiniões de vários especialistas. Para traders interessados em aproveitar a análise automatizada e estratégias personalizadas, considere o EA The xCustomEA: Universal Trading Advisor para indicadores iCustom.

É melhor se o trader tiver sua própria avaliação, verificando-a em relação a outras opiniões. No entanto, o principal fator ao tomar decisões com base em dados fundamentais é entender a opinião geral do mercado (market opinion).

Nenhuma previsão econômica é exata. Se os dados publicados diferirem significativamente do que o mercado esperava, o mercado reagirá de acordo. Em tais cenários, movimentos de preços súbitos e vigorosos frequentemente começam.

Cada indicador econômico naturalmente se conecta com o comportamento da taxa de câmbio devido ao seu conteúdo econômico.

Pode-se imaginar uma tabela simples de recomendações: se um determinado indicador cresce, a taxa de câmbio deve subir. Mas se o mercado reage “normalmente” ou não reage — ou mesmo se move na direção oposta — depende do humor do mercado (market mood) predominante, das percepções atuais e das expectativas futuras.

Existe um esquema geral de causa e efeito, mas humores e sentimentos específicos podem ou se encaixar nesse esquema (levando a uma reação de mercado “normal”) ou contradizê-lo (causando uma reação brusca e não padrão).

Devemos enfatizar a natureza psicológica de como o mercado percebe os dados econômicos. No momento da publicação, o fator crucial não é apenas o valor numérico do indicador, mas o quanto ele difere da expectativa do mercado.

Se o indicador divulgado corresponder à expectativa do mercado, geralmente já está “precificado”. Nesses casos, pode não haver uma reação especial, mesmo que o indicador seja significativo (como PIB (GDP) ou inflação).

Mas se o mercado esperava uma coisa e números completamente diferentes são publicados, então a reação do mercado a indicadores econômicos significativos será perceptível.

Observe que a opinião do mercado pode não coincidir com as previsões oficiais. Um trader profissional deve distinguir uma da outra e entender quais fatores atualmente mais importam para o mercado FOREX (FOREX market).

A importância de qualquer indicador não é constante. Dependendo das condições econômicas e de mercado financeiro (financial market) atuais, alguns indicadores ganham destaque e, por um tempo, todas as atenções permanecem neles.

As expectativas em torno desses indicadores podem influenciar os preços das moedas muito antes da divulgação dos dados.

Após a publicação, a taxa de câmbio pode reverter drasticamente, às vezes movendo-se por porcentagens inteiras se o valor divulgado diferir das previsões por frações de porcentagem.

Mais tarde, o foco do mercado pode mudar para outros indicadores ou outras moedas. Nesse ponto, o indicador que antes era influente pode não desencadear mais nenhuma resposta significativa do mercado, mesmo que apresente grandes desvios em relação às previsões.

Existem muitos exemplos de parâmetros econômicos que eram uma vez centrais para a atenção do mercado, mas eventualmente perderam sua influência à medida que surgiram novas preocupações.

Isso é natural e inevitável — os mercados são organismos vivos, e com o tempo, suas prioridades e reações mudam.

O principal objetivo deste livro é ajudar o trader a entender a natureza dos principais indicadores econômicos e a aplicar esse conhecimento nas negociações. Para ter sucesso, é necessário monitorar continuamente a vida do mercado, seus problemas, sentimentos em mudança e reações que mudam. Lembre-se disso!

Um indicador econômico tirado de contexto pode enganar em vez de informar.

Por exemplo, um livro didático pode afirmar que se um determinado indicador cresce, a taxa de câmbio cai.

Um trader vendo isso na tela pode vender a moeda precipitadamente, apenas para sofrer perdas porque a taxa de câmbio na verdade sobe.

Por que isso acontece? Talvez porque, antes da divulgação do indicador, o mercado estava saturado com comentários e pesquisas sugerindo que todos esperavam que o indicador crescesse, e o preço já havia se ajustado para baixo em antecipação.

Quando os dados confirmam as expectativas, muitos traders que venderam a moeda antes agora começam a obter lucros comprando a um preço baixo o que venderam a um preço mais alto.

A compra massiva impulsiona o preço para cima, causando perdas para quem ignorou o comportamento anterior do mercado. Usar ferramentas que ajudam a analisar e automatizar reações pode ser útil. Por exemplo, o TickSniper Automatic Expert Advisor pode ajudar a reagir rapidamente a flutuações de curto prazo no mercado.

Da mesma forma, copiar estratégias de traders ou terminais bem-sucedidos pode agilizar a tomada de decisões. Considere Copylot – copiador de Forex para operações de negociação entre terminais MetaTrader.

análise técnica estuda a dinâmica de mercado para identificar as principais tendências de preços, prever comportamentos futuros e determinar pontos de entrada e saída ideais.

“Dinâmica de mercado” inclui três principais fontes de informação para o analista técnico (technical analyst): preço, volume e tempo.

Vamos formular três princípios fundamentais da análise técnica:

- O preço desconta tudo. Qualquer fator (econômico, político ou psicológico) é considerado pelo mercado e refletido no preço. O gráfico de preços “anuncia” as intenções do mercado, e a tarefa do analista é interpretar corretamente esses sinais. Não há necessidade de conhecer a motivação de cada participante do mercado; estudar o gráfico de preços é suficiente.

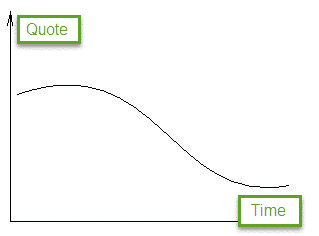

- O movimento dos preços segue tendências. O principal objetivo da charting é detectar essas tendências cedo e negociar na direção delas. Uma tendência é um movimento direcional de preços.

- A história se repete. Os princípios válidos no passado permanecem válidos hoje e persistirão no futuro. Isso fundamenta todos os métodos de interpolação para prever movimentos futuros de preços, essencialmente vendo o futuro como uma repetição do passado.

Três tipos de tendências pela direção do movimento dos preços:

- Ascendente (bullish trend) – os preços sobem

- Descendente (bearish trend) – os preços descem

- Lateral (sideways) – sem direção definida

Três tipos de tendências pela duração:

- Longo prazo (principal) – mais de 6 meses a vários anos

- Médio prazo (intermediário) – de 2 semanas a 6 meses

- Curto prazo (menor) – até 2 semanas

Leis básicas do movimento dos preços:

- Uma tendência em andamento é mais provável de continuar do que de reverter.

- A tendência persiste até que mostre sinais de enfraquecimento.

A principal ferramenta da análise técnica clássica é um gráfico de variações de preços ao longo de um período selecionado. Os gráficos de preço e volume dependem dos dados plotados.

Antes de examinar os tipos de gráficos usados no mercado FOREX, observe que dados de preços em intervalos pequenos podem criar muito “ruído”, dificultando a avaliação de longo prazo.

Para filtrar flutuações de curto prazo e o ruído do mercado, apenas os principais eventos do período escolhido são usados.

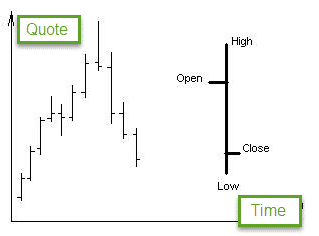

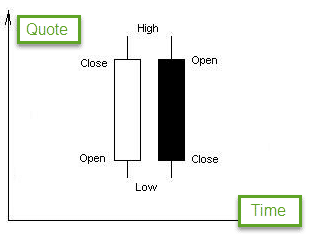

No final de um determinado intervalo de tempo, plotamos:

- Abertura (Open) – preço no início do intervalo

- Alta (High) – preço mais alto no intervalo

- Baixa (Low) – preço mais baixo no intervalo

- Fechamento (Close) – preço no final do intervalo

Assim, informações contínuas são transformadas em pontos de dados discretos.

Dependendo do intervalo de tempo selecionado, os gráficos podem ser:

- Mensal (Monthly)

- Semanal (Weekly)

- Diário (Daily)

- Horário (Hourly)

- Meia hora (Half-hourly)

- 15 minutos (15-minute)

- 5 minutos (5-minute)

Principais Tipos de Gráficos

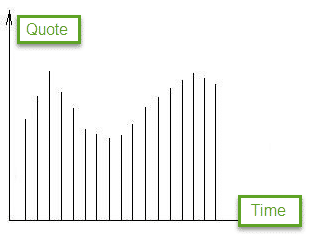

Os tipos de gráficos diferem pela forma como os dados de preços são representados:

- Linear – Uma linha conectando os preços de fechamento. Os preços de fechamento são considerados o fator mais significativo. A desvantagem: ignora as flutuações de preços intraperíodo.

- Gráfico de Barras (Bar Chart) – Usa quatro preços: Alta (High), Fechamento (Close), Abertura (Open), Baixa (Low). O topo e a base da barra representam a Alta e a Baixa, respectivamente. Traços à esquerda e à direita representam a Abertura e o Fechamento.

- Velas japonesas – Desenvolvidos no Japão do século XVII, os gráficos de velas são altamente avançados e podem servir como um método independente de análise técnica.

Velas japonesas refletem informações do mercado e podem ser analisadas como um método independente de análise técnica.

- Gráficos de Volume (Volume Charts) – Geralmente colocados abaixo do gráfico de preços. Gráficos de volume por tick (Tick volume charts) mostram o volume pelo número de contratos negociados dentro do intervalo selecionado, não pela oferta monetária. Para analisar o desempenho das negociações, considere ExtraReportPad – Diário do Trader, que fornece análise profissional de contas.

ANÁLISE DE TENDÊNCIA

Uma tendência é um certo movimento direcional de preços. Mercados reais não se movem em linhas retas; eles zigzagueiam. Identificar tendências cedo e negociar na direção delas é crucial, alinhando-se com o princípio “A tendência é sua amiga”. Para estratégias de tendência automatizadas, considere EAs avançados como o AI Sniper Automatic Smart Expert Advisor.

O conceito de tendência é essencial no mercado FOREX. Identificar corretamente uma tendência em estágio inicial ajuda a preservar e aumentar seu capital. Ignorá-la pode levar a perdas.

Seguir a tendência reduz os riscos de negociação. Por outro lado, ir contra a tendência aumenta a chance de perdas.

A principal tarefa da análise de tendência é identificar uma tendência cedo e determinar a faixa de preço de curto prazo mais provável, bem como as condições para uma quebra de preço.

As tendências no mercado FOREX são categorizadas por duração (longo prazo, médio prazo, curto prazo) e direção (tendência altista (bullish trend), tendência baixista (bearish trend), ou lateral). Para facilitar a execução de negociações alinhadas com as tendências, considere o VirtualTradePad (VTP) Painel de Negociação.

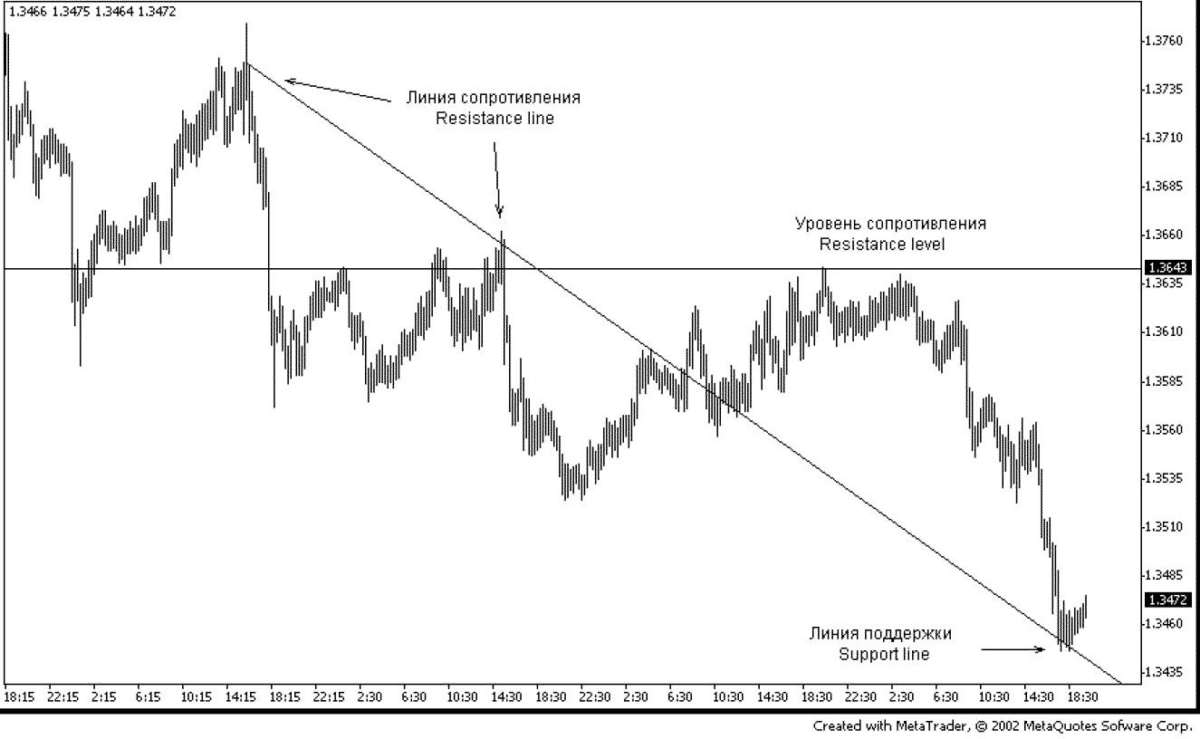

Linhas de Resistência:

- Conectar altas importantes (tops) do mercado.

- Quando os vendedores não conseguem empurrar os preços para cima, sua pressão excede a pressão dos compradores, fazendo com que o crescimento pare e comece uma queda.

- Um tipo chave de linha de resistência é o nível de resistência (resistance level), geralmente uma linha horizontal que atua como uma “cerca (fence)” para o movimento dos preços.

- Os preços frequentemente rebatem nesses níveis ao invés de romper. Se um nível de resistência for rompido (geralmente por 20-30 pontos), ele pode se tornar um nível de suporte.

Linhas de Suporte:

- Conectar baixas importantes (bottoms) do mercado.

- Quando os compradores suportam o nível de preço, isso impede novas quedas e pode incentivar uma subida.

- Um nível de suporte (support level) é outro tipo de “cerca horizontal”. Os preços tendem a rebatem nos níveis de suporte ao invés de romper. Romper um nível de suporte frequentemente o transforma em um nível de resistência.

O gráfico acima mostra casos onde uma linha de resistência rompe e se torna uma linha de suporte, e vice-versa.

Identificar e construir níveis de suporte/resistência é uma parte chave da análise técnica. Esses níveis representam valores de preços psicológicos significativos onde muitos traders mudam ou encerram suas posições.

Conhecer pontos potenciais de rebote permite que os traders planejem suas negociações de forma eficaz. A construção de níveis também é integral a certas táticas de negociação. Para saídas parciais e gestão avançada de posições, recursos como Fechamento Parcial e Trailing (Partial Close and Trailing) podem ser úteis.

Força dos Níveis e Linhas de Suporte e Resistência

Quanto mais vezes os preços rebatem de um nível ou linha, mais significativo ele se torna. Quanto mais tempo esses níveis persistem, mais os traders os reconhecem, aumentando sua importância.

Por exemplo, um nível de suporte que dura três semanas é mais significativo do que um que dura três dias, já que mais traders interagiram com ele ao longo do tempo.

Outra medida de significância é o volume. Se um volume pesado de negociações acompanhou a formação de um nível de suporte, esse nível é altamente significativo, e vice-versa.

Você Pode Ler Outros Capítulos

Negociação Forex para iniciantes Parte 6: Indicadores de demanda do consumidor

Indicadores de Demanda do Consumidor refletem a disposição dos consumidores para gastar. Alta demanda do consumidor pode estimular a produção e influenciar o mercado FOREX. Esses indicadores são críticos para entender as condições econômicas. Para estratégias que integram esses fundamentos com EAs, veja também Trabalhando com Telegram no MetaTrader para receber alertas de mercado oportunos.

Negociação Forex para iniciantes Parte 8: Linhas de Tendência

Aprenda sobre a construção de linhas de tendência, seleção de pontos TD, projeção de preços e compreensão dos comprimentos de correção. Dominar as linhas de tendência ajuda você a visualizar a direção do mercado de forma mais clara. Para insights abrangentes sobre recursos de vários especialistas, veja Recursos funcionais dos especialistas de expforex.com.

Este post também está disponível em: English Portuguese Español Deutsch Français Русский Українська Indonesian Italiano العربية Chinese 日本語 한국어 Türkçe ไทย Tiếng Việt