Negociação Forex para iniciantes Parte 9: MODELOS DE PREÇO GRÁFICO

Negociação Forex para iniciantes Parte 7: Psicologia do mercado, Tipos de gráficos, Análise de tendências

Linhas de Tendência (Trend Lines) e Linhas de Canal (Channel Lines)

Linhas de Tendência (Trend Lines) na análise de tendências não podem ser subestimadas, pois servem para dividir o espaço de preços em duas zonas – a zona onde o preço permanece dentro da tendência existente é a mais provável.

A zona onde o preço emerge sugere uma mudança na tendência atual.

A linha de tendência (trend line) atua como um divisor – o preço cruzando esse divisor sinaliza uma reversão de tendência.

Em uma tendência de alta, a linha de tendência (trend line) é traçada como uma linha de suporte (support line).

Em uma tendência de baixa, é marcada como uma linha de resistência (resistance line).

De fato, até que o preço cruze a linha de tendência (trend line) (linha de suporte (support line)) em uma tendência de alta, não pode ser concluído que essa tendência terminou e que uma tendência de baixa (downtrend) ou tendência lateral (side trend) começou.

Da mesma forma, em uma tendência de baixa, apenas o cruzamento do preço com a linha de tendência (trend line) (linha de resistência (resistance line)) indica uma possível mudança de tendência.

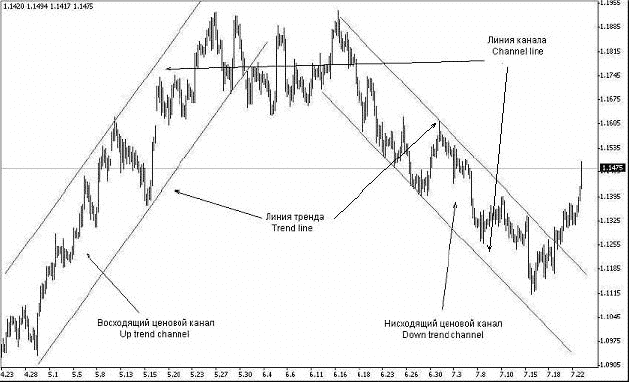

Linhas de Canal (Channel Lines) são linhas paralelas à linha de tendência (trend line) e construídas de forma que dentro da tendência existente, todos os preços fiquem entre a linha de tendência (trend line) e a linha de canal (channel line).

O canal formado ao traçar linhas paralelas (linha de tendência (trend line) e linha de canal (channel line)) representa a faixa de negociação ideal.

A direção do canal (channel) – descendente, ascendente ou lateral – determina a tendência do mercado.

Se os preços flutuarem entre duas linhas retas paralelas (linhas de canal (channel lines)), podemos discutir a presença de um canal ascendente, descendente ou horizontal.

Quando o preço está confinado dentro de um determinado canal de preços, a tarefa do trader de obter lucros é significativamente simplificada.

Abrir posições na direção da tendência quando o preço rebate a linha de tendência (trend line) é uma entrada ideal no mercado.

Em contraste, quando o preço se aproxima da linha de canal (channel line), fechar posições permite garantir o lucro máximo, que é o ponto mais otimizado para a realização de lucros.

Quando o preço sai do canal de preços, geralmente se move na direção da saída por 60-80% da largura do canal.

Construção de linhas de tendência (trend lines), linhas de suporte/resistência (support/resistance lines), linhas de canal (channel lines) e níveis (levels) são subjetivos.

Cada pessoa interpreta esses fenômenos de sua própria maneira.

Com essa abordagem pessoal, o número de linhas e níveis pode se tornar excessivo, enquanto na verdade são necessárias menos linhas.

Em seu livro “Análise Técnica – A Nova Ciência“, Thomas DeMark apresenta vários critérios que reduzem o número de linhas traçadas e aproximam seu número do real número de linhas de tendência (trend lines).

Aqui estão alguns trechos de seu livro.

Construindo Linhas de Tendência (Trend Lines)

Como qualquer aspecto de charting, desenhar uma linha de tendência (trend line) é uma forma de arte.

Às vezes, uma linha que inicialmente parece precisa precisa ser descartada.

No entanto, aqui estão algumas regras que ajudarão você a identificar a linha correta.

Primeiramente, deve haver sinais claros de uma tendência.

Isso significa que para desenhar uma linha de tendência de alta (uptrend line), você deve ter pelo menos dois mínimos mais baixos, com o segundo mínimo sendo mais alto que o primeiro.

Naturalmente, são sempre necessários dois pontos para desenhar uma linha.

Uma vez que dois pontos consecutivos de declínio, onde o próximo mínimo é mais alto que o anterior, são marcados no gráfico, eles são conectados por uma linha reta desenhada da esquerda para a direita.

Uma vez que a natureza da tendência é confirmada, a linha de tendência (trend line) pode ser usada efetivamente para abordar vários aspectos.

Um dos princípios fundamentais de uma tendência é que uma tendência em andamento tende a continuar seu movimento.

Portanto, uma vez que uma tendência ganha um certo ritmo e a linha de tendência (trend line) está em um ângulo específico, esse ângulo geralmente permanecerá consistente à medida que a tendência se desenvolve ainda mais.

Neste caso, a linha de tendência (trend line) ajudará você a identificar os pontos extremos das fases corretivas e, mais importante, indicar a possibilidade de uma reversão de tendência.

Vamos dizer que estamos lidando com uma tendência de alta (uptrend).

Neste caso, os inevitáveis recuos corretivos ou intermediários se aproximarão ou tocarão a linha de tendência (trend line) ascendente.

Como um trader espera comprar em quedas em uma tendência de alta, a linha de tendência (trend line) servirá como um nível de suporte (support level) abaixo do mercado, que pode ser usado como uma zona de compra.

Por outro lado, se a tendência é uma tendência de baixa (downtrend), a linha de tendência (trend line) pode ser usada como um nível de resistência (resistance level) para venda.

Vários parâmetros caracterizam a linha de tendência (trend line).

A característica mais importante de uma linha de tendência (trend line) é seu ângulo de inclinação: ele indica a força da tendência.

Reflete o sentimento de mercado da tendência dominante.

Outro aspecto importante é o método de desenho de uma linha de tendência (trend line).

Muitos analistas preferem construir linhas de tendência (trend lines) através de pontos extremos.

No entanto, Elder acredita que tais linhas são melhores traçadas através de áreas de intensa atividade comercial, já que o objetivo é identificar o sentimento de mercado predominante, não os outliers.

Alguns traders preferem desenhar linhas de tendência (trend lines) através de pontos de preço de fechamento.

No entanto, essa abordagem não é totalmente adequada; embora o preço de fechamento seja um valor significativo, ele representa apenas um aspecto específico da dinâmica de preços dentro de todo o período.

Portanto, alguns analistas argumentam que a linha de tendência (trend line) deve ser construída considerando tanto os mínimos quanto os máximos de preço.

Consequentemente, cada trader pode escolher seu próprio método de construção de uma linha de tendência (trend line).

Vamos considerar um dos métodos para escolher dois pontos críticos necessários para construir uma linha de tendência (trend line).

Construção e Seleção de Pontos TD (TD Points)

Os movimentos de preços de mercado geralmente são vistos retrospectivamente – do passado para o futuro, então as datas no gráfico são listadas da esquerda para a direita.

Consequentemente, linhas de oferta e demanda (supply and demand lines) (linhas de tendência (trend lines)) são construídas e colocadas no gráfico da esquerda para a direita.

No entanto, essa intuição é falha.

O movimento dos preços no momento presente é mais importante do que o movimento do mercado no passado.

Em outras palavras, linhas de tendência (trend lines) padrão devem ser desenhadas da direita para a esquerda para que os dados de mercado mais recentes estejam no lado direito do gráfico.

Pontos pivô de preço de oferta (supply price pivot points) importantes são determinados quando um preço alto é registrado, acima do qual os preços não subiram no dia imediatamente antes ou depois dele.

Da mesma forma, pontos pivô de preço de demanda (demand price pivot points) importantes são determinados quando um preço baixo é registrado, abaixo do qual os preços não caíram imediatamente antes ou depois dele.

Tais pontos-chave são chamados de pontos TD (TD points).

Linhas de tendência (trend lines) são desenhadas através de pontos TD (TD points).

Qualquer desequilíbrio entre oferta e demanda é refletido no gráfico pelo aparecimento de novos pontos TD (TD points).

À medida que aparecem, linhas TD (TD lines) estão constantemente sendo ajustadas.

Portanto, é importante determinar os últimos pontos TD (TD points) e desenhar linhas TD (TD lines) através deles.

Existem dois métodos para melhorar a seleção de pontos TD (TD points).

Um fator importante na seleção de pontos TD (TD points) são os preços de fechamento dois dias antes da formação do ponto pivô de preço alto (pivot price high) e do ponto pivô de preço baixo (pivot price low).

- Ao formar um ponto pivô de preço baixo (pivot price low), além de ser o preço mais baixo do dia, deve ser mais alto que o ponto pivô de preço baixo (pivot price low) anterior e mais baixo que o preço de fechamento dois dias antes de seu registro.

- Ao formar um ponto pivô de preço alto (pivot price high), além de ser o preço mais alto do dia, deve ser mais baixo que o ponto pivô de preço alto (pivot price high) anterior e mais alto que o preço de fechamento dois dias antes de seu registro.

Altos e baixos registrados sem métodos de melhoria na seleção de pontos TD (TD point selection improvement methods) são chamados de altos e baixos “gráficos”.

Os altos e baixos registrados usando as técnicas de melhoria na seleção de pontos TD (TD point selection improvement techniques) são referidos como altos e baixos “verdadeiros”.

Avaliar a validade de um dado ponto também requer comparar dois valores de preço: o último ponto pivô de preço alto (pivot price high) (ou baixo) e o preço de fechamento no dia imediatamente após ele.

A validade do ponto pivô de preço baixo (pivot price low) é questionável se o preço de fechamento no dia seguinte ao seu registro for inferior ao valor calculado da taxa de avanço da Linha TD (TD Line’s rate of advance).

Da mesma forma, a validade do ponto pivô de preço alto (pivot price high) é duvidosa se o preço de fechamento no dia seguinte ao seu registro for superior ao valor calculado da taxa de declínio da Linha TD (TD Line’s rate of decline).

Essas correções reduzem significativamente o número de pontos TD (TD points) e, consequentemente, o número de linhas TD (TD lines).

Ao mesmo tempo, aumentam a significância dos pontos TD (TD points) e a confiabilidade das linhas TD (TD lines) para determinar níveis de suporte e resistência (support and resistance levels) e calcular projeções de preço (price projections).

Linhas TD Mais Longas (Longer TD Lines)

As linhas TD (TD lines) descritas anteriormente têm uma magnitude de Nível 1 (Level 1 magnitude).

Leva três dias para determinar cada ponto TD (TD point) usado para construí-las.

Uma linha TD (TD line) traçada a partir de dois desses pontos é insignificante, pois pode levar apenas cinco dias para formar dois pontos TD (TD points).

No entanto, um trader muitas vezes precisa de uma perspectiva de longo prazo dos desenvolvimentos de preços.

Para desenhar uma linha TD de magnitude Nível 2 (Level 2 magnitude TD line), cada ponto TD (TD point) precisa de pelo menos 5 dias para se formar: o ponto pivô de preço alto (pivot price high) deve estar cercado de cada lado por dois altos menores, e o ponto pivô de preço baixo (pivot price low) por dois baixos menores.

Consequentemente, para construir uma linha TD (TD line) com o comprimento do terceiro nível (magnitude de Nível 3 (Level 3 magnitude)), são necessários pelo menos 7 dias para registrar cada ponto TD (TD point), e assim por diante.

Neste caso, todos os pontos TD (TD points) de um nível de extensão superior são simultaneamente pontos TD (TD points) de um nível de extensão inferior.

No entanto, nem todos são pontos “ativos” do primeiro nível, porque apenas os dois últimos são pontos TD (TD points) válidos de primeiro nível.

A linha TD (TD line) dos níveis de extensão segundo e superiores obedecem às mesmas leis que as linhas TD (TD lines) do primeiro nível.

Todos os níveis de linhas TD (TD lines) usam os mesmos projetores de preço.

É preferível trabalhar com linhas TD de primeiro nível (first-level TD lines).

Duas razões determinam essa escolha:

- Usar linhas TD (TD lines) de ordem superior aumenta a probabilidade de que a linha de tendência seja quebrada antes que o último ponto TD (TD point) seja totalmente formado, fazendo com que o trader perca uma oportunidade lucrativa de abrir uma posição.

- À medida que o nível da linha TD (TD line) aumenta, a probabilidade de um sinal oposto ocorrer antes que a meta de preço seja realizada aumenta proporcionalmente.

Quebras de Linhas de Tendência (Breakouts of Trend Lines)

Quebras (Breakouts) de linhas de tendência (trend lines) indicam que o grupo dominante está perdendo sua posição de comando.

No entanto, a chave aqui é não tirar conclusões precipitadas.

Agora, abordamos a questão dos critérios para uma verdadeira quebra (breakout) da linha de tendência (trend line).

Essa questão não é direta, e algum grau de subjetividade é inevitável na resposta.

Uma quebra (breakout) de uma linha de tendência (trend line) só é válida quando os preços fecham do outro lado da linha de tendência (trend line).

Geralmente, uma quebra de linha de tendência (trend line breakout) pelo fechamento do dia significa muito mais do que apenas uma quebra intra-diária.

No entanto, às vezes, mesmo uma quebra do preço de fechamento do dia é insuficiente para indicar uma verdadeira quebra de linha de tendência (trend line breakout).

A maioria dos analistas emprega vários filtros de preço e tempo para eliminar sinais falsos.

Um exemplo de filtro de preço é o critério de quebrar a linha de tendência por um certo número de pontos.

O filtro de tempo mais comum é a chamada regra de dois períodos (two-slot rule).

Em outras palavras, uma quebra (breakout) da linha de tendência é considerada verdadeira se, por dois intervalos consecutivos (por exemplo, dias), os preços de fechamento permanecerem fora dela.

Deve-se notar que os filtros de tempo e preço (time and price filters) também são usados para avaliar importantes níveis de suporte e resistência (support and resistance levels), não apenas as principais linhas de tendência (trend lines).

Muito frequentemente, uma quebra (break) de uma linha de tendência (trend line) é o primeiro sinal de uma mudança na tendência.

Um dos métodos para determinar as metas de preço mínimas quando uma linha de tendência (trend line) é quebrada é o chamado método de encontrar projeções de preço TD (TD price projections), que é descrito abaixo.

Projeções de Preço (Price Projections)

Existem três métodos para calcular projeções de preço (price projections) após uma verdadeira quebra de linha de tendência (trend line breakout).

Eles são chamados de projetores de preço TD (TD price projectors).

Projetor de Preço 1 (Price Projector 1) é o mais fácil de calcular, mas tem a menor precisão.

É definido da seguinte forma: Quando ocorre uma quebra (breakout) de uma linha TD descendente (descending TD line), os preços geralmente continuam a subir pelo menos a distância entre o preço baixo abaixo da linha TD (TD line) e o ponto de preço na linha TD (TD line) imediatamente acima dele, adicionada ao preço no ponto de quebra.

Quando ocorre uma quebra (breakout) de uma linha TD ascendente (ascending TD line), os preços continuam a cair para um nível calculado da seguinte forma: a distância do preço alto acima da linha TD (TD line) até o ponto de preço na linha TD (TD line) imediatamente abaixo dele é subtraída do preço no ponto de quebra.

Frequentemente, as metas de preço (price targets) podem ser determinadas “a olho”, mas a maioria dos traders requer mais precisão.

A taxa de variação da linha TD (TD line) pode ser calculada da seguinte forma: a diferença entre os pontos TD (TD points) é dividida pelo número de dias entre eles (excluindo dias não comerciais).

Você pode calcular com precisão o preço de quebra multiplicando o número adicional de dias comerciais desde o último ponto TD (TD point) até o ponto de quebra pela taxa de variação.

Adicionando ao (ou subtraindo do) preço de quebra a diferença entre o ponto na linha TD (TD line) e o preço baixo (alto) diretamente abaixo (acima) dele, dependendo se é uma compra ou venda, uma meta de preço (price target) pode ser determinada.

Projetor de Preço TD 2 (TD Price Projector 2) é um pouco mais complicado.

Por exemplo, se uma linha TD descendente (descending TD line) quebra para cima, em vez de selecionar o preço mínimo abaixo dela, o mínimo intradiário abaixo da linha TD (TD line) no dia com o preço de fechamento mais baixo é escolhido.

Esse valor é então adicionado ao preço de quebra.

O menor mínimo intradiário é frequentemente registrado no dia com o preço de fechamento mais baixo.

Neste caso, Projetor de Preço 1 (Price Projector 1) é idêntico ao Projetor de Preço 2 (Price Projector 2).

Para calcular o projetor de preço (price projector) no caso de uma quebra para baixo de uma linha TD ascendente (ascending TD line), o dia-chave é considerado o dia com o preço de fechamento mais alto ou, mais precisamente, o preço alto intradiário nesse dia.

Pode parecer que o Projetor de Preço TD 2 (TD Price Projector 2) é mais preciso e conservador do que o Projetor de Preço 1 (Price Projector 1), mas nem sempre é o caso.

Por exemplo, suponha que a taxa de avanço ou declínio seja particularmente rápida, e o preço de fechamento baixo em uma tendência de baixa ou o preço de fechamento alto em uma tendência de alta (dia-chave para Projetor 2 (Projector 2)) ocorra antes do mínimo ou máximo intradiário.

Nesse caso, a meta de preço (price target) obtida usando o Projetor de Preço 2 (Price Projector 2) é maior.

Por outro lado, se um dia-chave para o Projetor 2 (Projector 2) ocorrer após um mínimo ou máximo intradiário, o Projetor de Preço 2 (Price Projector 2) fornece uma meta de preço (price target) menor.

Projetor 3 (Projector 3) é ainda mais conservador, calculado como a diferença entre a linha TD (TD line) e o preço de fechamento abaixo dela (acima dela) no dia em que ocorre o valor de preço intradiário mínimo (valor de preço intradiário máximo).

Por que as projeções de preço (price projections) podem não funcionar:

- Houve uma quebra (breakout) de uma linha TD (TD line) dirigida na direção oposta, resultando em um novo sinal que contradiz o original. Nesse caso, um novo sinal, indicando o início de uma nova tendência oposta, torna-se efetivo, substituindo o anterior. As metas de preço (price targets) calculadas são canceladas.

- O sinal de quebra (breakout signal) da linha TD (TD line) foi falso desde o início. Alternativamente, um evento inesperado pode ter perturbado drasticamente o equilíbrio de oferta e demanda, fazendo com que os preços revertessem imediatamente após a quebra. Isso se torna aparente no dia seguinte quando o preço da primeira negociação é registrado. Se a linha TD (TD line) atual estiver descendente, o preço na abertura pode cair abaixo dessa linha previamente quebrada e continuar a cair ou declinar acentuadamente na abertura, formando um gap de preço, e cair abaixo da linha TD (TD line) até o fechamento. No caso de uma linha TD ascendente (ascending TD line), a validade de uma quebra de preço (price breakout) é duvidosa se o dia seguinte, o preço de abertura ou fechamento subir novamente acima da linha TD ascendente (ascending TD line), formando um gap de preço, e os preços continuarem a crescer.

Avaliando a Verdade das Quebras de Preço Intradiárias (Assessing the Truth of Intraday Price Breakouts)

Existem três Qualificadores de Quebra TD (TD Breakout Qualifiers) – dois padrões de preço formados no dia anterior à quebra esperada e um padrão formado no dia da quebra.

Suponha que o mercado esteja sobrevendido (oversold) (sobrecomprado (overbought)) no dia anterior à quebra.

Nesse caso, é mais provável que a pressão de compra (venda) não diminua após a quebra, criando assim apenas a ilusão de potencial força (fraqueza) no mercado.

Se o preço de fechamento na véspera da quebra de alta for inferior ao dia anterior (uma condição sobrevendida (oversold)), então a probabilidade de uma verdadeira quebra de preço intradiária aumenta.

Nesse caso, recomendamos abrir uma posição quando a linha de tendência (trend line) for cruzada intradiariamente.

Por outro lado, se o preço de fechamento no dia anterior à quebra de linha de tendência ascendente (upward trend line breakout) for superior ao dia anterior, uma quebra falsa é possível.

Se o preço de fechamento aumentar no dia anterior à quebra de baixa, a probabilidade de que a quebra intradiária seja verdadeira aumenta, permitindo que você entre no mercado.

Se o preço de fechamento tiver diminuído na véspera da quebra, então uma quebra falsa é possível.

Essas regras são a essência do Qualificador de Quebra TD 1 (TD Breakout Qualifier 1).

O sinal para abrir uma posição pode ser o preço de fechamento, indicando um mercado sobrevendido (oversold) (sobrecomprado (overbought)), e o preço de abertura acima da linha TD descendente (descending TD line) ou abaixo da linha TD ascendente (ascending TD line) (Qualificador de Quebra TD 2 (TD Breakout Qualifier 2)).

Tal preço de abertura sugere força extrema (fraqueza) no mercado.

Justifica abrir uma posição, mesmo que os preços de fechamento no dia anterior indicaram que isso não é recomendado.

Essência do Qualificador de Quebra TD 3 (TD Breakout Qualifier 3): Um sinal de compra é verdadeiro se a soma do preço de fechamento na véspera da quebra e a diferença entre o preço de fechamento e o preço baixo no mesmo dia (ou o preço de fechamento dois dias antes da quebra, se menor) for menor que o preço de quebra.

Um sinal de venda é verdadeiro se a diferença entre o fechamento na véspera da quebra e a diferença entre o alto (ou o fechamento dois dias antes da quebra, se maior) e o fechamento no mesmo dia for maior que o preço de quebra.

Comprimentos de Correção (Correction Lengths)

As taxas de câmbio no mercado Forex mudam de maneira ziguezague.

Frequentemente, os preços se movem contra a tendência existente.

Tal movimento é chamado de pullback (pullback) ou correção (correction).

Na análise técnica, números de Fibonacci (Fibonacci numbers) e coeficientes (coefficients) são amplamente utilizados, que, como você sabe, carregam um certo significado místico.

Ao calcular os comprimentos da correção (o valor do recuo de preço contra a tendência), são usados os coeficientes de Fibonacci de 0,382 e 0,618, bem como o coeficiente de 0,5.

Em um mercado Forex forte (onde a taxa de variação da taxa de câmbio é mais de 40 pontos por minuto), o comprimento da correção (correction length) geralmente é 0,382 do comprimento da tendência anterior.

Em um mercado Forex médio (onde a taxa de variação da taxa de câmbio está entre 20-40 pontos por minuto), o comprimento da correção (correction length) geralmente é igual a 0,5 do comprimento da tendência anterior.

O comprimento máximo da correção (maximum correction length) é 0,618.

Esse nível é o mais interessante em termos de entrar no mercado porque romper esse nível não é mais considerado uma correção, mas uma reversão de tendência (trend reversal).

Assim, o trader abre uma posição na direção da tendência e simultaneamente define uma ordem de stop-loss (stop-loss order) 20 pontos abaixo desse nível de correção.

Abaixo está um gráfico da taxa EUR/USD de 240 minutos (EUR/USD 240-minute rate), no qual três comprimentos de correção (correction lengths) estão pendentes.

Como pode ser visto na figura, o preço não conseguiu romper o terceiro nível de correção, e a tendência de alta (uptrend) continuou.

Para estratégias de negociação avançadas, considere usar o xCustomEA, um consultor de negociação universal para indicadores iCustom (iCustom Indicators).

Aumente sua eficiência de negociação com o VirtualTradePad (VTP) Painel de Negociação (Trading Panel), um painel de negociação para negociações com um clique a partir de gráficos e teclado.

Utilize o TickSniper Expert Advisor Automático (TickSniper Automatic Expert Advisor) para scalping de tick preciso.

Sincronize suas negociações em múltiplos terminais com Copylot – Copiador Forex para MetaTrader (Forex Copier for MetaTrader).

Gerencie suas posições de forma eficaz usando o Assistant – o melhor painel de negociação gratuito (Assistant – the best free trading panel) para suportar posições e negócios com StopLoss, TakeProfit e Trailing Stop reais/virtuais.

Duplique suas negociações e posições de forma contínua com o Duplicator – Duplicação de Negociações/Posições no MetaTrader (Duplicator – Duplication of Deals/Positions on MetaTrader).

Teste suas estratégias com o Tester Pad Simulador de Negociação Forex (Tester Pad Forex Trading Simulator).

Automatize sua negociação com o Tick Hamster Robô de Negociação Automático (Tick Hamster Automatic Trading Robot).

Aprenda como navegar no Mercado MetaTrader (MetaTrader Market) para comprar, alugar, atualizar e instalar consultores.

Para solucionar problemas, consulte Relatórios de Expert MT5 e Arquivos de Log do Servidor (MT5 Expert Reports and Server Log Files).

Você Pode Ler Outros Capítulos

Negociação Forex para Iniciantes Parte 7: Psicologia de Mercado, Tipos de Gráficos, Análise de Tendência

Dados fundamentais, psicologia de mercado e tomada de decisões, Principais tipos de gráficos, ANÁLISE DE TENDÊNCIA

Negociação Forex para Iniciantes Parte 9: MODELOS GRÁFICOS DE PREÇO

MODELOS GRÁFICOS DE PREÇO, MODELOS DE REVERSÃO, PADRÕES DE CONTINUAÇÃO, PADRÕES DE REVERSÃO CONTÍNUA,

Este post também está disponível em: English Portuguese Español Deutsch Français Русский Українська Indonesian Italiano العربية Chinese 日本語 한국어 Türkçe ไทย Tiếng Việt