초보자를 위한 외환 거래 11부: 거래 패턴

초보자를 위한 외환 거래 9부: 그래픽 가격 모델

수학적 분석

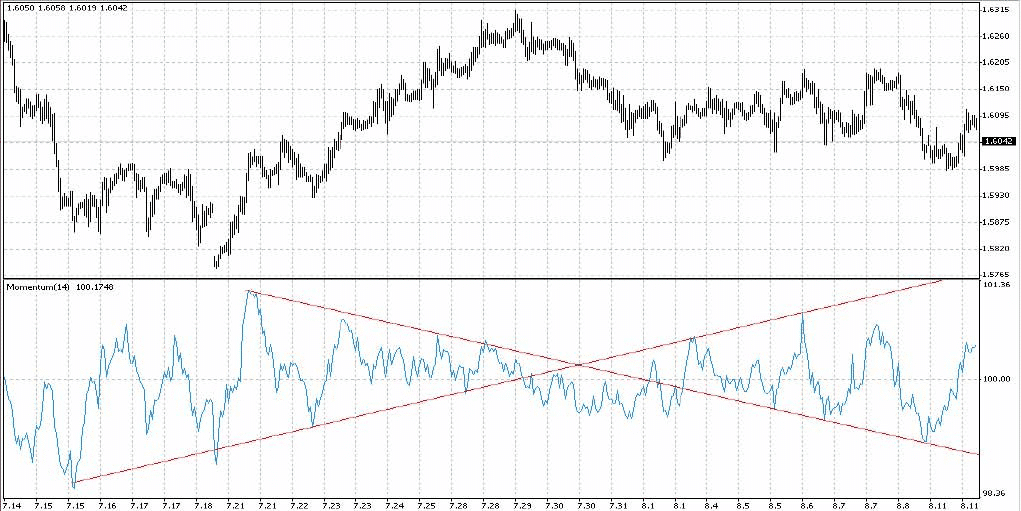

수학적 분석, 지표의 종류, 오실레이터, 하락 수렴, 상승 발산, 평행.

수학적 분석은 기술적 분석의 한 분야로, 컴퓨터의 출현과 함께 널리 적용되기 시작했습니다.

다양한 시장의 다수 차트를 분석하고, 여러 지표를 신속하게 계산하며, 다양한 시장 상황에 맞게 수정할 수 있는 능력은 다양한 금융 시장에서 분석가들 사이에서 수학적 분석의 인기를 결정지었습니다.

컴퓨터를 이용한 기술적 분석은 전통적인 차트 분석보다 더 객관적입니다.

차트에 “헤드 앤 숄더” 패턴이 존재하는지에 대해 논쟁할 수 있다면, 지표의 방향에 대해서는 논쟁할 수 없습니다.

지표가 상승하면 확실히 상승합니다.

지표가 하락하면 확실히 하락합니다.

지표는 시장에서 강세와 약세 간의 힘의 균형을 더 깊이 평가할 수 있게 해줍니다.

그러나 지표는 종종 서로 모순된다는 단점도 있습니다.

일부 지표는 추세를 감지하는 데 더 뛰어나고, 다른 지표는 횡보 거래 범위에 더 적합합니다.

일부는 반전 신호를 보내는 데 탁월하고, 다른 지표는 추세의 방향을 추적하는 데 더 적합합니다.

분석가의 과제는 다양한 시장 상황에 적합한 지표를 선택하는 것입니다.

지표를 사용하기 전에, 그것이 무엇을 측정하는지, 그리고 어떻게 적용하는지 명확히 이해해야 합니다.

그때야 비로소 그 신호에 의존할 수 있습니다.

지표의 종류

전문가들은 지표를 추세 추종 지표와 오실레이터의 두 그룹으로 나눕니다.

추세 지표는 상승 또는 하락하는 시장을 분석하는 데 효과적인 도구입니다.

하지만 시장이 정체될 때, 그 신호는 신뢰할 수 없고 종종 거짓이 됩니다.

반면에 오실레이터는 범위 내에서 움직이는 시장의 변화를 감지하는 데 뛰어납니다.

그러나 추세가 형성되면 오실레이터는 조기 또는 심지어 거짓 신호를 보낼 수 있습니다.

성공적인 거래의 비결은 서로 다른 그룹의 지표를 결합하여 그들의 단점을 상쇄하고 강점을 유지하는 능력에 있습니다.

추세 지표에는 이동 평균 (Moving Averages – MA), 볼린저 밴드 (Bollinger Band – BB), 이동 평균 수렴/발산 (MACD), 오실레이터의 이동 평균 (OsMA) 등이 포함됩니다.

이러한 지표는 동시 또는 지연된 신호를 제공합니다, 즉 추세 반전과 동시에 또는 그 이후에 신호를 보냅니다.

오실레이터는 전환점을 식별하는 데 도움을 줍니다.

그들은 스토캐스틱 오실레이터 (Stochastic Oscillator), 상대 강도 지수 (Relative Strength Index – RSI), 상품 채널 지수 (Commodity Channel Index – CCI), 모멘텀 (Momentum) 등을 포함합니다.

이러한 지표는 선행 또는 동시 신호를 제공하며 종종 가격 변동 전에 나타납니다.

어떤 추세에서도 가격은 모멘텀을 얻거나 유지하거나 잃습니다.

상승 추세나 하락 추세의 속도가 감소하는 것은 추세가 변할 수 있음을 경고하는 초기 신호입니다.

예를 들어, 상승 추세의 속도가 감소하면 이는 추세 반전 가능성의 경고 신호입니다.

알고 계셨나요?

The X와 The xCustomEA는 Forex를 위한 최고의 전문가 고문 (EAs)입니다.

이들은 표준 지표와 iCustom 지표를 사용하여 전략을 생성하고, 우리의 기능을 고문으로 사용할 수 있게 해줍니다.

추세 지표

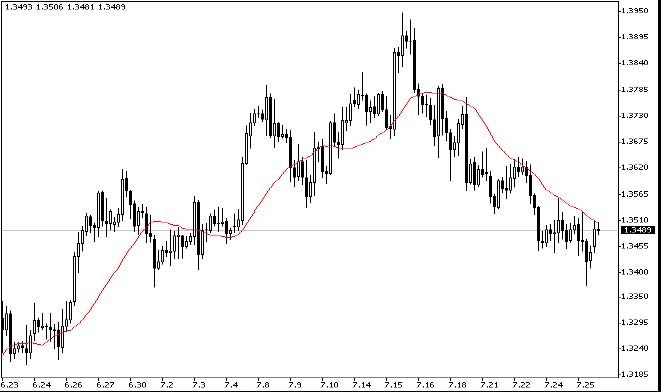

지표이동 평균 (Moving Averages – MA)

기술적 지표인 이동 평균 (MA)은 특정 기간 동안의 상품 가격의 평균 값을 보여줍니다. 이동 평균을 계산할 때, 주어진 기간 동안의 상품 가격을 수학적으로 평균화합니다. 가격이 변동함에 따라 평균 값은 상승하거나 하락합니다.

신호는 두 개의 이동 평균의 상호 위치를 기반으로 계산됩니다. 하나는 짧은 기간의 (빠른 MA)이고, 다른 하나는 긴 기간의 (느린 MA)입니다.

그들의 매개변수는 변수로 지정할 수 있습니다.

매수 신호는 빠른 MA가 느린 MA 위에 있을 때 생성됩니다.

매도 신호는 느린 MA가 빠른 MA 위에 있을 때 생성됩니다.

“신호 없음” 상태는 사용되지 않습니다.

이동 평균 (MA)은 가격 시리즈를 단순하게 평활화하는 도구로서, 어떠한 추세도 더 명확하게 보이게 합니다.

주요 MA 유형은 단순 (SMA), 가중 (WMA), 그리고 지수 (EMA)입니다.

단순 이동 평균 (SMA)은 마지막 N개의 캔들의 평균 종가를 의미하며, 여기서 N은 평균의 기간이라고 합니다.

이는 산술 평균으로 계산됩니다.

예를 들어, SMA = (기간 동안의 종가 합) / N.

단순 MA의 장점은 그 단순성에 있습니다.

단점은 모든 캔들에 동일한 중요성을 부여한다는 것입니다.

평균이 마지막 캔들 근처에 그려지기 때문에, 최근의 시세를 더 중요하게 고려하는 것이 더 논리적일 것입니다.

이 단점을 해결하기 위해 가중 이동 평균 (WMA)이 사용됩니다.

WMA = (가격과 가중치의 곱의 합) / (가중치의 합).

WMA에서는 최근의 캔들이 더 큰 가중치를 가지므로, 지표의 반응성이 향상되고 지연이 줄어듭니다.

하지만 오래된 데이터가 제거될 때 여전히 갑작스러운 영향이 남아 있습니다.

이 문제는 지수 이동 평균 (EMA)으로 해결됩니다. EMA는 고정된 범위가 아닌 이전 기간의 모든 가격을 포함합니다.

EMA는 다음 공식으로 계산됩니다: EMA = EMA(t-1) + K*(Price(t)-EMA(t-1)), 여기서 K=2/(N+1)입니다.

여기서 N은 평균의 기간이고, EMA(t-1)은 이전 EMA 값입니다.

올바른 평균 기간을 선택하는 것이 중요합니다.

짧은 MA는 가격 변동에 더 빠르게 반응하지만, 종종 더 많은 거짓 신호를 제공합니다.

긴 MA는 더 느리게 반응하지만, 거짓 신호는 더 적게 제공합니다.

트레이더의 과제는 현재 거래 전략의 요구에 맞는 MA 기간을 선택하는 것입니다.

일반적으로 MA 기간은 피보나치 수열에서 선택됩니다: 8, 13, 21, 34, 55, 89, 144.

짧은 시간대에서는 더 긴 MA 기간이 자주 사용되며, 긴 시간대에서는 전략에 따라 때때로 짧은 기간이 효과적일 수 있습니다.

시장의 주기를 결정할 수 있다면, MA 기간을 지배적인 주기의 절반과 일치시키는 것이 유리할 수 있습니다. 그러나 시장 주기는 불안정할 수 있습니다.

MA 분석을 위한 일반 규칙:

1. MA의 방향을 따르세요. MA의 방향으로 거래하세요. 상승 추세에서는 MA 선이 매수의 지지 수준 역할을 할 수 있습니다. 하락 추세에서는 매도의 저항 수준 역할을 할 수 있습니다.

2. 가격과 MA 간의 유의한 발산 지점을 식별하세요. 큰 차이는 잠재적인 수정이나 반전을 나타낼 수 있습니다.

3. 가격이 MA를 교차하는 지점을 식별하세요. 이러한 교차는 잠재적인 추세 반전을 신호할 수 있습니다.

권장 MA 기간:

| 가격 차트 | MA 기간 |

| 5일 | 8, 13, 21 |

| 1일 | 8, 13, 21, 55, 89 |

| 3시간 | 8, 34, 55, 89, 144 |

| 1시간 | 5, 13, 34, 55, 89, 144 |

| 15분 미만 | 34, 55, 144 |

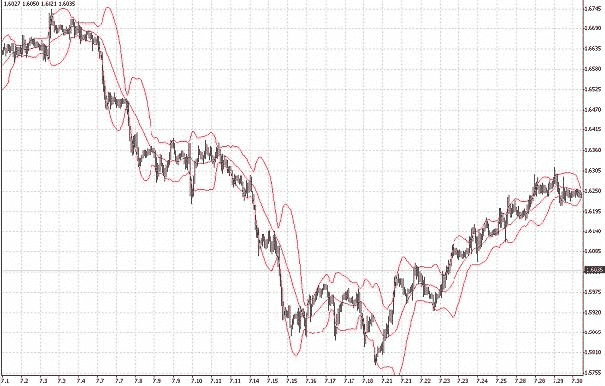

지표볼린저 밴드 (Bollinger Band – BB)

볼린저 밴드 (BB)는 엔벨로프와 유사합니다. 차이점은 엔벨로프의 경계는 MA로부터 고정된 거리에 있는 반면, BB의 경계는 변동성에 따라 달라지는 표준 편차로 결정된다는 점입니다. 변동성이 증가하면 밴드는 넓어지고, 변동성이 감소하면 좁아집니다.

세 가지 신호 유형이 있습니다:

매수 – 이전 캔들의 종가가 하단 밴드 아래에 있을 때.

매도 – 이전 캔들의 종가가 상단 밴드 위에 있을 때.

“신호 없음” – 캔들의 종가가 밴드 사이에 있을 때.

BB는 MA 주위에 밴드로 그려지며, 너비는 표준 편차에 비례합니다.

정확하게 선택되면 가격의 95% 이상이 이 밴드 내에 있어야 합니다.

상승 추세에서는 BB의 MA가 지지선 역할을 할 수 있습니다; 하락 추세에서는 저항선 역할을 할 수 있습니다.

가격이 한 밴드 경계에서 이동할 때, 반대쪽 경계에 도달하는 경향이 있습니다.

밴드의 좁아짐은 종종 급격한 가격 움직임에 선행합니다.

가격이 밴드 외부로 돌파하면, 이는 현재 추세의 지속을 나타낼 수 있습니다.

밴드 내부의 피크와 트로프는 외부의 것과 비교할 때 추세 반전을 신호할 수 있습니다.

BB의 수렴은 시장이 안정될 때 발생합니다. BB의 발산은 종종 새로운 추세가 시작되거나 기존 추세가 강화될 때 발생합니다.

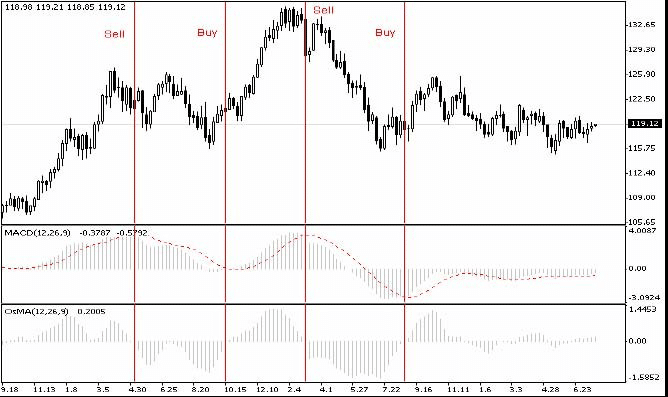

지표이동 평균 수렴/발산 (MACD)

MACD는 동적인 추세 지표입니다. 두 개의 EMA 간의 관계를 보여줍니다. MACD는 넓고 진동하는 시장에서 효과적입니다. 가장 일반적으로 사용되는 신호는 선 교차, 과매수/과매도 상태, 그리고 발산입니다.

MACD는 네 개의 변수를 사용하며 간단한 신호를 제공합니다:

매수 – 주요 MACD 선이 신호선 위에 있을 때.

매도 – 주요 MACD 선이 신호선 아래에 있을 때.

“신호 없음”은 사용되지 않습니다.

MACD는 빠른 선 (두 EMA의 차이)과 느린 선 (MACD 선의 MA인 신호선)으로 구성됩니다.

빠른 선이 느린 선을 위로 교차하면 상승 신호이고, 아래로 교차하면 하락 신호입니다.

두 선이 모두 0 위에 있으면 시장은 강세이고, 0 아래에 있으면 약세입니다.

MACD와 가격 간의 발산은 중요한 신호입니다. 상승 발산은 하락 추세의 약화를 시사합니다. 하락 수렴은 상승 추세의 약화를 시사합니다.

시간별 차트의 MACD 표준 매개변수는 종종 12, 26, 9입니다.

트레이더들은 때때로 다른 이동 평균을 사용하여 매개변수를 변경함으로써 MACD를 최적화하려 하지만, 견고한 전략 없이 지속적인 최적화는 열악한 결과를 초래할 수 있습니다.

또한, 선들이 0 위에 위치하면 시장이 강세임을, 0 아래에 위치하면 약세임을 나타낸다는 점을 고려해야 합니다. MACD 선이 0 수준과 관련하여 더 큰 값을 가질수록 해당 주식의 심리가 더 강해집니다.

예측 계획에서 가장 중요한 신호는 소위 상승 발산 또는 하락 수렴입니다. 빠른 MACD 선의 두 개의 가장 가까운 극값을 연결한다고 가정할 때, 두 가지 경우가 가능합니다: MACD 선의 직선 방향이 가격 차트의 유사한 극값을 연결하는 직선의 방향과 일치하거나, 해당 선들의 방향이 반대일 수 있습니다. 후자의 경우, 상승 발산 (가격은 상승하지만 MACD는 하락) 또는 하락 수렴 (가격은 하락하지만 MACD는 상승)이라고 하며, 이는 추세 반전의 순간을 의미합니다.

발산/수렴 신호의 의미는 상당히 명확하며 다음과 같습니다. 상승 추세에서 다음 MACD 고점이 이전 고점보다 낮으면, 이는 작은 주문의 EMA와 더 큰 주문의 EMA 간의 차이가 감소하기 시작했다는 것을 의미합니다. 즉, 작은 주문의 EMA가 더 큰 주문의 EMA에 가까워졌다는 뜻입니다. 따라서 이 기간 동안 강세의 활동이 감소했습니다. 강세 활동의 감소에 대한 설명은 상황에 따라 다를 수 있지만, 일반적으로 강세 추세에서 매수하려는 모든 사람들이 매수했고, 새로운 트레이더들이 시장에 진입하면서 강세가 감소했다고 주장할 수 있습니다. 가격은 여전히 약세의 활동이 강세의 활동보다 낮았기 때문에 강세 추세에 따라 움직였지만, 간격이 좁아지기 시작했고, 아마도 가까운 미래에 현재의 추세가 방향을 바꿀 것입니다.

| 상승 발산 | 하락 수렴 |

| 상승 추세의 반전 또는 일시적인 약화를 신호 | 하락 추세의 반전 또는 일시적인 약화를 신호 |

시간별 차트를 위한 MACD 지표의 표준 매개변수는 다음과 같습니다:

- – 빠른 EMA: 12 – 짧은 기간의 EMA

- – 느린 EMA: 26 – 긴 기간의 EMA

- – MACD SMA: 9 – 신호선, 평활 이동 평균

많은 트레이더들이 다른 이동 평균을 사용하여 MACD의 매개변수를 변경하려고 시도합니다. 5, 34, 7과 같은 변형이 꽤 인기가 있습니다. 원하는 (그러나 반드시 올바르지 않은) 신호를 얻기 위해 매개변수를 변경하는 것은 좋은 관행이 아닙니다. 이는 거짓 신호의 증가나 적용된 신호의 큰 지연을 초래할 수 있습니다. 지표의 매개변수는 선택한 거래 전략에 따라 선택됩니다. 따라서 지표를 자주 최적화하는 것은 거래 전략이 없다는 신호일 가능성이 높습니다.

지표이동 평균 발산의 히스토그램 (OsMA)

OsMA (Oscillator의 이동 평균)은 MACD 선과 신호선의 차이입니다. 히스토그램으로 표시됩니다.

신호는 약간 다릅니다:

매수 – 히스토그램이 0 위에 있을 때.

매도 – 히스토그램이 0 아래에 있을 때.

“신호 없음”은 OsMA가 정확히 0일 때만 발생합니다.

OsMA는 강세 또는 약세 지배에 대한 더 깊은 통찰을 제공합니다.

OsMA가 상승하면 강세가 강해지고, 하락하면 약세가 강해집니다.

OsMA가 가격과 발산하면, 이는 잠재적인 반전을 신호할 수 있습니다.

가격이 안정되고 OsMA가 중간점으로 돌아오면, 이전 추세가 종종 재개됩니다.

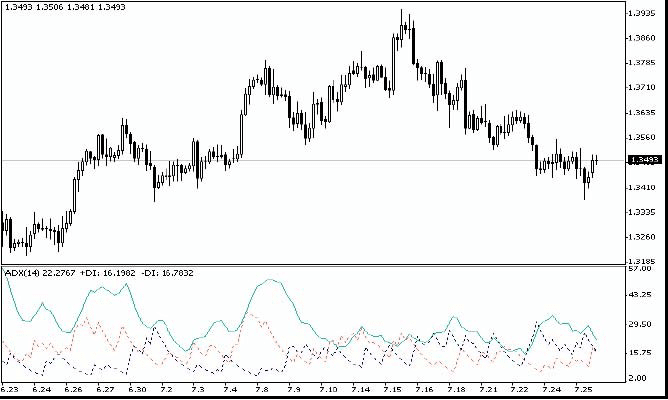

평균 방향성 지수 (ADX)

평균 방향성 지수 (ADX)는 가격이 추세를 형성하고 있는지 여부를 판단하는 데 도움을 줍니다. J. Welles Wilder Jr.가 개발한 이 지표는 방향이 아닌 추세의 강도를 평가합니다.

디렉토리의 신호 전략:

ADXLevel = 0인 경우:

Wilder는 +DI가 -DI를 위로 교차하면 매수하고, +DI가 -DI를 아래로 교차하면 매도할 것을 제안합니다.

ADXLevel ≠ 0인 경우:

+DI > -DI이고 ADX > ADXLevel일 때 매수; -DI > +DI이고 ADX > ADXLevel일 때 매도.

ADX 시스템은 추세의 강도를 보여줍니다.

+DI와 -DI는 강세 또는 약세가 지배적인지를 나타냅니다.

+DI > -DI이면 추세는 강세이고, -DI > +DI이면 추세는 약세입니다.

ADX는 추세의 강도를 측정합니다. 낮은 ADX는 약하거나 횡보하는 시장을 나타내고, 상승하는 ADX는 추세가 강화되고 있음을 나타냅니다.

ADX가 높을 때, 시장이 과열되었을 수 있으므로 주의가 필요합니다.

ADX는 일간 차트에서 잘 작동합니다.

이는 오늘의 범위가 이전 날의 범위를 얼마나 넘어서는지를 명확하게 보여줍니다.

오실레이터

관성 (Momentum)

관성 (Inertia) 지표는 추세 – 가속, 감속 또는 부드러운 진행 속도를 모니터링할 수 있게 합니다.

일반적으로 이러한 지표는 가격이 도달하기 전에 절정, 바닥 또는 반전을 이룹니다.

상승 중일 때는 매수 포지션을 안전하게 유지할 수 있습니다.

지표가 계속 하락하면 하락에 대한 포지션을 안전하게 유지할 수 있습니다.

새로운 고점을 찍으면 신호는 상승 추세의 가속과 그 지속 가능성을 나타냅니다.

낮은 수준에서 반전할 때 신호는 가속이 멈췄음을 보여줍니다: 추세는 이제 연료를 다 쓴 로켓처럼 움직이고 있습니다.

관성만으로 움직이기 때문에 가능한 반전을 대비해야 합니다.

하락 추세에서 지표의 바닥 상황은 동일한 논리를 사용하여 평가됩니다.

이는 단순히 특정 기간 동안의 가격 변동으로 계산됩니다.

각 가격은 거래 시점의 시장 참여자들의 집단적 합의를 반영합니다.

관성은 오늘의 가격 (오늘의 가치 합의)과 이전 가격 (이전 가치 합의)을 비교하여 계산됩니다.

이는 집단적 낙관론 또는 비관론 수준의 변화를 측정합니다.

모멘텀 (Momentum) 지표가 새로운 고점을 찍으면 시장에서의 낙관론 증가와 추가적인 가격 상승 가능성을 반영합니다.

모멘텀 지표가 새로운 저점을 찍으면 비관론 증가와 추가적인 가격 하락 가능성을 나타냅니다.

가격이 상승하고 모멘텀이 하락하면 피크가 접근하고 있음을 경고합니다: 매수 포지션을 청산하거나 스탑을 조정하는 것을 고려하세요.

가격이 새로운 고점을 찍고 관성 또는 변화율의 피크가 이전 피크보다 낮으면, 이러한 피크의 발산은 강력한 매도 신호를 제공합니다.

하락 추세에 대해서도 동일한 작업을 반대 방향으로 수행합니다.

상승 추세에서는 모멘텀 지표가 영점 아래로 떨어졌다가 다시 상승할 때마다 매수하세요.

하락 추세에서는 모멘텀 지표가 영점 위로 상승했다가 다시 하락할 때 매도하세요.

관성 지표 차트에서 지표 자체에 추세선을 그릴 수 있습니다.

추세선의 돌파 또는 반등은 신뢰할 수 있는 매수 또는 매도 신호를 제공할 수 있습니다.

상품 채널 지수 (CCI)

기술적 지표인 상품 채널 지수 (Commodity Channel Index, CCI)는 도구의 가격이 평균 통계 가격에서 얼마나 벗어났는지를 측정합니다. 높은 CCI 값은 가격이 평균에 비해 비정상적으로 높음을, 낮은 값은 너무 낮음을 나타냅니다. 이름과 달리, 상품 채널 지수는 상품뿐만 아니라 모든 금융 상품에 적용됩니다.

또한, 세 가지 신호가 모두 사용되지만 기본 상태는 “신호 없음“으로 유지됩니다.

매수 (BUY) – 상위 수준의 교차가 위에서 아래로

매도 (SELL) – 하위 수준의 교차가 아래에서 위로

외부 매개변수 CCIHighLevel과 CCILowLevel의 값이 상위 및 하위 수준을 결정합니다.

계산에 사용되는 기간과 가격은 CCIPeriod와 CCIPrice에 의해 결정됩니다.

최대 진폭으로 값을 나누어 모멘텀 차트를 정규화합니다:

CCI = [ X – SMA(X, n) ] / [0.015 x dX ], 여기서 X = [ 종가 + 고가 + 저가 ] / 3,

- 종가 (Close) – 마감 가격

- 고가 (High)와 저가 (Low) – 분석 기간 동안의 최대 및 최소 가격

- dX = Sum [ Xi – SMA(X, n) ] / n

- n – 기간 길이

- Xi는 시간 i에서의 가격 값

- SMA(X, n)은 기간 n에 대한 이동 평균입니다.

권장 n = 8.

상품 채널 지수 (CCI)는 증권의 가격이 평균 가격에서 얼마나 벗어났는지를 측정합니다.

높은 지수 값은 가격이 평균에 비해 비정상적으로 높음을, 낮은 값은 가격이 비정상적으로 낮음을 나타냅니다.

이름과 달리, CCI는 상품뿐만 아니라 모든 금융 상품에 적용할 수 있습니다.

CCI를 사용하는 주요 방법 두 가지는 다음과 같습니다:

발산 (Divergence) 찾기

발산은 가격이 새로운 고점을 찍지만 CCI는 이전 고점을 넘지 않을 때 발생합니다.

이 고전적인 발산은 종종 가격 조정에 앞서 발생합니다.

과매수/과매도 지표로서, CCI는 일반적으로 ±100 범위 내에서 변동합니다.

+100 이상 값은 과매수 상태 (및 가능한 조정 하락)을, -100 이하 값은 과매도 상태 (및 가능한 조정 상승)을 나타냅니다.

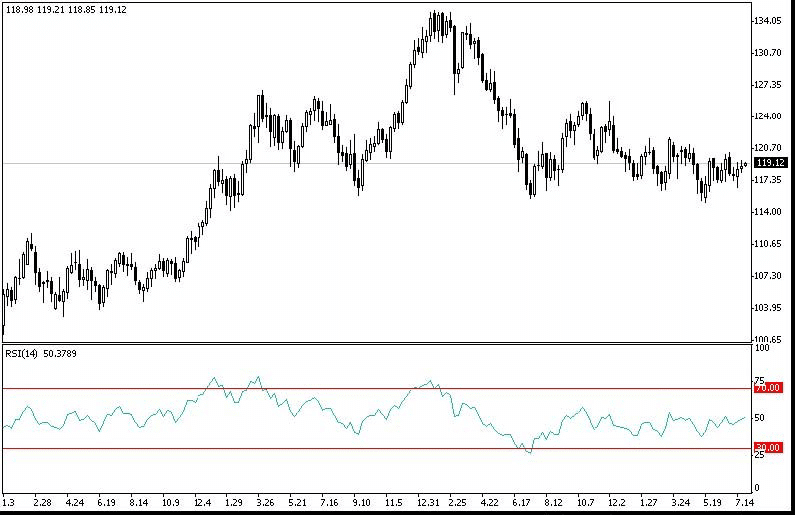

상대 강도 지수 (Relative Strength Index, RSI)

기술적 지표인 상대 강도 지수 (Relative Strength Index, RSI)는 0에서 100까지 범위의 또 다른 오실레이터입니다. W. 윌더는 14-기간 RSI 사용을 권장했습니다. 이후 9- 및 25-기간 변형도 인기를 얻었습니다. RSI를 분석하는 가장 일반적인 방법 중 하나는 발산을 찾는 것입니다. 이는 가격이 새로운 고점을 찍지만 RSI가 이전 고점을 넘지 못할 때 발생합니다. 이러한 발산은 가능한 가격 반전을 신호합니다. 그 후 RSI가 하락하여 이전 저점 아래로 떨어지면, 이는 ‘실패 스윙’을 형성하며, 이는 임박한 가격 반전의 확인으로 간주됩니다.

CCI와 DeMarker와 유사하게, RSI 신호는 과매수 (RSIHighLevel) 및 과매도 (RSILowLevel) 영역을 벗어날 때 발생합니다.

매수 신호 (BUY)는 RSI가 낮은 값에서 상승하여 (RSILowLevel)을 교차할 때 나타납니다.

매도 신호 (SELL)는 RSI가 높은 값에서 하락하여 RSIHighLevel을 교차할 때 나타납니다.

기본 상태는 “신호 없음“입니다.

RSI 기간은 RSIPeriod에서 설정되며, 계산에 사용되는 가격은 RSIPrice에서 설정됩니다.

1978년 J. Wheeler Jr.에 의해 개발된 RSI는 현재 가장 인기 있는 오실레이터 중 하나입니다.

RSI = 100 – [ 100 / (1 + RS) ], 여기서 RS = AUx / ADx, x는 분석 기간의 일수 (RSI 순서), 권장 값은 8입니다.

AUx는 기간 동안의 양의 가격 변화의 합계이고, ADx는 기간 동안의 음의 가격 변화의 합계입니다.

권장 순서는 8입니다 (모든 기간에 대해).

저자는 원래 일일 차트에 주로 적용되었기 때문에 14를 사용했습니다.

RSI는 0에서 100까지 범위의 가격-추종 오실레이터입니다.

일반적인 분석 방법은 발산을 찾는 것입니다: 가격이 새로운 고점을 찍지만 RSI는 이를 넘지 못할 때 발생합니다.

이러한 발산은 가능한 가격 반전을 시사합니다.

그 후 RSI가 하락하여 이전 저점 아래로 떨어지면, 이는 ‘실패 스윙’을 완료하여 가능한 반전을 확인합니다.

차트 분석을 위한 RSI 사용 방법:

고점과 저점

RSI의 고점은 일반적으로 70 이상, 저점은 30 이하에서 형성되며, 이는 일반적으로 가격 차트의 고점과 저점에 앞서 발생합니다.

차트 패턴

RSI는 종종 ‘헤드 앤 숄더’나 삼각형과 같은 차트 패턴을 형성하며, 이는 가격 차트에서는 나타나지 않을 수 있습니다.

실패 스윙 (지지선 또는 저항선의 돌파)은 RSI가 이전 고점 (피크) 위로 상승하거나 이전 저점 (트러프) 아래로 하락할 때 발생합니다.

지지 및 저항 수준

RSI 차트에서 지지 및 저항 수준은 가격 차트보다 더 명확하게 나타납니다.

발산 (Divergences)

앞서 언급한 바와 같이, 발산은 가격이 새로운 고점 (저점)을 찍지만 RSI 차트에서 새로운 고점 (저점)으로 확인되지 않을 때 형성됩니다.

이 경우, 가격은 일반적으로 RSI 움직임 방향으로 조정됩니다.

동일한 방법을 사용하여 평균 가격을 분석할 때도 이를 분석합니다.

장점은 RSI의 변동이 제한적이며, RSI 평균의 신호가 차트 평균의 신호를 능가할 수 있다는 점입니다.

포물선 SAR (Parabolic SAR)

포물선 SAR 지표는 가격 차트에 표시됩니다.

개념적으로 이동 평균과 유사하지만, 포물선 SAR은 더 큰 가속도로 움직입니다.

이 지표는 종종 이동 스톱 라인 신호로 사용됩니다.

포물선 시스템은 시장 종료 지점을 식별하는 데 탁월합니다.

롱 포지션은 가격이 SAR 선 아래로 떨어질 때 청산해야 하며, 숏 포지션은 가격이 SAR 선 위로 상승할 때 청산해야 합니다.

롱 포지션을 유지하는 경우 (가격이 SAR 선 위에 있을 때), SAR 선은 가격 방향에 관계없이 상승하게 됩니다.

SAR 선의 이동량은 가격 움직임의 크기에 따라 달라집니다.

윌리엄스 퍼센트 레인지 (%R)

기술적 지표인 윌리엄스 퍼센트 레인지 (%R)는 과매수/과매도 상태를 결정하는 동적 지표입니다. 윌리엄스 퍼센트 레인지는 스토캐스틱 오실레이터와 매우 유사합니다. 두 지표의 차이점은 첫 번째는 역방향 척도를 가지며, 두 번째는 내부 스무딩을 사용하여 구성된다는 점입니다.

윌리엄스 퍼센트 레인지 기술 지표 (%R)는 스토캐스틱 오실레이터와 매우 유사합니다. -80%에서 -100% 사이의 값은 과매도 상태를, -0%에서 -20% 사이의 값은 과매수 상태를 나타냅니다. 값 앞에 마이너스 기호를 붙여 척도를 역전시킵니다 (예: -30%). 분석 시 마이너스 기호는 무시하세요 (MetaTrader 5).

RSI, CCI, DeMarker와 유사합니다.

매수 신호 (BUY) – 과매수 수준 (WPRHighLevel)의 교차가 위에서 아래로

매도 신호 (SELL) – 과매도 수준 (WPRLowLevel)의 교차가 아래에서 위로

나머지는 “신호 없음“입니다.

지표 기간 매개변수만 외부에서 변경할 수 있습니다 – WPRPeriod.

윌리엄스 퍼센트 레인지 (%R)는 과매수/과매도 상태를 결정하는 동적 지표입니다.

(%R) 지표는 스토캐스틱 오실레이터와 매우 유사합니다.

유일한 차이점은 첫 번째는 역방향 척도를 가지며, 두 번째는 내부 스무딩을 사용하여 구성된다는 점입니다.

%R 지표는 역방향 척도에서 구성되기 때문에 일반적으로 값에 음수 기호를 부여합니다 (예: -30%).

분석 시 음수 기호는 무시할 수 있습니다.

지표 값은 80에서 100% 범위 내에서 변동하여 과매도 상태를 나타냅니다.

0에서 20% 범위의 값은 과매수 상태임을 나타냅니다.

모든 과매수/과매도 지표에 공통적인 규칙에 따르면, 신호에 따라 적절한 방향으로 가격이 전환될 때까지 기다리는 것이 최선입니다.

지표가 과매수 상태를 나타내면, 증권을 매도하기 전에 가격이 하향 전환될 때까지 기다리는 것이 합리적입니다.

%R 지표는 가격 반전을 예상하는 놀라운 능력을 가지고 있습니다.

가격이 최고점을 찍기 전에 거의 항상 최고점에 도달하고 하향 전환되며, 마찬가지로 가격이 상승하기 전에 저점에 도달하고 상향 전환됩니다.

오실레이터 분석 규칙:

- 오실레이터의 최대 또는 최소 값을 따른 값은 거래를 경고합니다. 최소 두 번의 확인을 기다리세요.

- 상위/하위 값의 정의된 경계와의 교차: 거래할 시간입니다. 매도 또는 매수를 위해 최소 한 번의 확인을 기다리세요.

- 중간과의 교차: 늦을 수 있으므로 최소 두 번의 확인을 기다리세요.

- 강세 시장에서는 값 한계를 올리고, 약세 시장에서는 값을 내립니다.

- 오실레이터 분석은 횡보 (측면) 시장에서 잘 작동합니다.

- 강한 상승 추세 동안 오실레이터가 하향 움직임을 보이지만 가격이 따르지 않으면, 상승 추세가 더 강화될 수 있습니다; 강한 하락 추세에서도 반대가 적용됩니다.

- 추세가 변경될 때, 오실레이터는 오해를 불러일으키거나 경고를 먼저 할 수 있습니다.

- 오실레이터가 가격 차트와 상호 작용하는 방식을 고려하세요 (도표에서는 가격이 위에 있고, 오실레이터는 아래에 있습니다).

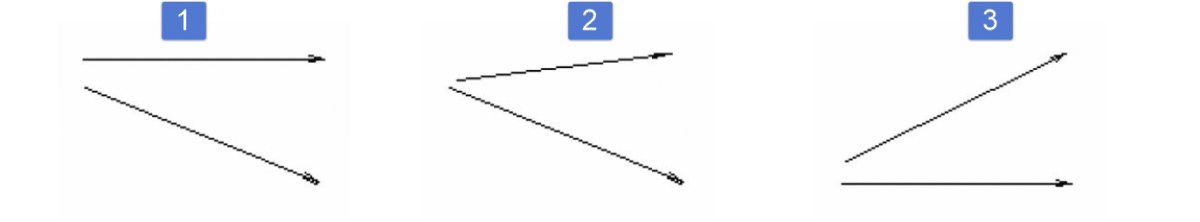

약세 수렴 (Bearish Convergence)

1. 중간 신호. 오실레이터의 끝이 상한선에 가까우면 가격 하락이 가능하며, 중간에 가까우면 환율이 안정될 수 있습니다.

2. 약한 신호. 가격 안정화 후 추세 변경이 예상됩니다.

3. 중간 신호. 오실레이터의 끝이 상한선에 가까우면 추세가 강화될 수 있으며, 하한선에 가까우면 상승이 예상됩니다; 중간에 가까우면 하락과 가격 안정화가 모두 동일하게 가능성이 있습니다.

강세 발산 (Bullish Divergence)

1. 중간 신호. 오실레이터의 끝이 하한선에 가까우면 가격 상승 가능성이 있으며, 중간에 가까우면 하락이 더 가능성이 높습니다.

2. 강한 신호. 가격 안정화 후 추세 변경이 예상됩니다.

3. 중간 신호. 오실레이터의 끝이 하한선에 가까우면 추세가 강화될 수 있으며, 상한선에 가까우면 안정화가 가능하며, 중간에 가까우면 가격 상승과 안정화가 모두 동일하게 가능성이 있습니다.

평행 (Parallelism)

평균 신호.

1. 강한 상승 추세.

2. 추세 변경을 예상합니다.

3. 강한 하락 추세.

최종 의견.

강한 추세에서 거래할 때, 오실레이터 신호를 신중하게 다루세요. 잘못된 오실레이터 신호는 종종 추세 강화의 신호일 수 있습니다.

추세가 상승하면 오실레이터는 대부분의 시간 동안 과매수 영역에 머물며, 하락하면 과매도 영역에 머물게 됩니다.

거래량 분석을 위한 기본 규칙:

- 거래량 감소 – 현재 환율 역학에 대한 관심 감소, 가능한 추세 변경 또는 일시적인 가격 안정화.

- 거래량 증가 – 현재 환율 역학에 대한 관심 증가, 현재 움직임의 강화 또는 새로운 가격 방향의 출현.

- 때때로 급격한 가격 변동과 함께 점진적인 거래량 감소가 발생합니다.

- 거래량 피크는 가능한 추세 반전을 신호합니다.

일본식 촛대 차트를 그리고 촛대 패턴을 분석하는 것은 비교적 새로운 기술적 분석 영역입니다.

일본식 촛대의 장점은 데이터를 시각적으로 나타내어 내부 관계를 볼 수 있다는 점이며, 거래의 명확한 심리적 그림을 만듭니다.

일본식 촛대는 근본 원인보다는 단기적인 시장 심리를 보여줍니다. 이는 기술적 분석에 속합니다. 두려움, 탐욕, 희망과 같은 투자자의 감정이 가격에 영향을 미칩니다. 일반적인 심리적 분위기는 통계적으로 측정할 수 없기 때문에 기술적 분석은 심리 변화 평가에 도움을 줍니다.

일본식 촛대는 투자자의 가치 인식 변화를 기록하며, 이는 가격 움직임에 반영됩니다. 이는 매수자와 매도자가 상호 작용하는 방식을 보여줍니다.

아래는 참조용으로 간단한 촛대 패턴 개요이며, 전체적인 다재다능함을 여기서 완전히 다룰 수는 없습니다.

Expforex.com에서 최고의 Forex 도구 및 가이드를 탐색하세요

Expforex.com은 Forex 트레이더를 위해 초보자와 전문가 모두에게 이상적인 강력한 도구와 포괄적인 가이드를 제공합니다. 다음은 몇 가지 주요 리소스의 간략한 개요입니다:

- EA The xCustomEA: Universal Trading Advisor

이 범용 Expert Advisor (EA)를 사용하여 맞춤형 전략을 구축하세요. iCustom 지표와 함께 사용 가능합니다. 맞춤형 접근 방식을 원하는 트레이더에게 완벽합니다. 자세히 알아보기. - The X – Universal Expert Advisor

표준 지표를 활용하고 다양한 거래 시나리오에 유연성을 제공하는 강력한 EA. 기능 탐색. - Averager: Smart Averaging Tool

추세에 따라 거래를 효율적으로 관리하고, 정밀한 포지션 평균을 위한 필수 도구입니다. 자세한 내용. - Extra Report Pad – Trader’s Diary

실시간 통찰력과 시각화된 보고서를 통해 전문적으로 거래 계정을 분석하세요. MyFxBook과 원활하게 통합됩니다. 더 알아보기. - CLP: CloseIfProfitorLoss

트레일링 기능을 사용하여 전체 이익 또는 손실을 모니터링하고 제어하세요. 리스크 관리 전략을 강화합니다. 확인하기. - SafetyLOCK PRO: Lock and Hedge Positions

반대의 보류 주문으로 포지션을 잠금으로써 거래를 보호하세요. 리스크를 최소화하기 위한 필수 도구입니다. 사용 방법 알아보기. - Forex Glossary – Essential Concepts

핵심 Forex 용어를 익혀 거래 지식을 향상시키세요. 용어집 둘러보기. - Forex for Beginners Series

금융 시장부터 거래 패턴에 이르기까지 모든 것을 다루는 단계별 Forex 거래 가이드에 뛰어드세요. 초보자에게 이상적입니다. 학습 시작. - Functional Features of Experts

Expforex에서 개발한 Expert Advisors (EAs)의 고유한 기능과 매개변수를 탐색하세요. 더 읽어보기. - Testing and Optimization for EAs

고급 테스트 및 최적화 방법을 통해 Expert Advisors의 성능을 극대화하세요. 세부 사항 보기.

이러한 도구와 가이드는 트레이더가 자신의 기술과 전략을 향상시키는 데 도움을 주며, Expforex.com을 Forex 애호가를 위한 필수 리소스로 만듭니다.

다른 챕터도 읽어보실 수 있습니다.

초보자를 위한 Forex 거래 파트 11: 거래 패턴

반전 패턴, 스타, 망치 및 행잉 맨, 기타 반전 패턴, 추세 지속 패턴. 일본식 기술 분석의 주요 규정: 가격 고점과 저점에서의 갭 플레이

이 게시물은 다음 언어로도 제공됩니다: English Portuguese Español Deutsch Français Русский Українська Indonesian Italiano العربية Chinese 日本語 한국어 Türkçe ไทย Tiếng Việt